Embarking on a Forex Adventure: A Journey into the World of Long and Short

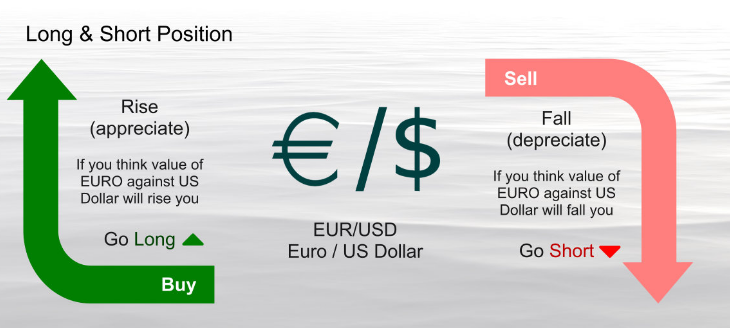

The dynamic landscape of foreign exchange trading, commonly known as forex, offers a fascinating arena for traders seeking financial opportunities. Comprising currency pairs, the forex market enables traders to capitalize on price fluctuations for potential profits. Central to this market are the concepts of going long and short, fundamental strategies that shape the trading experience. Understanding these strategies empowers traders with a solid foundation for navigating the intricacies of currency markets.

Image: purrgramming.life

Going Long: A Bullish Outlook for Appreciation

Adopting a long position in forex trading signifies a trader’s belief that the base currency of a currency pair will rise in value against its counter currency. This strategy is often employed when economic indicators, market sentiment, and technical analysis suggest a potential for currency appreciation. For instance, if a trader believes the US dollar will strengthen against the euro, they might choose to go long on the USD/EUR currency pair.

Going Short: Embracing the Bearish Trend for Depreciation

On the flip side, going short in forex represents a trader’s anticipation that the base currency of a currency pair will depreciate in value against its counter currency. This approach aligns with a bearish market outlook, where traders believe a currency is likely to decline in value. Continuing with our previous example, if a trader expects the euro to weaken against the US dollar, they might decide to go short on the EUR/USD currency pair.

Market Dynamics: Navigating Currency Fluctuations

The interplay between long and short positions drives market dynamics, influencing currency prices and influencing trading strategies. When more traders anticipate a currency’s appreciation, they tend to go long, creating upward pressure on its value. Conversely, if a majority of traders hold a bearish sentiment, they might go short, leading to a decrease in the currency’s value. These market forces determine the overall trend and volatility of currency pairs.

Image: pipsedge.com

Understanding Long and Short: A Comparative View

While both long and short positions involve speculating on currency fluctuations, they differ in terms of direction and profit potential. Let’s delve deeper into these distinctions:

Directionality: Going long implies a trader’s belief in currency appreciation, while going short indicates an expectation of currency depreciation. These opposing directions dictate the specific trading strategies and entry and exit points.

Profit Potential: Profits for long positions stem from correctly predicting currency appreciation, whereas profits for short positions materialize when currency depreciation occurs. The extent of profit potential depends on the magnitude of currency fluctuations and the leverage employed by the trader.

Timing and Execution: Long positions thrive in bullish markets with expectations of sustained currency appreciation. Short positions, on the other hand, align with bearish markets where traders anticipate extended periods of currency depreciation. Identifying the appropriateタイミング and executing trades accordingly is crucial for successful outcomes.

Practical Tips for Effective Long and Short Trading

Embarking on long or short positions in forex trading requires a strategic approach. Here are a few practical tips to enhance your trading endeavors:

Conduct Thorough Research: Studying market trends, economic fundamentals, and technical indicators is essential for informed decision-making. This groundwork sets the foundation for identifying potential long or short opportunities.

Risk Management is Paramount: Maintaining a prudent risk management strategy is non-negotiable. Determine appropriate leverage levels, employ stop-loss orders, and monitor positions closely to mitigate potential losses.

Capitalizing on Trends: Identifying and riding the prevailing market trends can contribute to successful long or short positions. Recognizing market momentum and aligning your strategy accordingly increases the likelihood of profitable outcomes.

Staying Up-to-Date with Market News: Keeping abreast of economic data, central bank announcements, and geopolitical events is imperative for staying ahead of market movements. These factors can significantly influence currency fluctuations and shape profitable trading opportunities.

FAQs on Long and Short Positions in Forex

To further clarify the concepts of long and short positions, let’s address some frequently asked questions:

Q: Can I go long and short on the same currency pair?

A: Yes, it is possible to maintain both long and short positions in the same currency pair, but this requires a high level of risk management expertise.

Q: What are the key differences between long and short positions?

A: The primary difference lies in the directionality of the trade, with long positions anticipating currency appreciation and short positions expecting currency depreciation.

Q: How do I determine which strategy to use?

A: Choosing between long and short positions hinges on market analysis, economic indicators, and personal trading preferences.

Q: Is going long or short in forex inherently risky?

A: Forex trading involves inherent risks, and the potential for losses exists in both long and short positions. Risk management strategies and prudent trading practices are essential for mitigating risks.

Long And Short Meaning In Forex

https://youtube.com/watch?v=FnsSpqcNvSU

Conclusion

Navigating the world of forex trading requires a thorough understanding of long and short positions. By comprehending the differences, profit potential, and market dynamics associated with these strategies, traders can make informed decisions and embark on their trading journey with greater confidence. Remember, the forex market offers boundless opportunities, but careful research and risk management are key to unlocking your trading potential.

Call to Action: Are you ready to delve into the captivating world of long and short positions in forex? If you seek further insights and a comprehensive guide to forex trading, we invite you to explore our website’s resources. Embark on your trading adventure today and discover the thrilling possibilities that await.