In the ever-fluctuating world of forex trading, discerning genuine trends amidst the market’s oscillations is paramount to success. Confidently recognizing these trends empowers traders to make informed decisions, potentially leading to lucrative outcomes. But how does one ascertain the authenticity of a trend? Let’s embark on a comprehensive voyage through the essential steps of trend confirmation in forex trading.

Image: fxpipsgainer.com

Delving into Trend Patterns

A trend in forex trading depicts a sustained price movement in a particular direction over time. Whether it’s an uptrend, downtrend, or sideways movement, recognizing these patterns is the cornerstone of successful trading. Two prevalent trend patterns include:

-

Upward Trend (Bullish): In an uptrend, the market exhibits a series of higher highs and higher lows, indicating an overall upward movement.

-

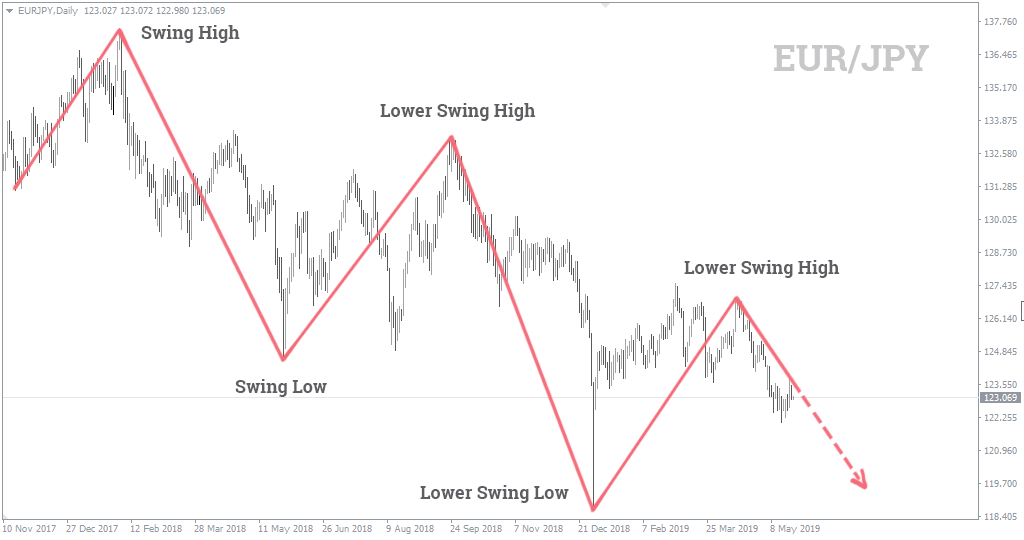

Downward Trend (Bearish): Conversely, a downtrend manifests as a sequence of lower lows and lower highs, suggesting a predominant downward price direction.

Indicators that Reinforce Trends

Confirming a trend involves incorporating various technical indicators. These tools, when used in tandem, provide a comprehensive analysis, boosting traders’ confidence in their trend assessments.

-

Trendlines: Trendlines connect significant high or low points, providing visual representation of the trend’s trajectory.

-

Moving Averages: Moving averages smooth price fluctuations and establish a trend’s path by calculating the average price over a selected period.

-

Momentum Indicators: Indicators like the Relative Strength Index (RSI) and the Stochastic Oscillator gauge price momentum, helping traders identify overbought or oversold conditions.

-

Volume Analysis: Volume analysis reveals the number of trades occurring at a specific price point, providing insight into market sentiment and trend strength.

Combining Indicators for Validation

The key to effective trend confirmation lies in harmonizing multiple indicators. When several indicators align in concordance, it significantly enhances the reliability of the trend assessment. For instance, an uptrend is corroborated when price action aligns with an upward sloping trendline, exhibits a positive RSI, and experiences high trading volume.

Influences on Trend Behavior

Beyond technical analysis, external factors can influence trend dynamics:

-

Economic Data: Major economic releases, such as GDP figures and interest rate decisions, can trigger market reactions and potential trend reversals.

-

Political Events: Political uncertainty or significant events can lead to market volatility and impact trends.

-

News and Market Sentiment: Media coverage and investor sentiment can stir market emotions, potentially affecting trend direction.

Conclusion

Mastering the art of trend confirmation in forex trading empowers traders to navigate the market’s complexities with greater confidence. By embracing proven technical indicators, understanding external influences, and harmonizing multiple signals, traders can pinpoint genuine trends, make informed trading decisions, and potentially reap the rewards of favorable market movements. Remember, the path to trading success is paved with constant learning and the ability to adapt to the ever-evolving forex landscape.

Image: howtotradeonforex.github.io

How To Confirm A Trend In Forex