Navigating the intricate world of forex trading is no easy feat. One indispensable tool that empowers traders with critical insights into market trends is the volume indicator. Understanding how to read and interpret this indicator can unlock a treasure trove of information, giving traders an edge in their pursuit of profitable opportunities.

Image: theforexscalpers.com

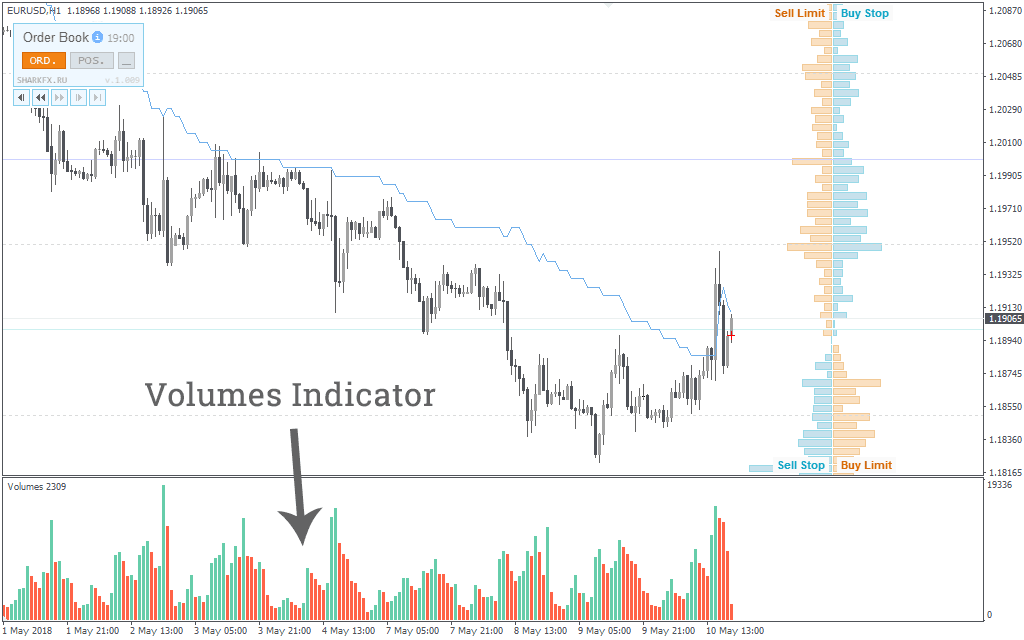

In the forex market, volume signifies the number of transactions or contracts traded within a specified timeframe. This data offers traders a glimpse into the intensity of trading activity, allowing them to gauge market sentiment and potential price movements.

Delving into Volume Interpretation

Analyzing volume in forex requires a discerning eye and an understanding of its nuances. Here’s a breakdown of key considerations:

- High volume: Indicative of strong market participation, often associated with significant price fluctuations or potential trend reversals.

- Low volume: Suggests a lull in trading activity, possibly signaling market indecision or a lack of conviction in the current trend.

- Rising volume during an uptrend: Confirms the strength of the upward momentum, increasing the likelihood of continued gains.

- Rising volume during a downtrend: Indicates selling pressure intensifying, potentially foreshadowing a further price decline.

Volume Patterns: Unveiling Trade Opportunities

Beyond basic volume analysis, traders can also delve into volume patterns to refine their understanding. Some common patterns include:

- Volume spikes: Sudden surges in volume indicate a potential breakout or a change in market direction.

- Volume divergence: When volume and price move in opposite directions, this divergence can signal a potential trend reversal.

li>Volume gaps: If the market opens at a price significantly higher or lower than the previous day’s close, and there is no corresponding volume, this ‘gap’ can suggest market volatility and potential disruptions.

Tips and Expert Advice for Enhanced Trading

Leveraging the insights gleaned from volume analysis, traders can employ specific strategies to enhance their trading performance:

- Trade with the trend: When volume supports the prevailing trend, it’s prudent to align trades with the market’s momentum.

- Confirm breakouts: Volume spikes can validate breakout attempts, increasing the probability of successful trades.

- Monitor volume divergences: Be cautious when price and volume diverge, as it may signal a pending trend reversal.

- Avoid trading during low-volume periods: Market conditions can be unpredictable during these times, increasing trading risks.

- Correlate volume with other indicators: Combine volume analysis with other technical indicators for a more comprehensive market assessment.

Image: howtotradeonforex.github.io

FAQs on Volume Indicator in Forex

To further empower traders, here’s a concise FAQ on volume indicator in forex:

Q: Is volume a reliable indicator in forex trading?

A: Volume, when analyzed in conjunction with other indicators, can provide valuable insights into market sentiment and potential price movements.

Q: How can I identify potential trend reversals using volume?

A: Volume divergence, particularly where volume declines while prices continue to rise or vice versa, often precedes trend reversals.

Q: Should I always trade with high volume?

A: While high volume can indicate strong market participation, it’s crucial to consider other factors, such as trend direction and price action, before making trading decisions.

How To Read Volume Indicator In Forex

Conclusion

Mastering the volume indicator in forex is a transformative skill for traders seeking to unlock market insights and navigate the complexities of the currency market. By understanding the principles outlined in this comprehensive guide and embracing expert advice, traders can enhance their analytical prowess and make informed trading decisions. Are you ready to dive into the world of volume analysis and uncover the secrets to unlocking profitable forex trades?