Introduction: Embark on a Lucrative Forex Swing Trading Journey

In the fast-paced world of financial markets, forex swing trading emerges as a captivating technique that has lured countless traders seeking both excitement and profitability. Swing trading in forex involves analyzing market trends and exploiting price fluctuations over a period of days or even weeks, aiming to capture sizable profits. Join us in this comprehensive guide as we decipher the intricacies of swing trading, unravel its strategies, and unlock its boundless potential to enhance your financial pursuits.

Image: theforexgeek.com

Unveiling Swing Trading: A Path to Market Mastery

Swing trading occupies a unique position within the trading spectrum, blending elements of both short-term scalping and long-term investing. This hybrid approach empowers traders to capitalize on price swings that unfold over multiple days or weeks, igniting the potential for substantial returns. Unlike day traders who pursue intraday profits, swing traders possess the flexibility to hold positions overnight, allowing them to navigate market vagaries while maximizing their profit-generating opportunities.

Selecting the Perfect Trading Weapons: Technical and Fundamental Analysis

The foundation of effective swing trading rests upon the harmonious interplay of technical and fundamental analysis. Technical analysis, the art of deciphering price charts and patterns, equips traders with a profound understanding of market sentiment and potential future price movements. By studying price action, support and resistance levels, and moving averages, swing traders discern trading opportunities with enhanced precision. Complementing technical analysis, fundamental analysis delves into the underlying economic factors that drive currency fluctuations, such as interest rates, economic growth, and geopolitical events. A comprehensive grasp of both methodologies empowers traders to make informed decisions that align with prevailing market dynamics.

The Secret Sauce: Identifying and Executing Swing Trades

Identifying lucrative swing trading opportunities demands a discerning eye and a thorough understanding of market behavior. Technical indicators such as the Relative Strength Index (RSI), moving averages, and Bollinger Bands provide valuable insights into market momentum and potential trend reversals. Once a trading opportunity arises, swift and decisive execution is paramount. Swing traders employ various order types to enter and exit trades strategically, including market orders, limit orders, and stop-loss orders, ensuring optimal trade execution and risk management.

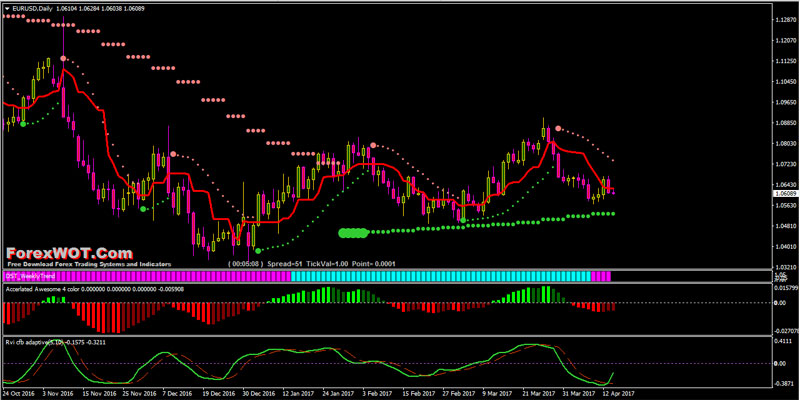

Image: forexwot.com

Mitigating Risk: The Cornerstone of Trading Success

Risk management lies at the heart of prudent swing trading practices. Implementing a robust risk management strategy safeguards your hard-earned capital and enhances your trading longevity. Establishing clear entry and exit points, adhering to predefined stop-loss levels, and diversifying your trading portfolio are fundamental pillars of risk mitigation. Moreover, maintaining a disciplined trading mindset, devoid of emotional biases, is crucial for navigating market volatility and preserving your financial well-being.

Psychology of Swing Trading: Mastering the Inner Game

The psychological aspect of swing trading holds immense sway over a trader’s success. Cultivating a positive mental attitude, grounded in patience and discipline, is paramount to overcoming the emotional rollercoaster inherent in financial markets. Swing traders must possess the fortitude to withstand drawdowns and the resilience to capitalize on profitable trades without succumbing to greed or fear. Embracing a holistic approach that incorporates mindfulness techniques and self-reflection can bolster a trader’s psychological well-being and optimize their trading performance.

Harnessing the Power of Technology: Tools for Trading Empowerment

In today’s digital trading landscape, an array of cutting-edge tools and platforms empowers swing traders to elevate their trading prowess. Sophisticated charting software, automated trading systems, and real-time market data feeds enhance traders’ ability to analyze markets, identify trading opportunities, and execute trades seamlessly. By embracing these technological advancements, swing traders gain a competitive edge, enabling them to make informed decisions and maximize their profit-generating potential.

Education and Continuous Learning: The Path to Trading Excellence

The pursuit of knowledge and continuous learning forms the bedrock of successful swing trading. A commitment to expanding your trading knowledge through books, online courses, webinars, and market commentary keeps you abreast of the latest strategies and market trends. By engaging in active learning and seeking mentorship from experienced traders, you lay the foundation for sustained trading success and personal growth.

How To Do Swing Trading In Forex

Conclusion

Swing trading forex presents a compelling opportunity to tap into the vast potential of currency markets. By mastering the art of technical and fundamental analysis, employing prudent risk management strategies, and cultivating a resilient trading psychology, you can unlock the secrets of successful swing trading. Embrace the power of technology, dedicate yourself to continuous learning, and embark on a journey of financial empowerment. Whether you are a seasoned trader or a novice eager to delve into the world of forex, this comprehensive guide has equipped you with the knowledge and strategies to navigate market fluctuations and achieve your trading aspirations.