In the realm of global finance, the foreign exchange (forex) market stands as a colossal arena where currencies are traded and exchanged in astronomical volumes. At its core lies the concept of forex pairs, which represent the value of one currency relative to another. Understanding how to read these pairs is akin to cracking the code of this intricate financial ecosystem.

Image: www.dailyfx.com

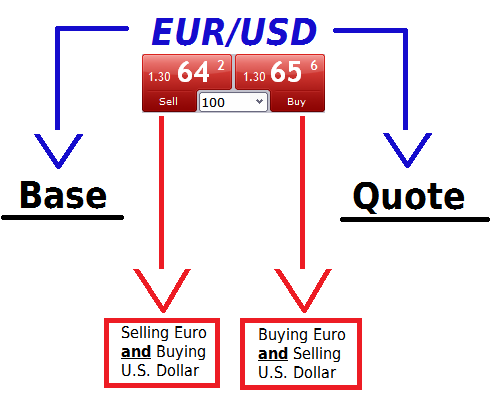

For the uninitiated, forex pairs appear as three-letter combinations, such as EUR/USD or GBP/JPY. The currency listed first, known as the base currency, is always one unit. The second currency, called the quote currency, indicates how much of the base currency is required to purchase one unit of it.

Deciphering the Dance of Currency Pairs

Imagine a currency pair as a dance performed by two opposing forces, each currency vying for dominance. The base currency represents the initial mover, setting the pace and direction of the dance. The quote currency, on the other hand, reacts to the base currency’s movements, adjusting its position to maintain balance.

When the value of the base currency rises relative to the quote currency, the pair is said to be appreciating. Conversely, a depreciation occurs when the value of the base currency falls against the quote currency. This constant interplay between the two currencies creates the fluctuations that define the forex market.

A Numerical Example to Illuminate

Let’s consider the EUR/USD pair as an example. Suppose the quoted value is 1.2000. This means that one euro is equivalent to 1.2000 U.S. dollars. If the value rises to 1.2050, it indicates that the euro has appreciated against the dollar. The higher the number, the stronger the euro is in relation to the dollar.

The Role of Pip: Measuring Currency Fluctuations

In the forex world, the smallest unit of measurement is called a pip (point in percentage). A pip represents a change of 0.0001 for currency pairs like EUR/USD and GBP/JPY. For currency pairs with yen as the quote currency, a pip is equivalent to 0.01. These tiny increments allow traders to track even the most minute changes in currency values.

Image: tradingstrategyguides.com

Leveraging the Power of Forex Pairs

Understanding how to read forex pairs empowers traders and investors with invaluable insights. By deciphering the dance of currencies, they can anticipate trends, make informed decisions, and potentially profit from the ebb and flow of the global currency market.

Mastering the Art of Currency Pair Interpretation

To master the art of reading forex pairs, traders and investors should delve into the following depths:

-

Research Currency Fundamentals : Understand the economic and political factors that influence currency values, such as interest rates, inflation, and Gross Domestic Product (GDP).

-

Keep an Eye on Economic Calendar : Stay abreast of upcoming economic events and announcements that can potentially impact currency movements.

-

Study Technical Analysis Indicators : Utilize charting tools and technical indicators (e.g., moving averages, Bollinger Bands) to identify patterns and potential trading opportunities.

-

Practice, Practice, Practice : The key to becoming proficient in forex trading lies in practice. Utilize virtual trading simulators or demo accounts to hone your skills and gain

How To Read Forex Pairs

Conclusion

Navigating the complexities of the forex market requires a keen understanding of how to read forex pairs. By unlocking the secrets of currency pairs, traders and investors can unlock a world of financial opportunities. Remember, the journey towards forex mastery demands continuous learning, practice, and a thirst for knowledge. Embrace the challenge, decipher the dance of currencies, and seize the rewards that await those who master this financial realm.