Trading Success: Demystifying the MACD Indicator

For those navigating the dynamic landscape of forex trading, mastering technical indicators is paramount to unlocking profit potential. Among the most popular and versatile tools in the trader’s arsenal is the Moving Average Convergence Divergence (MACD) indicator. This article will delve into the intricacies of MACD, guiding you through its workings and empowering you to harness its predictive prowess for trading success.

Image: freeforexcoach.com

Understanding the MACD: A Cornerstone of Technical Analysis

The MACD indicator tracks the relationship between two exponentially smoothed moving averages (EMA), generating three distinct lines: the MACD line, signal line, and histogram. By assessing the interplay between these components, traders can identify market trends, determine momentum, and pinpoint potential trading opportunities.

Unveiling the Elements of the MACD Indicator

MACD Line: Calculated by subtracting the 26-period EMA from the 12-period EMA, the MACD line oscillates above and below zero, reflecting the spread between the two moving averages.

Signal Line: A 9-period EMA of the MACD line, the signal line serves as a moving average of the MACD, smoothing out fluctuations and providing a reference point for identifying potential buy/sell signals.

Histogram: The histogram is formed by plotting the difference between the MACD line and the signal line. Positive values indicate bullish momentum, while negative values suggest bearishness.

Interpreting MACD: A Guide to Market Sentiment

Trending Market: A rising MACD line, coupled with an increasing signal line and positive histogram values, signifies a bullish trend. Conversely, a falling MACD line, decreasing signal line, and negative histogram values point to a bearish trend.

Momentum Shifts: Crossovers between the MACD and signal lines provide valuable trading signals. When the MACD line crosses above the signal line, it signals a bullish momentum shift. Conversely, a crossover below the signal line indicates a bearish momentum shift.

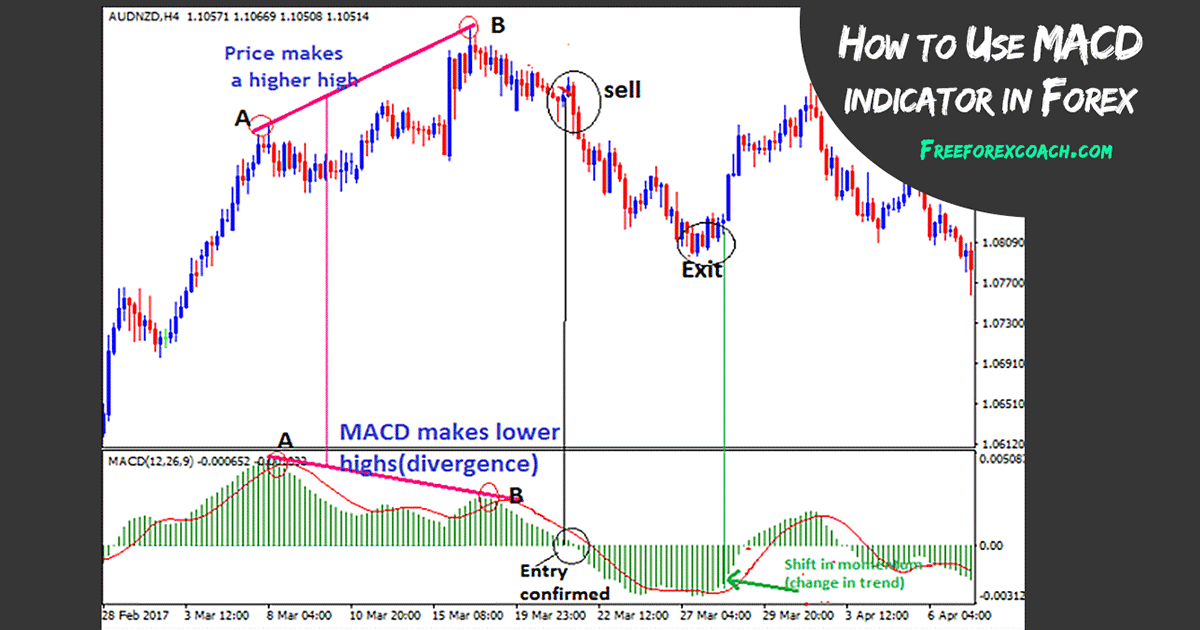

Divergences: Divergences between the MACD and price action can uncover potential trend reversals. A bullish divergence occurs when price makes a lower low while the MACD indicator makes a higher low. A bearish divergence occurs when price makes a higher high while the MACD indicator makes a lower high.

Image: proforexsignals.net

Practical Applications of MACD: Strategies for Trading Success

Crossover Strategy: Enter long positions when the MACD line crosses above the signal line and exit positions when the MACD line crosses below the signal line.

Histogram Strategy: Buy when the histogram crosses above the zero line and sell when it crosses below the zero line.

Divergence Strategy: Look for opportunities to capitalize on potential trend reversals by identifying bullish or bearish divergences between MACD and price action.

Fine-Tuning Your MACD Settings: Customizing Your Trading

The default settings of the MACD indicator can be adjusted to tailor it to different trading styles and market conditions. Experiment with varying the EMA periods, signal line periods, and histogram settings to optimize the indicator’s performance for your specific needs.

MACD in Action: Case Studies of Trading Success

Bullish Confirmation: In an uptrending market, a bullish crossover between the MACD and signal lines, supported by an expanding histogram, can provide confirmation for entering a long trade.

Bearish Anticipation: Conversely, in a downtrending market, a bearish crossover between the MACD and signal lines, accompanied by a shrinking histogram, can serve as a warning signal for potential further declines.

How To Use Macd Indicator In Forex

Conclusion: Harnessing the Power of MACD for Trading Success

In the competitive world of forex trading, harnessing the power of the MACD indicator can significantly enhance your ability to navigate market dynamics and make informed trading decisions. By understanding the inner workings of MACD, interpreting its signals effectively, and customizing its settings to suit your trading preferences, you can unlock its full potential as a valuable tool in your technical analysis arsenal. Embark on the path to trading mastery today by embracing the transformative power of MACD.