Introduction

Image: www.asiaforexmentor.com

In the ever-evolving world of financial markets, the foreign exchange market, or Forex, stands as a colossal arena where currencies dance to the rhythm of global economics. With a daily trading volume exceeding $5 trillion, the Forex market presents a thrilling opportunity for investors seeking to profit from currency fluctuations. However, navigating the intricacies of Forex trading can be a daunting task for those new to the game. This comprehensive guide is crafted to empower you with the knowledge and strategies you need to embark on your Forex trading journey with confidence.

Understanding the Forex Market

The Forex market is an over-the-counter (OTC) exchange where currencies from different countries are traded against each other. Unlike stock or commodity markets, there is no centralized location for Forex trading. Instead, transactions occur through a network of banks, brokers, and other financial institutions. The value of currencies is determined by supply and demand, along with a multitude of economic, political, and social factors.

Getting Started with Forex Trading

To step into the Forex market, you will need to choose a reputable broker. Brokers are companies that provide access to the market and execute your trades. They offer a range of trading platforms and tools, so choose one that suits your experience level and trading style. Once you have chosen a broker, you will need to create an account and fund it with the currency you wish to trade.

Fundamental Analysis: Unraveling the Economic Landscape

Fundamental analysis is an indispensable tool for Forex traders seeking to make informed decisions. This approach involves analyzing macroeconomic factors that influence currency values, such as economic growth, inflation, interest rates, and political stability. By monitoring these indicators, you can gauge the overall health of economies and anticipate changes in currency values.

Technical Analysis: Interpreting Market Behavior

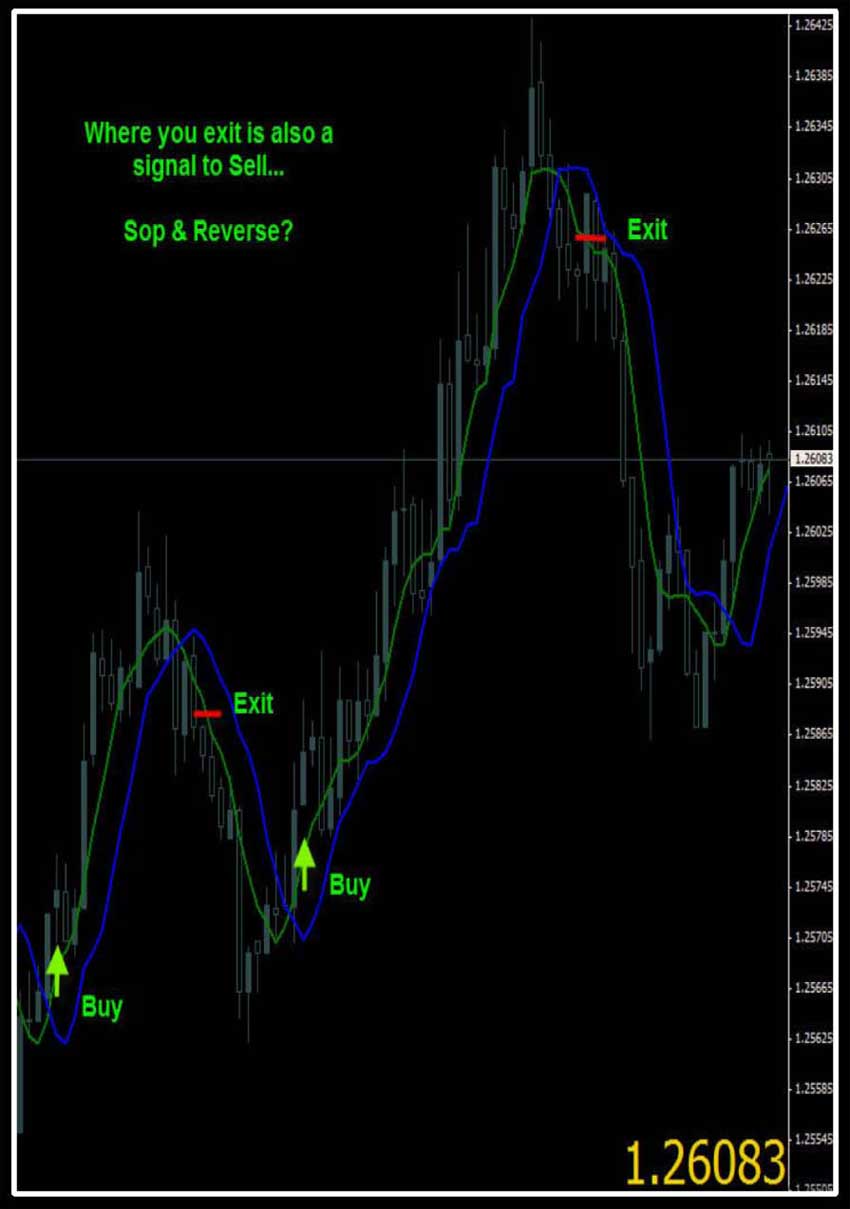

Technical analysis takes a different approach, focusing on historical price data to identify patterns and predict future price movements. Traders use various technical indicators, such as moving averages, trendlines, and support and resistance levels, to identify potential trading opportunities. While technical analysis can be a valuable tool, it should be used in conjunction with fundamental analysis for a more comprehensive view of the market.

Managing Risk: Protecting Your Financial Well-being

Risk management is paramount in Forex trading. The potential for profits is undeniable, but so is the potential for losses. To protect your capital, it is crucial to implement sound risk management strategies, such as setting stop-loss orders, using position sizing correctly, and understanding leverage risks. Remember, the key to successful trading lies in balancing the pursuit of profits with responsible risk management.

Developing a Trading Strategy: Your Path to Profitability

Every successful Forex trader has a well-defined trading strategy that outlines their approach to the market, including entry and exit points, risk management parameters, and profit targets. Developing a strategy that aligns with your personality, risk tolerance, and trading style is essential for long-term success. Take your time, backtest different strategies in a demo account, and choose the one that resonates with you.

The Emotional Journey of Forex Trading

Forex trading can be an emotionally demanding endeavor. The thrill of potential profits can be exhilarating, while losses can trigger feelings of frustration or disappointment. It is crucial to approach trading with a clear mind, free from the burden of uncontrolled emotions. Discipline and emotional control are indispensable traits for traders seeking to achieve financial success.

Conclusion

Embarking on a Forex trading journey can be a rewarding experience, but it demands a thirst for knowledge, unwavering discipline, and a commitment to continuous learning. By mastering the art of fundamental and technical analysis, embracing risk management, developing a tailored trading strategy, and managing your emotions, you can navigate the Forex market with confidence. Remember, the path to success in Forex trading is paved with knowledge, patience, and a burning desire to succeed.

Image: forexwot.com

How To Trade Forex Successfully