Introduction

In the intricate tapestry of financial trading, the choice of currency pairs holds paramount importance. Forex trading, the globalized arena for exchanging currencies, presents traders with a vast array of potential combinations. However, navigating this currency maze requires a discerning eye and an understanding of the factors that shape the dynamics between these pairs. This comprehensive guide delves into the essential elements to consider when selecting currency pairs, empowering traders to make informed decisions and maximize their trading potential.

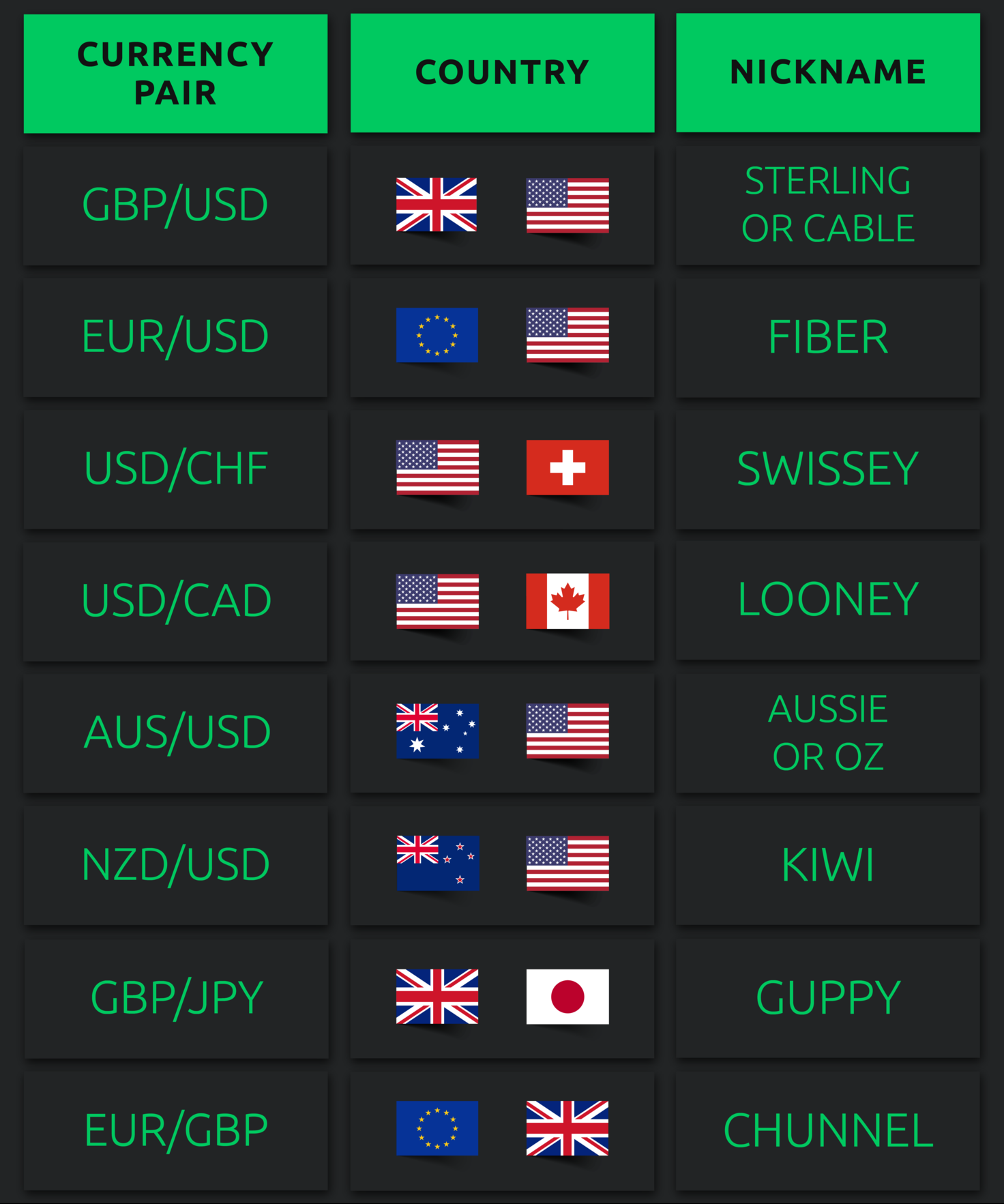

Image: dzengi.com

Factors to Consider When Choosing Currency Pairs

Economic Stability and Growth

Strong economic fundamentals are the cornerstone of stable currency pairs. Countries with steady economic growth, low inflation, and robust interest rates typically attract investors, thereby driving up the demand for their currency. Conversely, currencies from countries experiencing economic turmoil or political instability tend to exhibit high volatility, making them riskier for trading.

Interest Rate Differentials

Interest rate differentials play a pivotal role in currency pair selection. When two currencies have a significant difference in interest rates, it creates an opportunity for carry trading. Traders borrow in the currency with the lower interest rate and invest in the currency with the higher interest rate, profiting from the interest rate differential.

Image: www.aboutcurrency.com

Correlation

Correlation measures the degree to which two currencies move in tandem. Currency pairs with high positive correlation tend to move in the same direction, while those with high negative correlation tend to move in opposite directions. Knowing the correlation between currency pairs helps traders mitigate risk by diversifying their portfolio and avoiding pairs that move in sync.

Liquidity

Liquidity refers to the ease with which a currency pair can be traded. Highly liquid currency pairs are in high demand, making it easier to enter and exit trades at favorable prices. Popular currency pairs such as EUR/USD and USD/JPY offer high liquidity, ensuring swift order execution and minimal slippage.

Risk Tolerance and Trading Style

Every trader has a unique risk tolerance and trading style. Beginner traders or those seeking conservative strategies might prefer less volatile currency pairs like EUR/USD or USD/JPY. More experienced traders looking for higher returns can explore riskier pairs like AUD/USD or USD/MXN.

Popular Currency Pairs

EUR/USD (Euro vs. US Dollar)

EUR/USD is the most traded currency pair globally, representing around 24% of all Forex transactions. Its liquidity and high volatility attract both novice and experienced traders. The pair is influenced by economic data from the Eurozone and the United States, making it a barometer of global economic health.

USD/JPY (US Dollar vs. Japanese Yen)

USD/JPY is another highly liquid and popular currency pair, comprising about 19% of Forex trades. The Japanese Yen is often used as a safe-haven currency, making USD/JPY sensitive to changes in risk appetite.

GBP/USD (British Pound vs. US Dollar)

GBP/USD, also known as “Cable,” is the third most traded currency pair, representing around 13% of Forex transactions. The pair is influenced by economic factors in the United Kingdom and the United States, as well as geopolitical events.

Tips for Selecting the Right Currency Pairs

- Understand your own risk tolerance and trading style.

- Conduct thorough research on the economies of the countries involved.

- Consider the correlation between the currencies you’re considering.

- Monitor economic data and news releases that can impact the currencies.

- Trade with a reputable and regulated forex broker.

- Continuously educate yourself and stay updated on market trends.

How To Choose Currency Pairs In Forex Trading

Conclusion

Choosing the right currency pairs for Forex trading is a crucial step toward maximizing your potential profits and minimizing risks. By carefully considering the factors discussed in this guide, you can select currency pairs that align with your risk tolerance, trading style, and market conditions. Remember, the world of Forex is constantly evolving, and it’s essential to stay informed and agile to navigate its ever-changing landscape. By embracing this knowledge, you empower yourself to make informed decisions and unlock the path to successful Forex trading.