In the realm of financial trading, automated trading systems, known as Forex Expert Advisors (EAs), have emerged as indispensable tools for traders seeking to navigate the complexities of the foreign exchange market. Yet, for many, cracking the code of Forex EAs remains an elusive enigma. In this comprehensive guide, we embark on a journey to unveil the secrets of Forex EAs, empowering traders with actionable insights to harness their full potential.

Image: forexcrf.blogspot.com

Laying the Foundation

Forex EAs are software programs designed to execute trades automatically based on predefined parameters. They leverage advanced algorithms and technical indicators to analyze market data, identify trading opportunities, and execute trades accordingly. This level of automation dramatically reduces the need for manual intervention, allowing traders to step away from constant market monitoring and focus on other aspects of their trading strategies.

Unraveling the Intricacies

Cracking the code of Forex EAs requires a deep dive into their underlying mechanisms. At the heart of these programs lie complex algorithms and trading strategies. Some EAs employ trend-following strategies, analyzing market patterns to identify potential breakouts and reversals. Others rely on scalping strategies, executing numerous small trades to capitalize on minor price fluctuations. A thorough understanding of these strategies is essential for optimizing EAs’ performance.

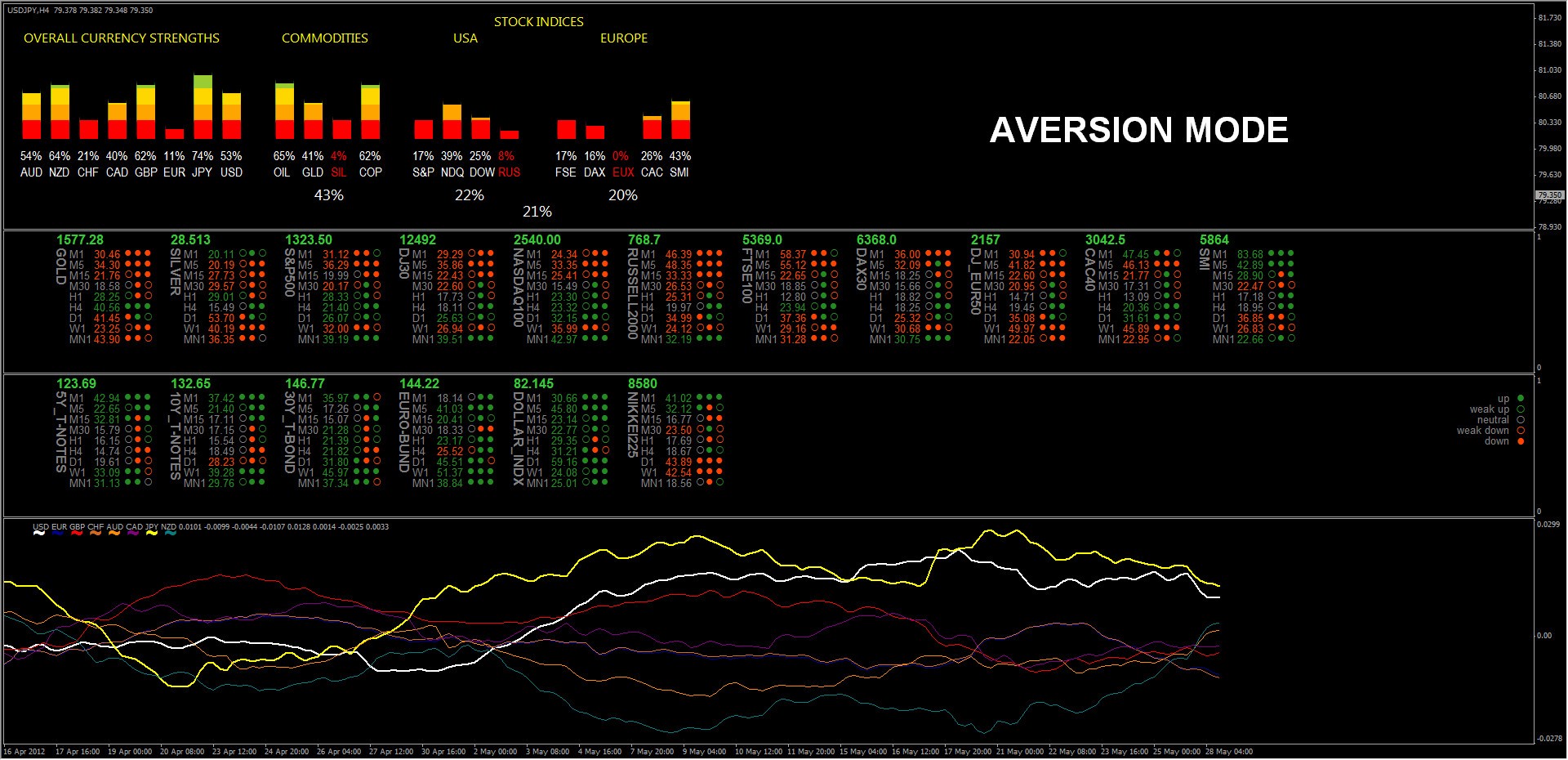

Harnessing the Power of Technical Indicators

Technical indicators play a pivotal role in Forex EAs, providing valuable insights into market trends and price movements. Popular indicators include moving averages, relative strength index (RSI), and Bollinger bands. By integrating these indicators into their EAs, traders can refine trading signals and make more informed decisions.

Image: lasopaforlife604.weebly.com

Exploring Real-World Applications

The versatility of Forex EAs extends beyond algorithmic trading. They can be programmed to execute specific tasks such as risk management, order management, and backtesting. By automating these functions, traders can streamline their trading workflow, improve efficiency, and prevent costly mistakes.

Seeking Expert Guidance

Navigating the complexities of Forex EAs can be a daunting task. Seeking expert guidance from experienced traders and mentors is invaluable. Reputable sources can provide insights into best practices, EA selection, and risk management strategies. By tapping into this collective knowledge, traders can accelerate their learning curve and maximize the effectiveness of their EAs.

Crafting an Effective EA Trading Strategy

To unlock the full potential of Forex EAs, traders must develop a robust trading strategy. This strategy should define the entry and exit points, trade frequency, risk management parameters, and money management strategies. By tailoring their EAs to align with their unique trading style and risk tolerance, traders can enhance their chances of success.

Continuous Evaluation and Refinement

The foreign exchange market is constantly evolving, and Forex EAs should be treated as living entities that require ongoing monitoring and refinement. Traders should regularly assess the performance of their EAs, tweak parameters, and explore innovative strategies to adapt to changing market conditions. This iterative approach ensures that EAs remain aligned with market realities and deliver optimal returns.

How To Crack Forex Ea

Conclusion

Cracking the code of Forex EAs is a transformative endeavor that empowers traders to unlock the hidden potential of automated trading. By delving into the mechanisms of these systems, harnessing the power of technical indicators, seeking expert guidance, and developing effective trading strategies, traders can unlock a new level of efficiency and profitability in the foreign exchange market. Embark on this journey today, and experience the transformative power of Forex EAs firsthand.