Introduction

In the realm of forex trading, false breakouts are a deceptive phenomenon that can leave unsuspecting traders with significant losses. They occur when a currency pair appears to break out of a range but then quickly reverses, leaving traders trapped on the wrong side of the trade. Recognizing and avoiding false breakouts is crucial for successful forex trading.

Image: www.viptrading.in

Identifying False Breakouts

Forex price action often exhibits range-bound behavior, oscillating within specific levels. When a currency pair breaks out of this range, traders may anticipate a trend continuation in the direction of the breakout. However, sometimes, these breakouts are false and merely temporary excursions outside the range.

To identify false breakouts, traders employ various technical indicators and chart patterns that provide insights into market behavior. These include:

Volume Analysis

False breakouts often occur with relatively low trading volume. When the volume is below average during a breakout, it can signal a lack of conviction among market participants and a potential reversal.

Outside Bars

Outside bars are candlesticks that extend beyond the previous day’s high and low. While they can indicate strong momentum, outside bars that form near support or resistance levels often lead to false breakouts.

Image: www.youtube.com

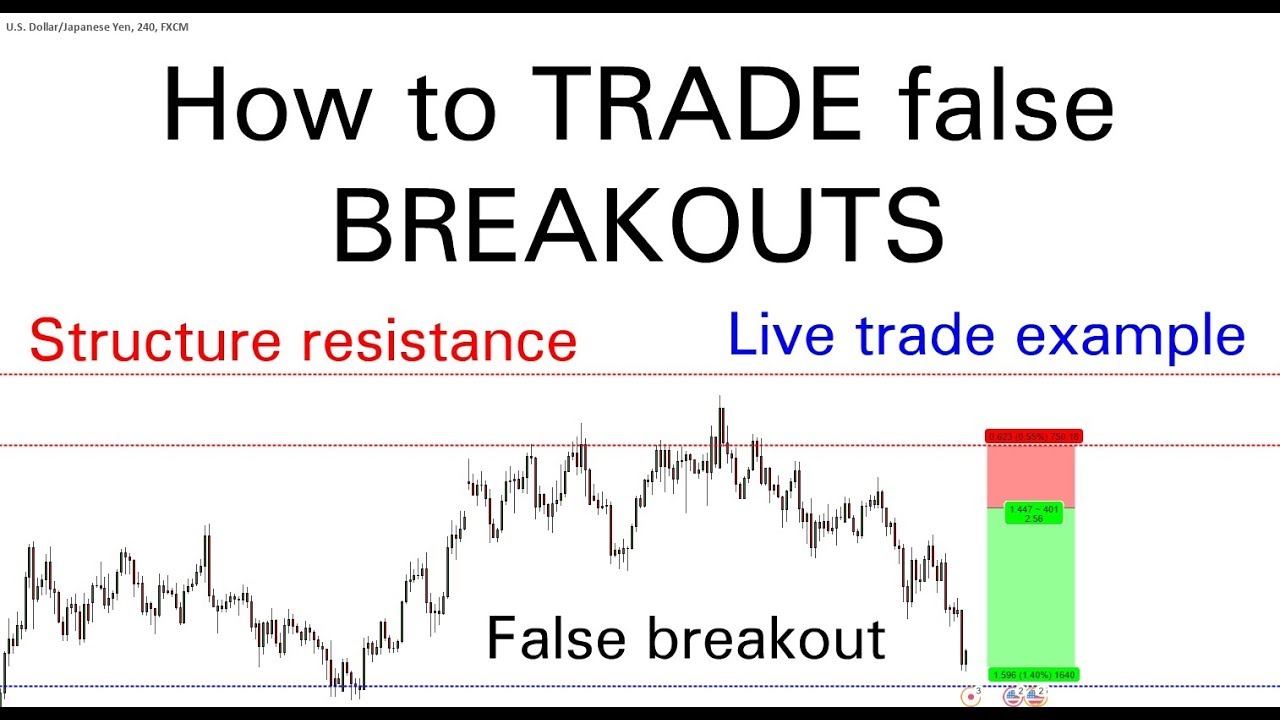

Support and Resistance Levels

Breakouts that fail to hold above or below key support or resistance levels are vulnerable to reversals. When a breakout falls back within the range, it suggests that the market has not genuinely overcome the technical barrier.

Trend Indicators

Trend indicators such as moving averages and trendlines can help identify false breakouts. For example, if a breakout occurs against the dominant trend, indicated by a declining moving average or sloping trendline, it is more likely to be reversed.

Expert Advice and Tips

Seasoned forex traders share the following tips to combat false breakouts:

Wait for Confirmation

Do not rush into trades based on breakouts. Wait for the price to confirm the breakout with a subsequent candle or volume spike before executing a trade.

Identify False Breakouts on Lower Time Frames

False breakouts often become more evident on lower time frames. Switch to a smaller time scale (e.g., 15-minute or 5-minute chart) to spot false breakouts more easily.

Use Multiple Confirmation Indicators

Do not rely solely on a single indicator. Combine several indicators to increase the probability of recognizing false breakouts accurately.

Common FAQs

- Q: Are false breakouts common in forex?

A: Yes, false breakouts occur frequently in forex, soprattutto during periods of ranging market behavior. - Q: How can I avoid the impact of false breakouts?

A: Employ proper risk management techniques such as stop-loss orders and prudent position sizing. Wait for confirmation before entering trades, and avoid impulsive decisions based solely on breakouts.

How To Identify False Breakout In Forex Pdf

Conclusion

Recognizing false breakouts is a vital skill for forex traders. By utilizing technical indicators, chart patterns, and expert advice, traders can mitigate the impact of these deceptive market events. Remember, patience and composure are key. Do not chase every breakout, and wait for the market to provide convincing confirmation before committing to a trade.

Are you interested in learning more about false breakouts and their implications in forex trading?