Introduction

Navigating the dynamic world of forex trading demands a deep understanding of currency strengths and weaknesses. Enter the live forex currency strength meter, a potent tool that empowers traders with real-time insights into the ever-fluctuating currency market landscape. This game-changing instrument provides a comprehensive analysis of currency performance, empowering traders to make informed trading decisions and seize profitable opportunities.

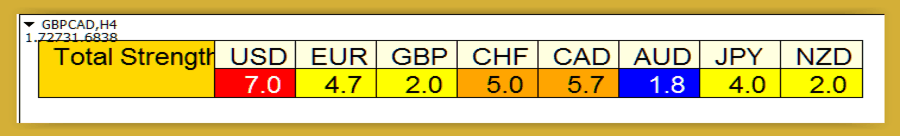

Image: daytradeforexcolor.com

In this article, we delve into the intricacies of the live forex currency strength meter, exploring its history, fundamental principles, and practical applications. By mastering this essential tool, traders can gain a competitive edge, minimize risks, and optimize their forex trading strategies.

Understanding Currency Strength Meters

Currency strength meters are indispensable tools that assess the relative strength of two or more currencies over time. They provide a visual representation of currency value changes, enabling traders to identify trends, patterns, and potential trading opportunities.

A currency strength meter typically comprises a series of lines or bars, each representing a different currency. The position of a currency on the meter indicates its strength relative to the other currencies included in the meter. A currency that is trending upward is considered strong, while a currency that is trending downward is considered weak.

Constructing a Live Forex Currency Strength Meter

Constructing a live forex currency strength meter involves gathering real-time data from various sources, such as forex brokers, data providers, and financial news outlets. This data is then processed and analyzed to determine the relative strength of each currency.

Various algorithms and statistical techniques are employed to calculate currency strength. One common method involves comparing the closing prices of a currency pair over a specific period, such as one hour, four hours, or one day. Other factors, such as economic news and events, market sentiment, and technical indicators, are also taken into account in some currency strength meters.

Historical Evolution of Currency Strength Meters

The concept of assessing currency strength is not new. Traders have employed various techniques for centuries to determine which currencies are likely to appreciate or depreciate in value. However, the advent of computers and the internet has revolutionized currency strength analysis, leading to the development of live forex currency strength meters.

Early currency strength meters were relatively simple, providing only basic information about the relative strength of a few major currencies. However, as technology advanced, currency strength meters became more sophisticated, incorporating more data, complex algorithms, and user-friendly interfaces.

Image: best-forex-indicator.com

Applications of Live Forex Currency Strength Meters

Live forex currency strength meters offer a multitude of applications for traders, including:

- Identifying Trends: Currency strength meters can help identify currency trends, enabling traders to make informed decisions about which currencies to buy or sell.

- Assessing Risk: Currency strength meters can help traders assess the risk of a currency trade by indicating how strong or weak a currency is relative to its counterparts.

- Implementing Trading Strategies: Currency strength meters can be used to implement various trading strategies, such as trend following, currency carry, and breakout strategies.

- Managing Currency Portfolios: Currency strength meters can be used to manage currency portfolios by helping traders determine which currencies to allocate funds.

- Analyzing Market Sentiment: Currency strength meters can provide insights into market sentiment by indicating how traders are positioning themselves in different currencies.

Advantages of Using Live Forex Currency Strength Meters

Live forex currency strength meters offer numerous advantages for traders, including:

- Real-Time Data: Live currency strength meters provide real-time data on currency strength, enabling traders to make informed trading decisions in the moment.

- Comprehensiveness: Currency strength meters typically include multiple currencies, providing traders with a comprehensive view of the forex market.

- User-Friendly: Live currency strength meters are designed to be user-friendly, making them accessible to traders of all levels of experience.

- Accuracy: Currency strength meters use sophisticated algorithms and data sources to ensure accuracy, providing traders with reliable information.

- Simplicity: Currency strength meters present information in a clear and concise manner, allowing traders to quickly grasp the relative strength of different currencies.

Limitations of Live Forex Currency Strength Meters

While live forex currency strength meters are valuable tools, it is important to be aware of their limitations:

- Historical Data: Currency strength meters only provide historical data, which does not always guarantee future performance.

- External Factors: Currency strength meters do not account for all external factors that can affect currency strength, such as political events or natural disasters.

- Subjectivity: Currency strength meters use algorithms and data sources that are subject to interpretation, which can lead to differences in currency strength rankings.

- Technical Issues: Live currency strength meters rely on technology, which can sometimes experience technical issues that can affect data accuracy.

Live Forex Currency Strength Meter

Conclusion

Live forex currency strength meters are essential tools for traders navigating the dynamic forex market. By providing real-time insights into currency strengths and weaknesses, currency strength meters empower traders to make informed decisions, manage risk, and optimize their trading strategies. While currency strength meters have limitations, the benefits they offer far outweigh the potential drawbacks.

Whether you are a seasoned trader or just starting out in the forex market, incorporating a live forex currency strength meter into your trading arsenal can significantly enhance your chances of success. So, embrace the power of currency strength meters today and unlock the potential for profitable forex trading.