In the realm of financial markets, foreign exchange (forex) trading stands as a tantalizing opportunity for both seasoned investors and ambitious entrepreneurs alike. Its global reach, liquidity, and potential for high returns have captivated the imaginations of many, beckoning them to explore this lucrative avenue. However, embarking on this exciting endeavor requires a well-informed and methodical approach. This comprehensive guide will equip you with the knowledge and insights necessary to navigate the intricate landscape of forex and lay the foundation for a successful business.

Image: www.andrewstradingchannel.com

Unveiling the Forex Market: A Glimpse into Its Dynamics

The forex market, also known as the currency market, is the largest and most liquid financial market globally. Its vast daily trading volume, exceeding trillions of dollars, dwarfs that of all other markets combined. This colossal size stems from the constant need for currency exchange, facilitating international trade, tourism, and investments.

The forex market operates 24 hours a day, five days a week, allowing traders to buy and sell currencies at any time. This accessibility offers both flexibility and the potential for continuous trading opportunities. However, with such fluidity comes inherent volatility, as geopolitical events, economic data, and market sentiment can swiftly influence currency prices.

Understanding the Mechanics of Forex Trading: A Primer on Fundamental Concepts

Forex trading involves buying one currency while simultaneously selling another, effectively betting on the relative change in their exchange rates. Traders analyze various factors, including economic indicators, interest rates, and political stability, to forecast currency movements and make informed decisions.

In retail forex trading, individuals and small businesses typically trade through brokers, who provide access to the markets and various trading platforms. These platforms offer a range of trading tools, such as real-time quotes, charts, and analysis tools, to facilitate decision-making.

Forex Trading Strategies: Devising a Plan for Success

Successful forex trading requires a well-defined strategy aligned with your risk tolerance and financial goals. Various strategies exist, catering to different trading styles and timeframes. Here are some popular approaches:

-

Trend Following: This strategy involves identifying and trading in the direction of an established market trend. Traders use technical analysis to identify trend patterns and entry and exit points.

-

Range Trading: Range traders seek to profit from currencies that are fluctuating within a defined price range. They buy near the lower end and sell near the upper end of the range.

-

Scalping: Scalpers aim for small, frequent profits by exploiting short-term price fluctuations. They hold positions for minutes or seconds and require precise execution and risk management.

-

News Trading: News trading involves speculating on the impact of economic news and events on currency markets. Traders monitor market news and attempt to trade ahead of anticipated market reactions.

Image: forexseo.com

Essential Skills for Forex Traders: Mastering the Craft

Exceling in forex trading demands a blend of skills, including:

-

Technical Analysis: This skill involves interpreting price charts and patterns to identify trading opportunities. Traders use various indicators and tools to analyze historical data and predict future price movements.

-

Fundamental Analysis: This approach focuses on economic and geopolitical factors that influence currency values. Traders study economic data, news, and political events to gauge the overall health of economies and identify potential market drivers.

-

Risk Management: Forex trading entails significant risk. Effective risk management is crucial to protecting your capital and minimizing potential losses. This involves setting stop-loss levels, monitoring positions regularly, and controlling the size of your trades.

-

Emotional Discipline: Forex trading can be an emotional roller coaster. Maintaining emotional discipline is essential to making sound trading decisions and avoiding irrational behavior. Traders must be able to manage their emotions and stick to their trading plan.

-

Continuous Learning: The forex market is constantly evolving. Successful traders continuously seek knowledge and refine their skills. They stay abreast of industry news, attend seminars, and engage with trading communities to enhance their understanding and adapt to changing market conditions.

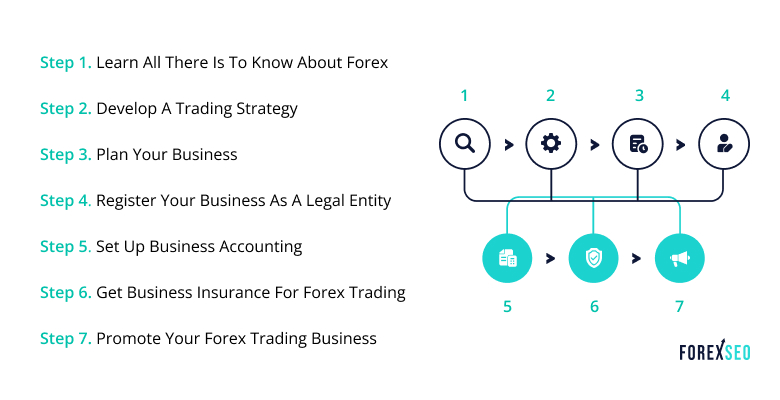

How To Start A Forex Business

Conclusion: Embark on Your Forex Journey with Confidence

The path to a successful forex business is paved with knowledge, skill, and discipline. By embracing the principles outlined in this guide, you can gain a solid understanding of the forex market, develop effective trading strategies, and cultivate the essential skills for long-term success.

Remember, forex trading carries inherent risks, so always trade cautiously and within your financial means. Seek guidance from experienced traders, continuously educate yourself, and approach the markets with a well-defined plan. With dedication and perseverance, you can harness the power of forex to achieve your financial goals.