For the uninitiated, navigating the tumultuous waters of the foreign exchange (forex) market can be akin to navigating a maze without a map. However, equipped with the right tools and strategies, traders can discern patterns within the chaotic market movements, revealing lucrative opportunities. One such tool is the ability to identify trends, allowing traders to ride the waves of market sentiment and maximize their profits.

Image: www.forexboat.com

What is a Trend in Forex?

In the realm of forex trading, a trend refers to a sustained movement in the exchange rate of a currency pair, characterized by a series of higher or lower peaks. Trends can range from short-term fluctuations, lasting a few hours or days, to long-term cycles that span months or even years. Understanding and exploiting these trends is paramount for successful forex trading.

Harnessing Technical Indicators for Trend Identification

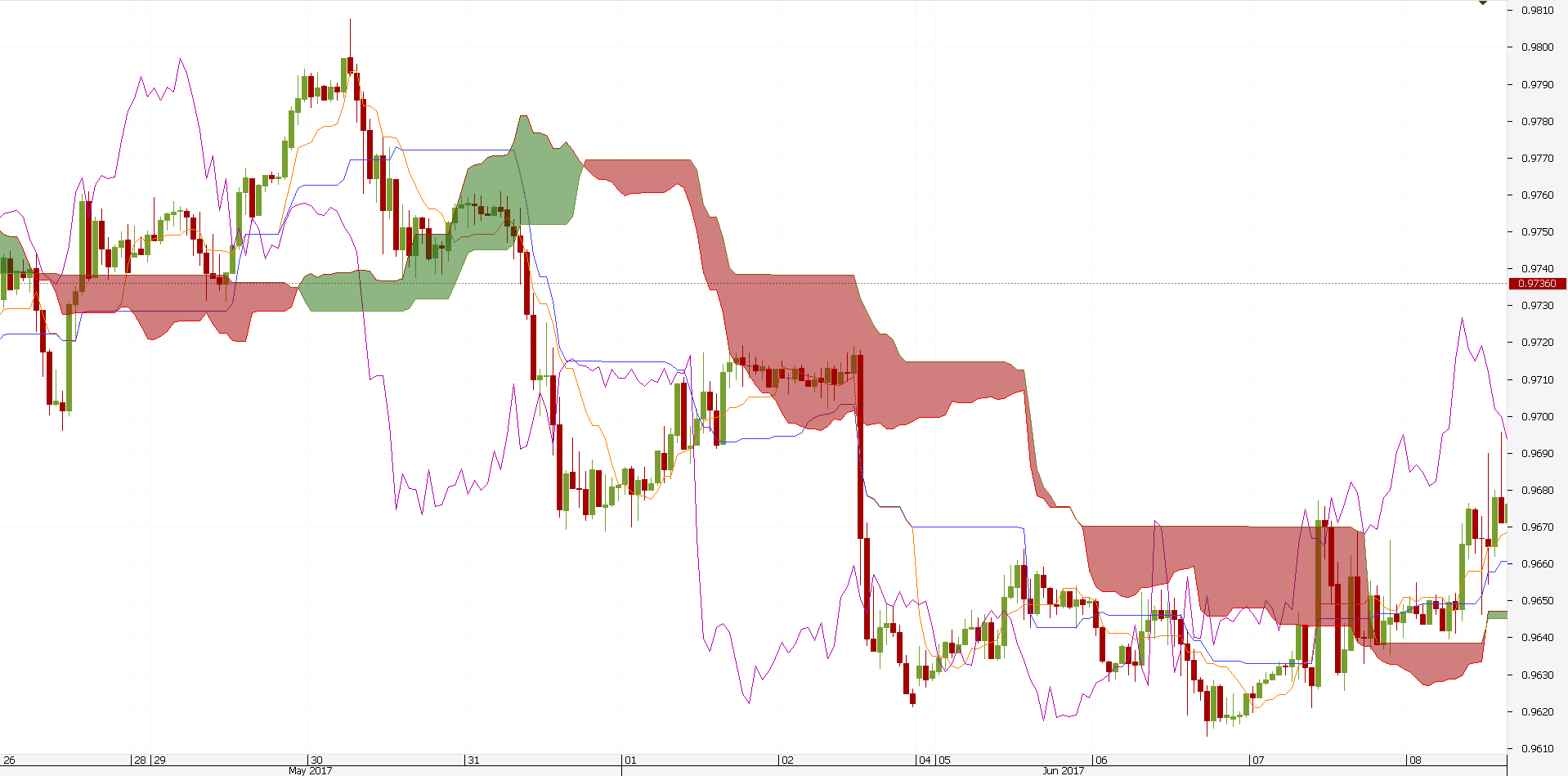

Technical analysis is a powerful tool for identifying trends in the forex market. By analyzing historical price data, traders can utilize various indicators to determine the prevailing market sentiment and predict future price movements.

- Moving Averages: Moving averages smooth out price fluctuations, revealing the underlying trend. Traders can use short-term, medium-term, and long-term moving averages to identify different time frames.

- Trend Lines: Trend lines connect a series of highs or lows, establishing support and resistance levels. Breaking through these lines can signal a change in trend.

- Momentum Indicators: Momentum indicators measure the strength and speed of a trend. For example, the relative strength index (RSI) helps traders identify overbought or oversold conditions.

- Oscillators: Oscillators fluctuate around a center line, indicating market sentiment. The stochastic oscillator and the commodity channel index (CCI) are popular examples.

Fundamental Analysis and Sentiment Indicators

While technical analysis focuses on price data, fundamental analysis examines economic factors that can influence currency values. Economic indicators, geopolitical events, and central bank policies can impact forex trends.

- Gross Domestic Product (GDP): Changes in GDP reflect economic growth and can influence currency demand.

- Interest Rates: Central banks set interest rates to control inflation, which can affect currency values.

- Consumer Price Index (CPI): CPI measures inflation, providing insights into economic conditions.

- News and Rumors: Major news events and rumors can trigger significant price movements in the forex market.

Image: www.pinterest.jp

How To Find Trend In Forex Market

Combining Technical and Fundamental Analysis

The most effective approach to trend identification is a combination of technical and fundamental analysis. By considering both price movements and economic factors, traders can gain a comprehensive perspective on market sentiment and make more informed trading decisions.

In conclusion, understanding and exploiting trends is essential for successful forex trading. By utilizing technical indicators, fundamental analysis, and a keen eye for market dynamics, traders can identify lucrative trading opportunities and navigate the volatile forex market with confidence. Remember, the ability to discern trends, combined with sound risk management and a disciplined trading strategy, can lead to consistent profits and long-term trading success.