In the realm of online foreign exchange (forex) trading, traders are faced with a plethora of brokers to choose from. Selecting the right broker is crucial as it can significantly impact your trading experience and profitability. One of the key factors to consider when selecting a broker is the execution model employed. One popular type of execution model is known as Electronic Communication Networks (ECNs).

Image: www.brokerforex.it

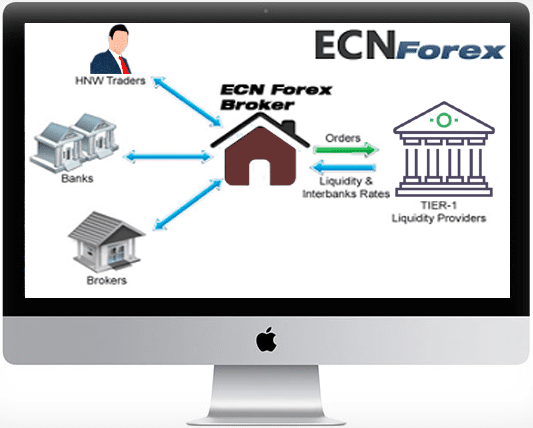

ECN brokers provide traders with direct access to liquidity providers, eliminating the dealing desk. This allows for more efficient execution, tighter spreads, and increased transparency. In this article, we will delve into the specifics of ECN brokers and examine whether Forex.com is one of them.

ECN Brokers: An Overview

ECN brokers facilitate order matching between buyers and sellers in real-time, enabling a decentralized and anonymous trading environment. The role of the broker in an ECN setup is limited to providing the platform and ensuring fair and efficient order execution.

Benefits of ECN Brokers

- Tighter Spreads: ECN brokers typically offer tighter spreads compared to non-ECN brokers due to direct access to liquidity providers.

- Faster Execution: ECNs provide immediate execution, as orders are processed and matched electronically without human intervention.

- Increased Transparency: The order book is visible to all participants, promoting transparency and ensuring that prices are based on real-time supply and demand.

- No Dealing Desk Intervention: With ECNs, there is no conflict of interest, as the broker does not act as a counterparty to your trades.

Is Forex.com an ECN Broker?

Forex.com is a reputable online forex broker that offers various account types and trading platforms. However, it is important to note that **Forex.com does not operate as a pure ECN broker.** While Forex.com’s DMA (Direct Market Access) account provides some benefits similar to ECN accounts, such as direct access to liquidity providers, it does not fully eliminate the dealing desk’s potential for intervention or price manipulation.

Image: tfspriceaction.com

Forex.com’s Execution Model

Forex.com’s execution model is a hybrid approach. The broker utilizes a combination of ECN execution, STP (Straight Through Processing), and a proprietary dealing desk. This model aims to balance the benefits of ECN execution with the stability and reliability of a dealing desk. While this approach may appeal to certain traders, it is crucial to understand that it introduces the potential for conflicts of interest and non-ECN execution.

Tips and Expert Advice

When choosing an online forex broker, it is essential to consider your individual trading needs and preferences. If you prioritize tighter spreads, faster execution, and a fully transparent environment, opting for a pure ECN broker might be more suitable. However, if you prefer a more traditional trading experience with additional support and guidance, a hybrid model like Forex.com’s may be a better choice.

To enhance your trading experience, consider seeking advice from experienced traders, consulting reputable sources, and continually educating yourself about the forex market and trading strategies. By leveraging the knowledge and expertise of others, you can increase your chances of long-term trading success.

FAQ

Q1: What is an ECN broker?

A: An ECN broker is an online forex broker that provides traders direct access to liquidity providers, eliminating the dealing desk and facilitating anonymous order matching between buyers and sellers.

Q2: Does Forex.com offer ECN execution?

A: While Forex.com provides a DMA account with some ECN features, it does not operate as a pure ECN broker, as it employs a hybrid model involving both ECN execution and a dealing desk.

Q3: What are the benefits of an ECN broker?

A: ECN brokers offer tighter spreads, faster execution, increased transparency, and reduced conflict of interest due to the elimination of the dealing desk.

Q4: What are the drawbacks of a hybrid execution model?

A: Hybrid models like Forex.com’s introduce the potential for conflicts of interest and price manipulation by the broker’s dealing desk.

Q5: What should I consider when choosing a forex broker?

A: When selecting a forex broker, consider factors such as your trading style, execution model preference, fees and commissions, trading platforms, customer support, and regulatory compliance.

Is Forex Com A Ecn Broker

Conclusion

Whether Forex.com is the right broker for you depends on your individual trading needs and preferences. If you prioritize ECN execution with a pure and anonymous order-matching environment, Forex.com may not be the ideal choice. However, if you prefer a hybrid model with additional features and support, Forex.com could be a suitable option for your trading endeavors.

Remember, it is crucial to conduct thorough research, seek expert advice, and carefully evaluate your own trading goals before making a decision. By taking the time to understand the different execution models and brokers available, you can choose the one that aligns best with your trading style and aspirations.

Interested in learning more about ECN brokers and Forex.com’s execution model? Feel free to reach out to us with your questions or share your experiences with these platforms in the comments below.