Unveiling the Secrets of Your HDFC Forex Card: A Comprehensive Guide to Accessing Statements

Image: www.paisabazaar.com

Introduction

Navigating the world of foreign exchange can be daunting, but managing your HDFC Forex Card should be anything but. Accessing your statement is crucial for keeping track of your transactions and ensuring financial well-being. In this comprehensive guide, we’ll delve into the ins and outs of checking your HDFC Forex Card statement, empowering you with the knowledge and confidence to manage your card effectively.

Step-by-Step Guide to Accessing Your Statement

Online Banking

- Login to HDFC NetBanking: Visit the official HDFC Bank website and sign into your NetBanking account.

- Select ‘Card’ > ‘Forex Card’: From the dashboard, navigate to the ‘Card’ section and select ‘Forex Card.’

- Choose Your Account: Select the HDFC Forex Card account you wish to view the statement for.

- View Statement History: Click on the ‘View Statement’ option to retrieve statements from previous months.

Mobile Banking

- Open HDFC Mobile Banking App: Download and install the HDFC Mobile Banking App on your smartphone.

- Login and Select Card Services: Enter your credentials to log in and navigate to the ‘Card Services’ section.

- Choose Forex Card: Select the ‘Forex Card’ option and choose the specific card you need.

- View Statements: Scroll down to the ‘Statements’ section and select the desired period to view the statement.

Call Customer Care

- Dial the Toll-Free Number: Call 1800 110 046 for HDFC Bank’s automated customer service helpline.

- Choose Forex Card Option: Select the option for ‘Forex Card’ followed by ‘Statements.’

- Provide Details: Input your HDFC Forex Card number and personal information as prompted.

- Receive Statement via Email: The bank will send your statement to your registered email address.

Additional Information

Understanding Your Statement:

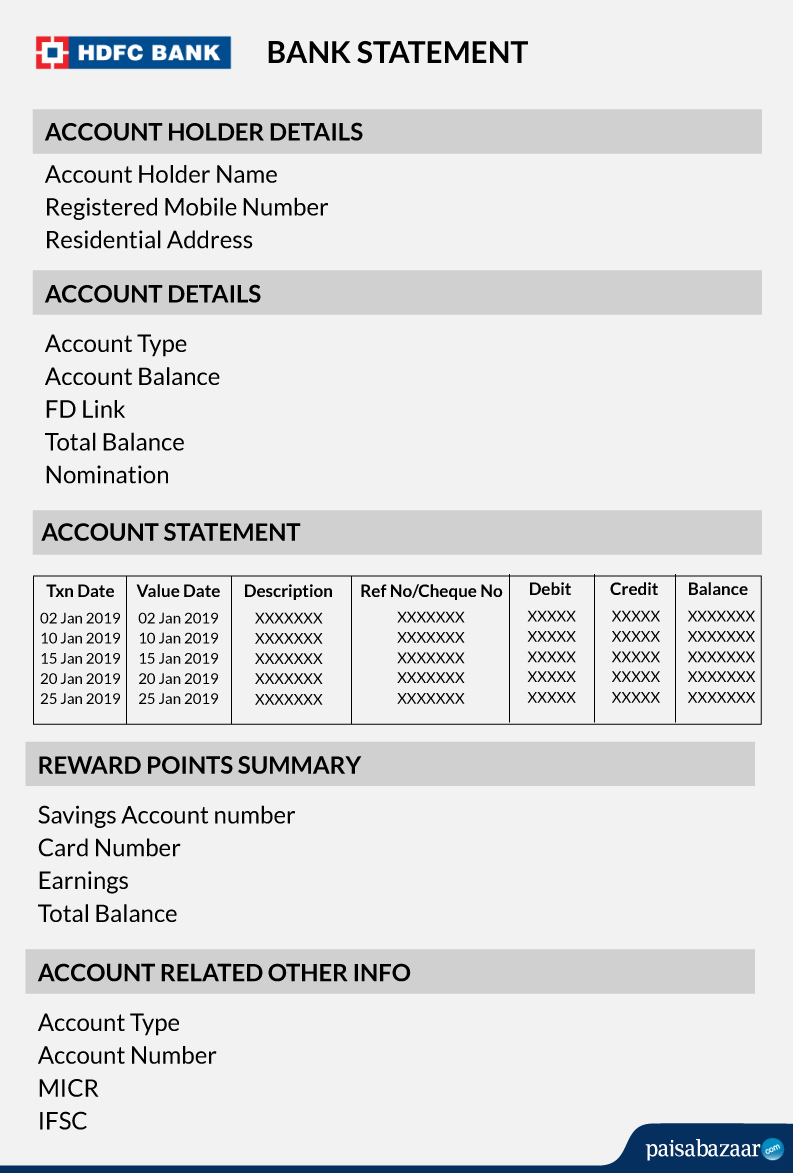

- Transaction Details: Each transaction made using your HDFC Forex Card is listed, including the date, amount, currency, merchant name, and location.

- Summary: The statement provides a summary of your card balance, total transactions, and any applicable charges or fees.

- Currency Conversion: Transactions made in foreign currencies are converted into your home currency for easy understanding.

Benefits of Regular Statement Monitoring:

- Track Expenses Easily: Keep tabs on your spending habits, ensuring you stay within budget.

- Identify Unauthorized Transactions: Detect and report any suspicious or fraudulent activities promptly.

- Plan Future Purchases: Understand your card usage patterns and adjust your spending limit or withdrawal amount accordingly.

- Manage Foreign Exchange: Optimize your currency exchanges based on real-time transaction costs displayed on your statement.

Conclusion

Checking your HDFC Forex Card statement is a vital part of responsible financial management. By following the steps outlined in this article, you can effortlessly access your statements through online banking, mobile banking, or customer care. Remember, regular statement monitoring empowers you to manage your card effectively, safeguard your account, and plan for the future. Embrace the convenience of the HDFC Forex Card and embark on your global financial adventures with confidence.

Image: www.forex.academy

How To Check Hdfc Forex Card Statement