The foreign exchange (forex) reserves of a nation represent a crucial indicator of its financial strength and economic stability. India’s forex reserves have witnessed a remarkable trajectory over the years, mirroring the country’s evolving economic landscape. This article delves into the historical data of India’s forex reserves, tracing their growth, fluctuations, and significance in shaping the nation’s economic narrative.

Image: currentaffairs.adda247.com

The Genesis and Early Days

India’s forex reserves originated in the early 1900s with the creation of the Reserve Bank of India (RBI). The primary purpose of these reserves was to manage the country’s external trade and maintain the stability of the rupee against foreign currencies. In the initial years, the reserves were relatively modest, reflecting India’s limited participation in global trade.

The Post-Independence Era

After India’s independence in 1947, the government embarked on an ambitious journey of economic development, prioritizing industrialization and self-reliance. The country’s forex reserves remained relatively low during this period, as the focus was on domestic production rather than imports.

Liberalization and Globalization

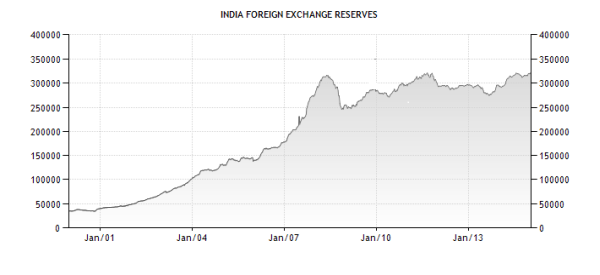

The 1990s witnessed a significant shift in India’s economic policy, characterized by liberalization and globalization. This led to increased international trade and integration into the global economy. As a result, India’s forex reserves began to grow steadily, supported by increased exports, remittances, and foreign direct investment.

Image: www.caclubindia.com

The Rise and Fluctuations

Over the next two decades, India’s forex reserves witnessed an impressive rise, reaching a record high of $590 billion in December 2021. This growth was fueled by strong economic growth, a surge in foreign investment, and the country’s emergence as a major IT and outsourcing hub.

However, the forex reserves have not been immune to fluctuations, reflecting the dynamic nature of the global economy. The 2008 financial crisis, for example, led to a temporary downturn in reserves. Similarly, the COVID-19 pandemic also impacted the reserves, as the country experienced a decline in exports and foreign investment.

Significance of Forex Reserves

India’s forex reserves play a multi-faceted role in the country’s economic health:

-

Exchange Rate Stability: The reserves help maintain the stability of the rupee against foreign currencies, preventing sharp fluctuations and protecting businesses and consumers.

-

Import Coverage: Forex reserves provide a buffer to finance essential imports, ensuring the availability of vital goods and services in case of external shocks.

-

Economic Confidence: Ample forex reserves instill confidence among investors and global institutions, supporting economic growth and stability.

-

Debt Repayment: The reserves act as a cushion to repay foreign loans and obligations, reducing the country’s external vulnerability.

India Forex Reserves Historical Data

The Future Outlook

India’s forex reserves are expected to continue growing in the medium term, supported by strong economic fundamentals, increased foreign investment, and a favorable trade balance. The government has also implemented measures to attract foreign capital, which will further contribute to the reserves.

As India embarks on its journey towards becoming a $5 trillion economy, the role of forex reserves will become even more critical, ensuring the country’s financial resilience and economic prosperity. By prudently managing these reserves, India can navigate the complexities of the global economy and secure its future as a leading economic powerhouse.