Drawdowns are an inevitable part of forex trading, but excessive drawdowns can wreak havoc on your trading account and erode your hard-earned profits. Experienced traders know that managing drawdowns effectively is crucial for preserving capital and maintaining a healthy trading mindset. In this article, we delve into the realm of drawdown management, providing you with practical strategies and techniques to tame the beast and prevent it from swallowing your trading aspirations.

Image: forexpropreviews.com

Understanding Drawdowns: A Double-Edged Sword

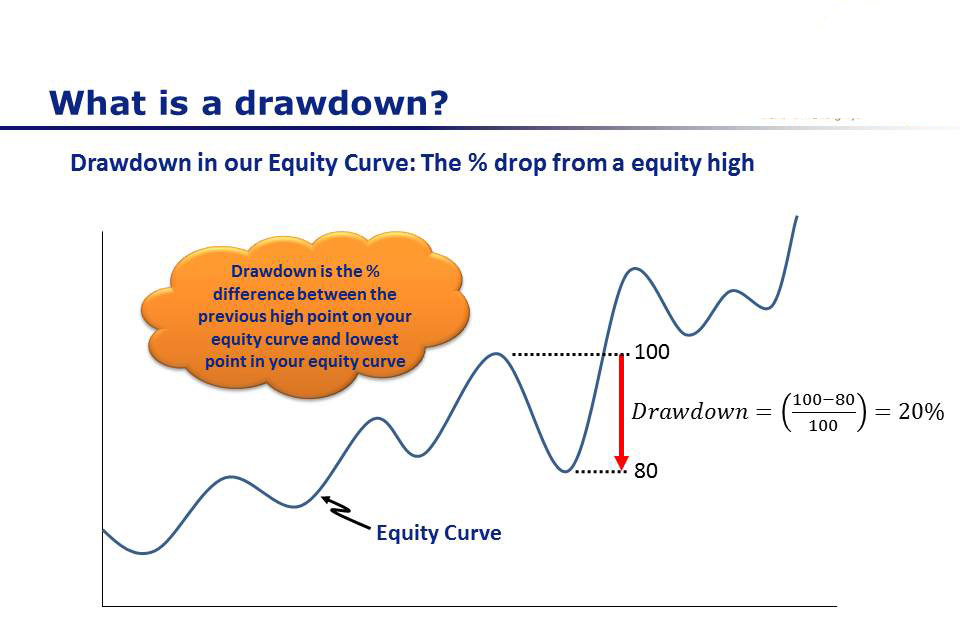

A drawdown is a temporary decline in the value of your trading account. It occurs when the market moves against your open positions or when your account balance dips below its previous high point. While drawdowns can be frustrating and anxiety-inducing, they are also a natural consequence of participating in the dynamic and unpredictable forex market. The key is to recognize that drawdowns are an integral part of trading and to equip yourself with the tools and strategies to mitigate their impact.

The Anatomy of Drawdown: Types, Causes, and Consequences

Drawdowns come in various forms, each with its unique characteristics and potential consequences. The most common types of drawdowns include:

- Normal Drawdowns: Temporary declines that occur during regular market fluctuations. These drawdowns are typically brief and recoverable if you have a solid trading plan and sound risk management practices.

- Excessive Drawdowns: Steep and prolonged declines that can severely deplete your account balance. Excessive drawdowns are often caused by poor risk management, overleveraging, or emotional trading.

- Catastrophic Drawdowns: Devastating declines that wipe out a significant portion of your trading capital. Catastrophic drawdowns can occur in the aftermath of unexpected events, such as extreme market volatility or geopolitical turmoil.

To avoid excessive or catastrophic drawdowns, it is essential to identify the common causes behind these setbacks:

- Poor Risk Management: Failing to establish appropriate risk limits and stop-loss levels can expose your account to excessive risk and magnify potential losses.

- Overleveraging: Borrowing excessive funds through leverage can exponentially increase your potential profits, but it also amplifies your potential losses.

- Emotional Trading: Allowing emotions like fear, greed, or revenge to influence your trading decisions can lead to impulsive choices and poor risk management.

- Lack of Discipline: Deviating from your trading plan or failing to adhere to sound trading practices can undermine your profitability and increase the likelihood of drawdowns.

Strategies for Taming the Beast: Risk Management, Diversification, and Psychology

Curbing drawdowns effectively requires a comprehensive approach that incorporates risk management, diversification, and psychological strategies. Here are some practical techniques to help you mitigate the impact of market fluctuations:

- Establish Strict Risk Parameters: Determine your maximum acceptable drawdown and adhere to it religiously. Calculate your position sizing carefully and ensure that your risk exposure is always within your tolerance level.

- Utilize Stop-Loss Orders: Stop-loss orders are your first line of defense against excessive losses. Set stop-loss levels at predetermined points to limit your downside risk and prevent catastrophic drawdowns.

- Diversify Your Portfolio: Spread your risk among multiple currency pairs and trading strategies. Diversification helps to reduce the impact of adverse price movements in any single asset or market condition.

- Practice Position Scaling: Instead of entering the market with a single large position, consider scaling into your trades gradually. This approach allows you to spread your risk over multiple entry points and reduce the impact of any single bad trade.

- Manage Your Emotions: Drawdowns can test your emotional resilience. Develop coping mechanisms to remain calm and rational during market downturns. Avoid making impulsive decisions and stick to your trading plan, even when faced with adversity.

- Embrace Learning and Growth: Drawdowns are opportunities for growth and improvement. Analyze your trades objectively to identify areas where you can enhance your risk management, trading strategies, or overall approach to the market.

Image: squareoff.in

How To Reduce Drawdown Forex

Conclusion: Turn Drawdowns into Stepping Stones to Success

Drawdowns are an unavoidable aspect of forex trading, but they do not have to be the end of your trading journey. By implementing sound risk management practices, diversifying your portfolio, and managing your emotions effectively, you can tame the beast of drawdowns and turn them into stepping stones towards greater profitability. Remember, the ability to manage drawdowns is not just about protecting your capital, but also about cultivating the discipline, patience, and psychological resilience that are essential for long-term trading success.