Candlestick charting, an ancient yet timeless technique, has stood the test of time as a potent tool for deciphering the cryptic messages of financial markets. In the arena of forex, candlesticks offer traders a profound lens through which they can scrutinize market sentiment, predict price movements, and make informed trading decisions.

Image: www.jlcatj.gob.mx

Each candlestick represents a specific time period, typically an hour, day, or week. Within this timeframe, the candlestick conveys crucial information about the opening price, closing price, high, and low of the corresponding period. The configuration of these elements creates unique shapes that serve as valuable clues to market behavior.

Breaking Down Candlestick Patterns

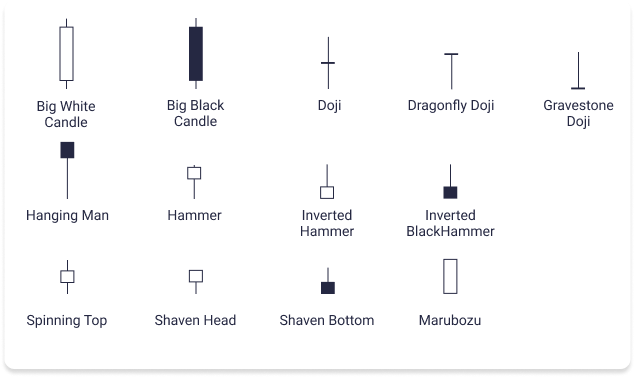

Dissecting the morphology of a candlestick is akin to examining a hieroglyphic, each stroke and curve holding hidden meaning. The most prevalent candlestick patterns include:

-

Bullish Candle: This robust candlestick, with a closing price higher than its opening price, signifies a surge in buying pressure. Its elongated body, typically in green or white, is reminiscent of a rocket soaring upwards.

-

Bearish Candle: This ominous candle, with its lower close relative to its open, signals that the bears have taken control. Its color, often red or black, evokes the image of a flame extinguished, extinguishing the hopes of bulls.

-

Hammer: Unlike its namesake tool, this bullish candle is characterized by a small body and a comparatively long lower shadow or tail. Emerging after a downtrend, it suggests a potential reversal, indicating that the bulls have stepped forward to defend their turf.

-

Hanging Man: This bearish cousin of the Hammer exhibits a similar small body but sports a long upper shadow or wick. Appearing at the tail end of an uptrend, it whispers caution, hinting that the bulls may be losing their grip.

Candlesticks in Context: Unraveling Market Dynamics

The significance of candlesticks multiplies when they are woven into the broader tapestry of market context. Sequential candlestick patterns, combined with technical indicators and fundamental analysis, paint a more nuanced picture of market dynamics.

-

Double Top: This ominous pattern, formed by two consecutive peaks, warns of a potential downtrend. The inability of bulls to break through the resistance level signals a shift in momentum.

-

Double Bottom: A glimmer of hope for bulls, this pattern comprises two consecutive troughs, implying a breakout and an impending uptrend. The bulls’ resilience in defending the support level is a testament to their determination.

-

Head and Shoulders: A visually striking pattern, this formation consists of a central peak flanked by two smaller peaks. Its somber message is of an imminent downtrend, with the neckline forming a crucial support level.

Candlesticks as a Trading Compass: Navigating Market Tides

Armed with the knowledge of candlestick patterns, traders gain an invaluable compass to guide their trading decisions.

-

Bullish Traders: Identify bullish candlesticks and patterns, signaling opportunities to enter long positions or reinforce existing ones. Buying as the candle closes above resistance levels maximizes potential profits.

-

Bearish Traders: Seek out bearish candlesticks and patterns to justify short positions or enhance existing ones. Waiting for candles to close below support levels is prudent for optimal execution.

Image: www.vlr.eng.br

How To Interpret Candlesticks In Forex

Beyond Candlesticks: Embracing a Holistic Trading Approach

While candlesticks provide valuable insights, they are not the sole oracle of the financial world. Employing a multi-faceted approach that incorporates technical analysis, fundamental analysis, and risk management strategies strengthens trading decisions.

By mastering the art of candlestick interpretation and integrating it into their trading strategies, forex traders can gain a competitive edge in navigating the ever-changing market landscape.