As an avid forex trader, I’ve witnessed firsthand how volatility can make or break a trading strategy. Volatility, a measure of price fluctuations in the currency market, is a crucial factor to consider when assessing market conditions and making informed decisions.

Image: paxforex.org

In the ever-changing forex market, volatility is omnipresent. It’s the thrill-inducing spice that entices traders while simultaneously posing a daunting challenge. By harnessing the power of volatility, traders can amplify their profits, but underestimating its impact can lead to rapid market exits.

Understanding Volatility in Forex

Volatility in forex refers to the magnitude and frequency of price changes in a given currency pair. It’s a crucial metric for traders because it indicates the risk associated with a particular currency pair and helps them make informed decisions about position sizing and risk management.

Measuring volatility is essential for understanding market conditions and forecasting future price movements. A highly volatile currency pair suggests that its price can swing wildly in either direction, potentially leading to significant gains or losses. In contrast, a currency pair with low volatility typically exhibits more stable prices, making it less risky but also less lucrative.

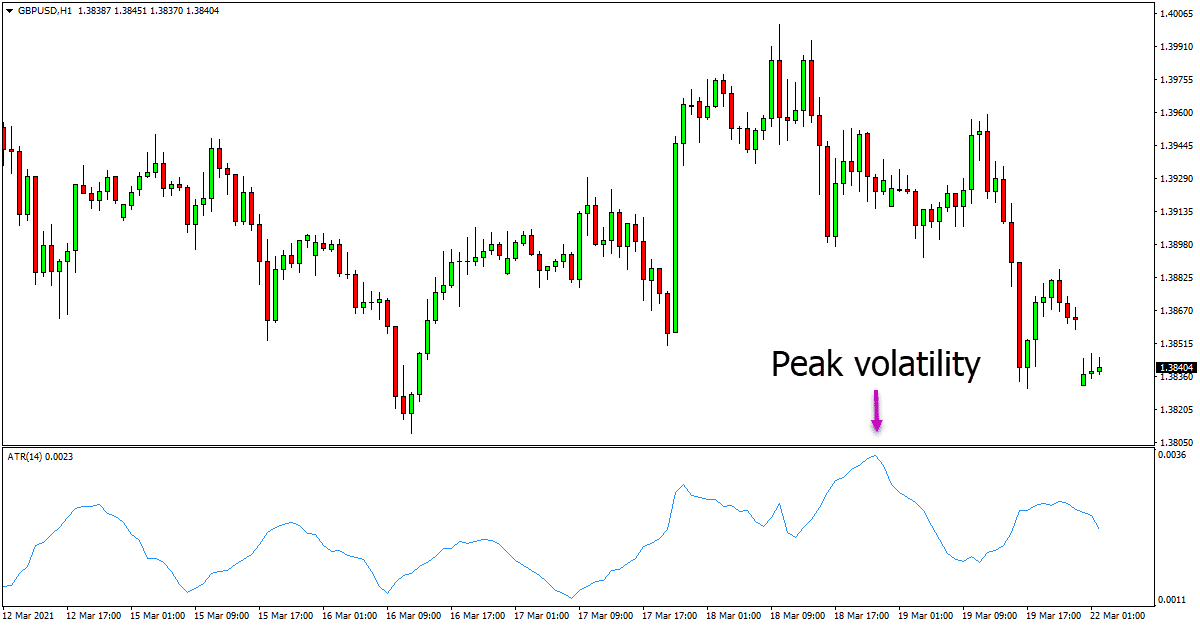

Measuring Volatility in Forex

There are numerous ways to measure volatility in forex, each with its own advantages and limitations. Some popular methods include:

- Average True Range (ATR): ATR measures the average range of true price movement in a currency pair over a specified period.

- Bollinger Bands: Bollinger Bands are a technical indicator that uses standard deviation to measure volatility. Wider bands indicate higher volatility, while narrower bands suggest lower volatility.

- Historical Volatility: Historical volatility is a measure of volatility that looks at past price data. It provides insights into the volatility patterns of a currency pair over time.

Tips for Managing Volatility in Trading

While volatility can be unpredictable, there are strategies traders can implement to manage its impact:

- Choose the Right Currency Pairs: Understand the volatility profile of different currency pairs and select those that align with your risk tolerance.

- Manage Position Sizing: Use position sizing to control the risk associated with volatile trades. Trade with smaller positions when volatility is high, and increase position sizes during periods of low volatility.

- Use Stop-Losses: Stop-loss orders are essential for protecting your capital in volatile markets. They allow you to define the maximum loss you’re willing to accept on a trade.

- Monitor Market News: Stay up-to-date with economic news and political events that can impact currency prices. This information can help you anticipate changes in volatility.

Image: learnpriceaction.com

FAQ on Volatility in Forex

Q: What causes volatility in forex?

A: Volatility in forex is influenced by various factors such as economic data releases, political events, natural disasters, and market sentiment.

Q: How do I measure volatility in forex?

A: Common methods for measuring volatility in forex include Average True Range (ATR), Bollinger Bands, and Historical Volatility.

Q: How can I manage volatility in forex trading?

A: Techniques for managing volatility include choosing the right currency pairs, managing position sizing, using stop-losses, and monitoring market news.

How To Measure Volatility In Forex

Conclusion

Volatility is an integral aspect of the forex market that can both challenge and reward traders. By understanding how to measure and manage volatility, traders can equip themselves with the knowledge and skills necessary to navigate the market’s complexities. Are you ready to embrace the power of volatility and expand your horizons in the world of forex?