Introduction

Image: www.youtube.com

The foreign exchange market offers traders a unique opportunity to generate profit, thanks to its global reach and around-the-clock availability. However, unlike other financial markets, the forex market undergoes a brief closure period over the weekend. This poses a critical decision for traders: should they close their open positions before the weekend or leave them open to potential gain or loss? In this comprehensive guide, we delve into the intricate world of leaving forex trades open over the weekend, exploring the benefits, risks, and strategies you can employ to navigate this complex terrain.

Understanding Weekend Trading Closure in the Forex Market

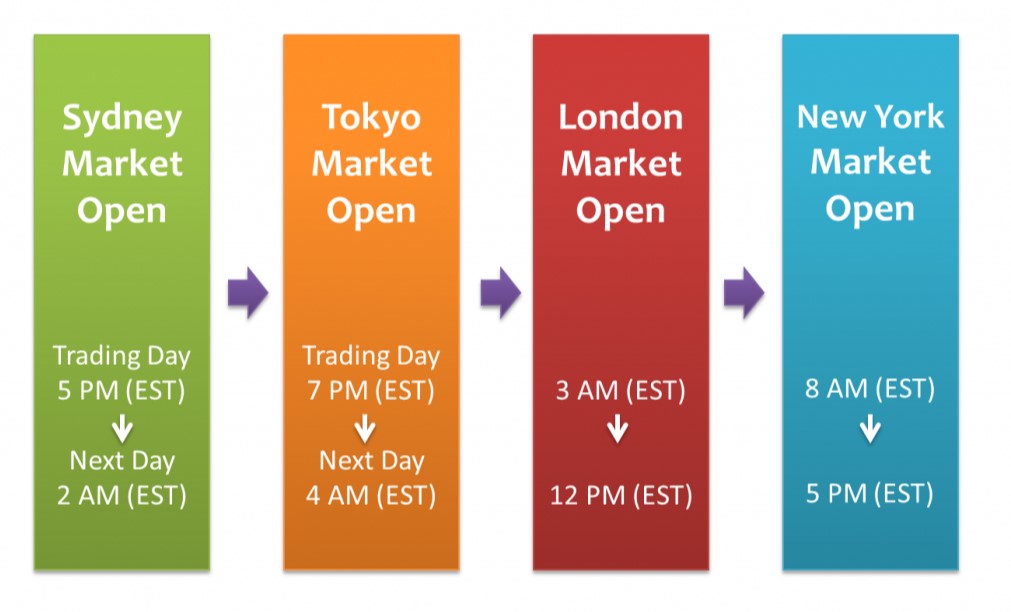

The forex market typically closes from Friday evening to Sunday evening, with specific closure times varying across currency pairs. This closure is due to the need for interbank settlements and synchronization with global financial institutions. During this hiatus, no trades are executed, and prices remain frozen at their pre-weekend levels.

Benefits of Leaving Trades Open Over the Weekend

- Increased Market Opportunities: The forex market is known for its volatility, and leaving trades open over the weekend allows you to capture potential price movements that might occur during this time. Significant economic or political events over the weekend could significantly impact currency values, providing ample opportunities for astute traders.

- Extended Profit Potential: If a trader anticipates a favorable price trend over the weekend, leaving the position open offers the chance to extend their profit. For instance, if you have a long position in EUR/USD and expect the euro to strengthen against the dollar, holding the trade over the weekend may allow you to reap the benefits of any further upward movement in the value of the euro.

- Lower Transaction Costs: Closing and reopening trades on Monday can incur additional transaction costs, such as spreads and commissions. By leaving trades open, you minimize these expenses, enhancing your overall profitability.

Risks of Leaving Trades Open Over the Weekend

- Gap Risk: Gap risk refers to the potential for a significant price change between the end of Friday’s trading session and the start of Monday’s session. This can occur due to unforeseen events or news releases over the weekend that move prices abruptly. If the gap is unfavorable, it could result in significant losses for your open trades.

- Increased Volatility: Currency markets are inherently volatile, and this characteristic can amplify over the weekend due to reduced market liquidity. Weekend volatility can lead to sharp and unpredictable price fluctuations, posing a higher risk to your open positions.

- Emotional Trading: Extended exposure to market fluctuations over the weekend can lead to emotional trading decisions. The uncertainty and potential for drastic price changes can evoke anxiety or FOMO (fear of missing out), influencing traders to make rash decisions.

Strategies for Managing Weekend Trades

- Use Stop-Loss and Take-Profit Orders: Stop-loss orders limit potential losses by automatically closing your position if the price reaches a predetermined level. Take-profit orders close your position when it reaches a target profit, securing your earnings.

- Trade Only with Available Capital: Never risk more money than you can afford to lose. Ensure you have sufficient capital to cover potential weekend losses, especially if you trade with leverage.

- Monitor News and Events: Keep track of important news and economic events that may impact the currency pairs you’re trading. This information will help you make informed decisions about your weekend trades.

- Choose Liquid Currency Pairs: Trade in highly liquid currency pairs with tight spreads to reduce the risk of slippage during weekend re-opening. Popular pairs like EUR/USD and USD/JPY typically have higher liquidity.

- Consider Hedging: Hedging involves opening opposite positions in correlated currency pairs to mitigate risk. For example, if you have a long position in EUR/USD, you could hedge with a short position in USD/EUR to limit potential weekend losses.

Conclusion

Leaving forex trades open over the weekend is a strategic decision that entails both benefits and risks. By understanding the market dynamics, employing robust risk management strategies, and staying informed, you can navigate this complex terrain effectively. Remember, success in weekend trading requires discipline, patience, and a sound understanding of the underlying principles that govern the forex market.

Image: www.forex.academy

Leaving Forex Trades Open Over Weekend