Introduction

Forex trading, the exhilarating world of currency exchange, has captivated traders worldwide with its potential for both soaring profits and catastrophic losses. In Australia, this high-stakes game is subject to a stringent regulatory framework designed to protect investors and maintain market integrity. Understanding the legal landscape of forex trading in Australia is paramount for aspiring traders seeking to navigate the complexities of this dynamic market.

Image: tradersunion.com

Forex Trading in Australia: A Legal Framework

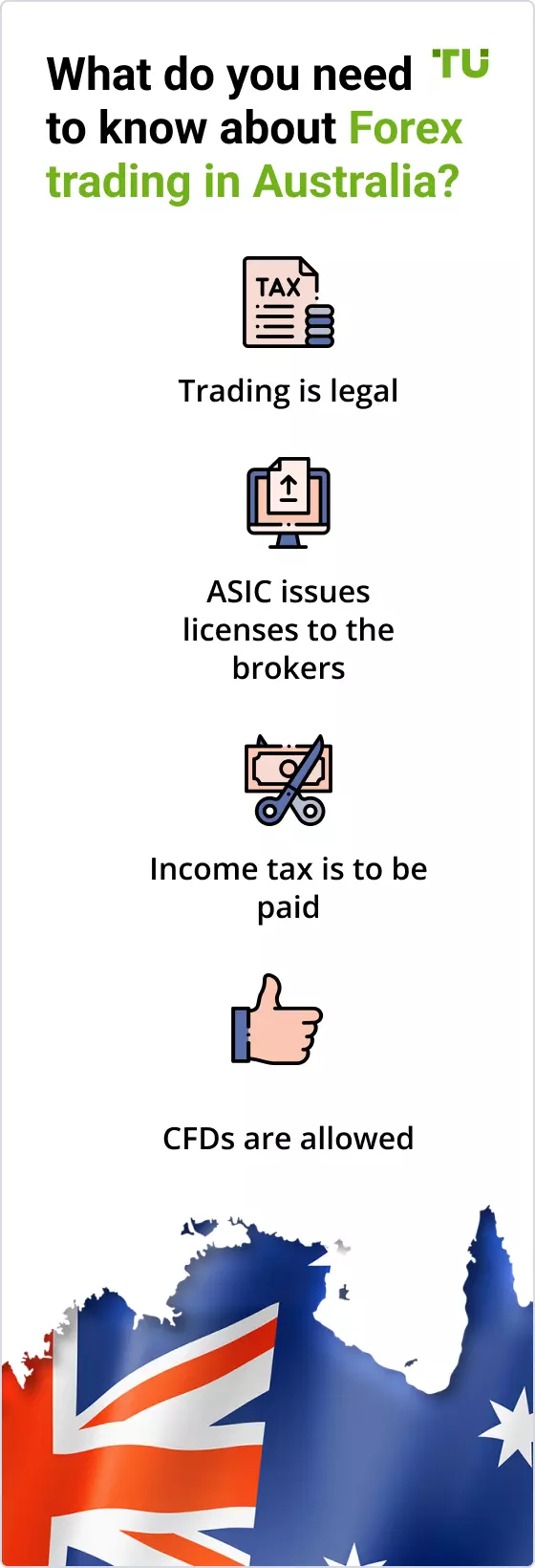

In Australia, forex trading falls under the purview of the Corporations Act 2001 and is regulated by the Australian Securities and Investments Commission (ASIC). This regulatory body plays a crucial role in ensuring that forex brokers operating in the country meet strict criteria, including adequate capital requirements, proper risk management systems, and transparent trading practices. ASIC’s oversight ensures that Australian traders have access to a well-regulated market, mitigating the risks associated with forex trading.

Licensing Requirements for Forex Brokers

Any entity offering forex trading services in Australia must possess an Australian Financial Services (AFS) license issued by ASIC. This license serves as a testament to the broker’s compliance with stringent industry standards and ethical practices. By choosing a forex broker with an AFS license, Australian traders can rest assured that their funds are protected and that they are engaging with a reputable and accountable organization.

Risks Associated with Forex Trading

Despite its allure, forex trading entails inherent risks that traders must be fully aware of. Fluctuations in currency values can lead to substantial losses, and traders are advised to approach the market with caution. Leveraged trading, a technique used to amplify profits, also magnifies potential losses, making it imperative for traders to employ effective risk management strategies.

To mitigate these risks, ASIC has implemented measures aimed at safeguarding Australian traders. These measures include mandatory risk warnings and educational material for new traders, a ban on automated trading systems, and restrictions on the use of leverage.

Image: tradersunion.com

Protecting Your Interests: Investor Education and Dispute Resolution

Investor education is paramount in the forex market. ASIC offers comprehensive resources to equip traders with the knowledge and skills necessary for navigating the complexities of forex trading. These resources include online courses, webinars, and publications covering topics such as market analysis, risk management, and fraud prevention.

In the event of disputes, traders have access to dispute resolution mechanisms. The Australian Financial Complaints Authority (AFCA) provides an independent and fair avenue for resolving complaints against forex brokers.

Exploring Offshore Brokers: A Cautionary Tale

While trading with an Australian-licensed forex broker ensures regulatory protection, some traders may be tempted to engage with offshore brokers. However, it is important to exercise extreme caution when dealing with offshore entities, as they may not be subject to the same stringent regulations as Australian brokers. Offshore brokers may offer seemingly attractive terms and conditions, but traders should be aware of the potential risks involved.

Is Forex Trading Legal In Australia

Conclusion

Forex trading in Australia is a legal activity subject to a robust regulatory framework. ASIC’s oversight, licensing requirements, and investor protection measures provide Australian traders with a safe and secure environment to participate in this dynamic market. By choosing an AFS-licensed broker, understanding the risks involved, and seeking continuous education, traders can mitigate the challenges and seize the opportunities offered by forex trading in Australia.