Introduction

In the ever-fluctuating world of forex trading, finding a reliable and profitable strategy is no easy feat. However, long-term forex trading signals can provide a beacon of guidance, helping traders navigate the complex market landscape and achieve consistent returns. This comprehensive guide delves into the intricacies of long-term forex trading signals, empowering you with insights and strategies to optimize your trading endeavors.

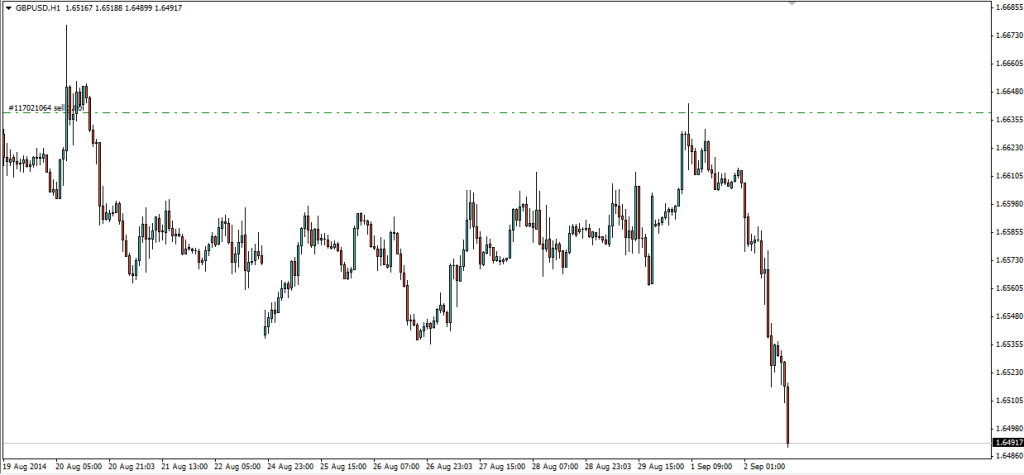

Image: preferforex.com

Understanding Long-Term Forex Trading Signals

Long-term forex trading signals provide a valuable indication of potential trading opportunities that align with a longer-term market trend. Unlike short-term signals that focus on intraday or swing trades, long-term signals typically identify profitable opportunities that span days, weeks, or even months. This approach is particularly beneficial for traders seeking stable returns with lower risk exposure.

How Do Long-Term Forex Signals Work?

Long-term forex trading signals are generated through a rigorous analysis of historical data, fundamental factors, and technical indicators. Professional analysts and expert traders utilize sophisticated algorithms and analytical tools to identify recurring patterns and market trends. This in-depth analysis helps eliminate subjectivity and enhances the reliability of the signals provided.

Types of Long-Term Forex Trading Signals

The realm of long-term forex trading signals encompasses a diverse range of approaches, each tailored to specific market conditions and trader preferences. Here are some of the most prevalent types:

- Trend Following Signals: Designed to identify and ride extended market trends, these signals seek to capture substantial price movements over time.

- Pullback and Reversal Signals: Focus on identifying potential reversals or continuation of an existing trend. They capitalize on price retracements to enter or exit positions.

- Range Trading Signals: Utilize support and resistance levels to identify suitable entry and exit points within specific price ranges. They exploit sideways market movement for profit.

Image: howtotradeonforex.github.io

Benefits of Utilizing Long-Term Forex Trading Signals

Incorporating long-term forex trading signals into your trading strategy offers a multitude of notable advantages:

- Enhanced Profitability: Signals provide valuable insights into market trends, allowing traders to capitalize on larger price movements and maximize profits.

- Reduced Risk Exposure: By aligning with longer-term market trends, traders mitigate short-term volatility and minimize the likelihood of significant losses.

- Time Efficiency: Signals simplify market analysis, freeing up traders’ time for other aspects of their trading activities or personal pursuits.

- Increased Confidence: Professional analysis and objective signals boost trader confidence, reducing the uncertainty and stress associated with independent decision-making.

Strategies for Optimizing Signal Performance

While long-term forex trading signals provide a valuable advantage, it’s crucial to complement them with effective strategies to enhance their performance:

- Proper Signal Selection: Research and compare different signal providers to find one that aligns with your risk tolerance, trading style, and market preferences.

- Risk Management: Implement sound risk management practices to determine optimal position sizing and stop-loss levels based on the signal’s recommended risk-to-reward ratio.

- Diversification: Spread your trades across multiple currency pairs and assets to diversify risk and improve overall portfolio performance.

- Simulate and Backtest: Test the performance of signals on historical data using a trading simulator. This provides valuable insights into their efficacy before risking real capital.

- Monitor and Adjust: Continuously monitor signal performance and adjust your trading strategy accordingly based on changing market dynamics and the signal’s track record.

Long Term Forex Trading Signals

Conclusion

Long-term forex trading signals offer a powerful tool for traders seeking steady returns with reduced risk. By leveraging expert analysis and identifying longer-term market trends, traders can make informed decisions and enhance their trading success. However, it’s essential to approach long-term forex trading signals with a blend of strategy, risk management, and continuous evaluation. By incorporating the insights provided in this guide, traders can unlock the full potential of long-term forex trading signals and navigate the complexities of the forex market to achieve their financial goals.