Have you ever wondered how to make money from the currency market? Forex trading, short for foreign exchange trading, is a global marketplace where currencies are bought and sold. As the world’s largest financial market, it offers opportunities for both individuals and businesses to profit from currency fluctuations.

Image: forexsignalsmarket.blogspot.com

Delving into Forex Trading

Forex trading involves buying one currency while simultaneously selling another. Its history dates back to the days of ancient Greece and Rome, where merchants exchanged currencies to facilitate trade. In modern times, forex trading has become a complex industry, driven by factors such as economic data, geopolitical events, and central bank policies.

Key Concepts in Forex Trading

Currency Pair: Forex trading pairs two currencies against each other; for example, EUR/USD (euro against US dollar).

Pip: The smallest price movement in a currency pair, typically representing 0.0001 or 0.01%.

Types of Forex Trading

Spot Trading: The immediate buying or selling of currencies for delivery within two business days.

Forward Trading: Contracts where currencies are bought or sold for delivery at a specific date in the future.

Swap Trading: Simultaneous buying and selling of two currency pairs with different maturities for speculation or hedging.

Image: www.educba.com

Understanding the Forex Market Dynamics

The forex market is influenced by a multitude of factors:

- Economic Indicators: GDP, inflation, interest rates, and job data can indicate the strength of a currency.

- **Geopolitical Events:** Political unrest, wars, and trade disputes can affect currency values.

- **Central bank policies:** Interest rate decisions and quantitative easing can impact currency values and their relative strength.

Tips for Successful Forex Trading

1. Education: Thoroughly study the forex market, currency pairs, and trading strategies.

2. Practice: Use a demo account to hone your trading skills without risking real money.

3. Risk Management: Use stop-loss orders to limit potential losses and manage risk effectively.

4. Control Emotions: Forex trading can be emotionally challenging. Stay composed and avoid making decisions based on fear or greed.

Expert Advice for Forex Traders

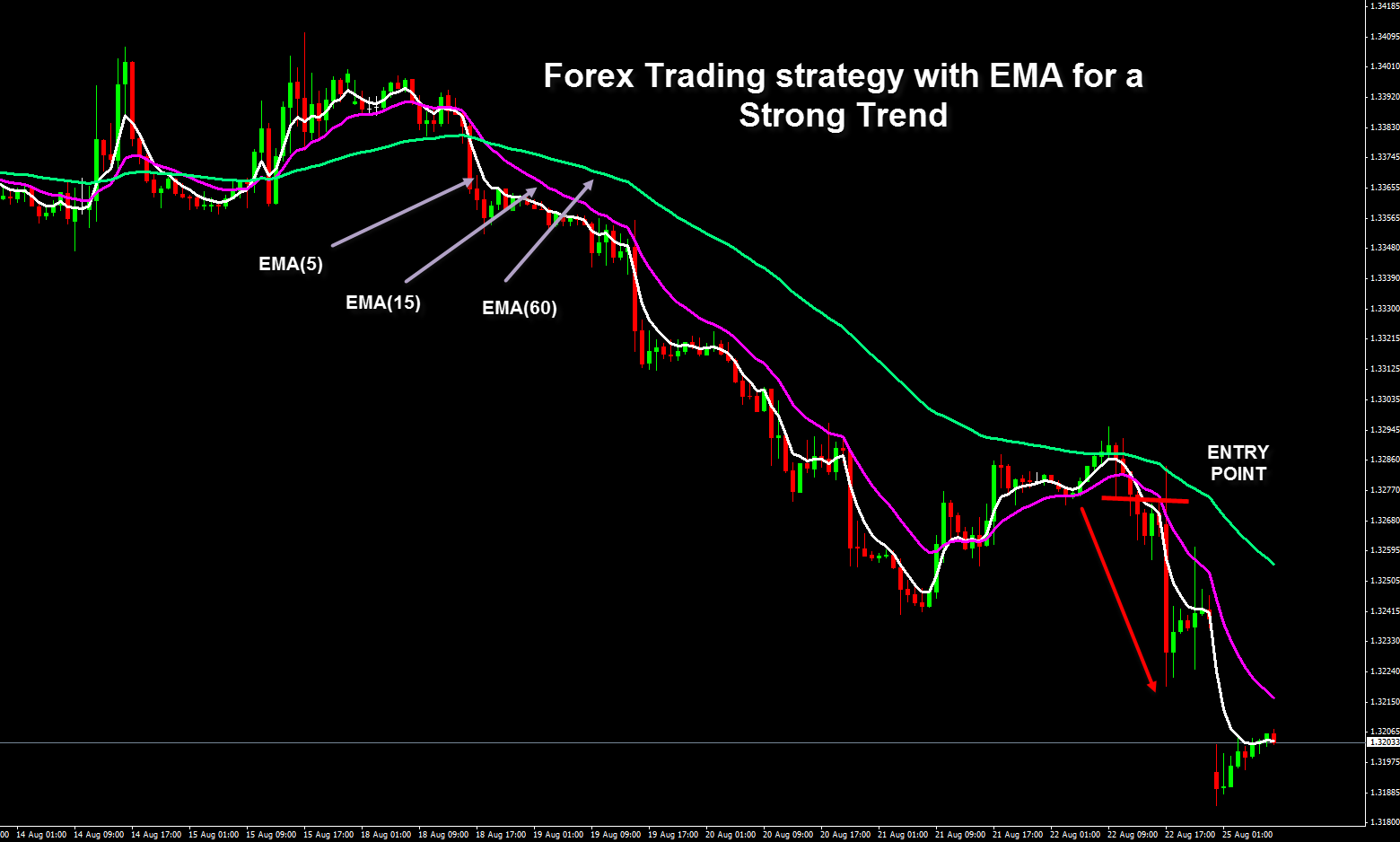

1. Chart Analysis: Technical analysis can provide insights into potential price movements by studying charts and patterns.

2. Fundamental Analysis: Monitoring economic data and news events can help predict long-term currency trends.

FAQs on Forex Trading

- Q: What is the minimum capital required to trade forex?

- A: There is no set minimum, but most brokers recommend starting with $1,000 or more.

- Q: How much can I earn from forex trading?

- A: Profits vary widely and depend on factors such as capital, trading strategy, and risk management.

- Q: Is forex trading a good way to make money?

- A: Forex trading can be profitable, but it is important to manage risk and approach it with a clear trading plan.

How To Use Forex Trading

Conclusion

Forex trading presents opportunities for individuals to potentially profit from currency fluctuations. It requires knowledge, practice, and prudent risk management. By following these guidelines and incorporating expert advice, traders of all levels can navigate the forex market and enhance their chances of success.

Are you ready to explore the exciting world of forex trading? Join the global financial markets and unlock its potential!