Foreword

As a seasoned forex trader, I’ve witnessed firsthand the transformative impact of increasing lot size on profit potential. However, it’s crucial to approach this concept with prudence and a deep understanding of its implications. In this exclusive article, I’ll guide you through the intricacies of increasing lot size in forex, empowering you to make informed decisions and unlock the full potential of your trading journey.

Image: www.cashbackforex.com

Leveraging the Power of Lot Size

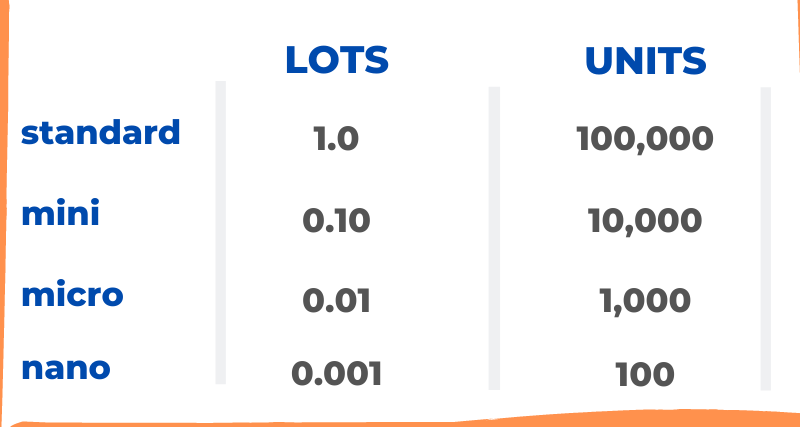

In the dynamic world of forex trading, lot size plays a pivotal role in determining the scale and potential returns of your trades. Simply put, lot size refers to the standard unit of measurement in forex, representing a predefined number of base currency units. By understanding the intricacies of lot sizes, traders can optimize their strategies and seize opportunities to maximize profitability.

Unveiling the Art of Lot Size Optimization

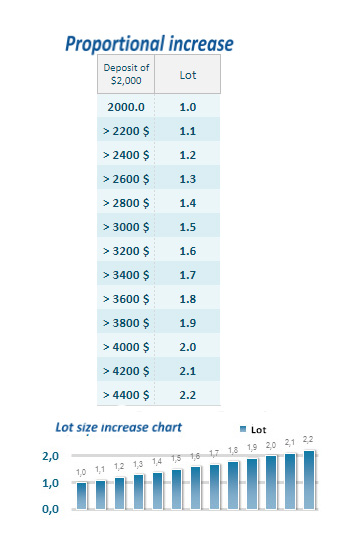

The key to mastering lot size optimization lies in striking a delicate balance between risk and reward. Novice traders often fall into the trap of increasing lot sizes prematurely, lured by the allure of quick profits. However, this approach can lead to substantial losses if not executed with caution. Instead, a gradual and calculated increase in lot size, aligned with your trading experience and risk tolerance, is the prudent path to success.

Assessing Trading Progress and Managing Risk

As you progress on your trading journey, it’s imperative to evaluate your performance and adjust your lot size accordingly. Consistent profitability serves as a testament to your proficiency and provides a solid foundation for increasing lot size. However, market volatility and unforeseen events are inherent to forex trading, necessitating a conservative approach. Conservative lot size management ensures that potential drawdowns are manageable, preserving your capital and providing a safety net against adverse market conditions.

Image: fxssi.com

Tips and Expert Insights for Maximizing Profits

-

Start Small:

Begin with a modest lot size that aligns with your account balance and risk appetite. Gradually increase lot size as your experience and confidence grow.

-

Manage Risk:

Implement a robust risk management strategy that aligns with your financial objectives. Use stop-loss orders to mitigate potential losses and protect your capital.

-

Consider Leverage:

Leverage can amplify both profits and losses. Use leverage judiciously and within the limits of your experience and risk tolerance.

-

Monitor Market Conditions:

Stay abreast of market news and economic data that may impact currency pairs. Adapt your lot size strategy based on prevailing market conditions.

-

Seek Professional Guidance:

Consider consulting with an experienced forex trader or mentor who can provide valuable insights and guidance.

FAQs (Frequently Asked Questions):

-

Q: What is the ideal lot size for beginners?

A: The ideal lot size for beginners is typically 0.01 lots, representing 1,000 units of the base currency.

-

Q: How do I determine the appropriate lot size for my trades?

A: Consider your account size, risk tolerance, and trading strategy when determining the appropriate lot size. Start small and gradually increase lot size as your experience and profitability grow.

-

Q: Can I increase lot size without increasing risk?

A: Increasing lot size inherently increases the potential risk of your trades. However, using proper risk management techniques, such as stop-loss orders, can mitigate potential losses.

-

Q: What are the potential consequences of increasing lot size too quickly?

A: Increasing lot size too quickly can lead to excessive drawdowns, margin calls, and substantial losses.

-

Q: How do I protect myself from market volatility when increasing lot size?

A: Monitoring market conditions, using stop-loss orders, and maintaining a conservative leverage ratio can help protect you from market volatility when increasing lot size.

How To Increase Lot Size In Forex

Conclusion

Increasing lot size in forex can be a potent strategy for enhancing profit potential. However, it’s essential to approach this concept with caution and a comprehensive understanding of its implications. By following the guidelines and expert advice outlined in this article, you can empower yourself to optimize your lot size strategy, maximize profits, and navigate the complexities of forex trading with confidence.

So, dear reader, are you ready to embark on a transformative journey in the realm of forex trading? By embracing the concepts discussed herein, you can unlock the full potential of increasing lot size and achieve new heights of profitability.