In the high-stakes world of Forex trading, predicting the market’s movements is essential for success. However, the Forex market is notoriously volatile, making it challenging to make informed decisions. Volatility, a measure of how much a currency’s price is likely to swing, can have a significant impact on your trades, potentially leading to substantial profits or devastating losses. Therefore, understanding how to check and interpret Forex market volatility is crucial for any trader. This guide will provide you with the knowledge and actionable steps to effectively monitor and analyze volatility in the Forex market.

Image: freeforexcoach.com

Defining Forex Market Volatility

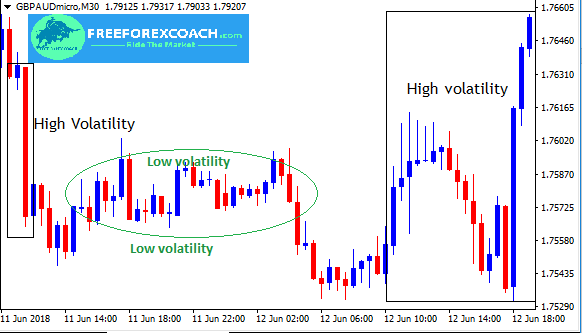

Volatility, in the context of Forex trading, refers to the extent of fluctuations in a currency pair’s price over time. High volatility indicates that the price of a currency pair is experiencing large price swings, while low volatility suggests that the price is relatively stable. Volatility is influenced by a complex interplay of economic, political, and social factors, including interest rate decisions, geopolitical events, and market sentiment.

The Importance of Volatility in Forex Trading

Understanding volatility is critical for Forex traders for several reasons. Firstly, it helps them assess the potential risks involved in a specific currency pair. High volatility can lead to more significant profit or loss, so traders need to determine if they are comfortable with the level of risk associated with a particular currency pair. Secondly, volatility can reveal potential trading opportunities. Traders can capitalize on periods of high volatility by implementing strategies that benefit from price swings, such as scalping or range trading.

Checking Forex Market Volatility

Several methods can be used to assess Forex market volatility. Here are some of the most common:

1. Historical Price Charts:

Analyzing historical price charts of a currency pair can give you valuable insights into its volatility. By studying the extent of price fluctuations over different periods, you can identify patterns and trends that may help you anticipate future volatility. Historical volatility can be measured using the Average True Range (ATR).

2. Volatility Indicators:

Technical analysis tools, called volatility indicators, can help you measure and visualize volatility over time. These indicators are often used in addition to price charts to provide a more comprehensive view of market conditions. Common volatility indicators include the Bollinger Bands, the Relative Volatility Index (RVI), and the Average Directional Index (ADX).

3. Volatility Indices:

Several volatility indices, such as the Chicago Board Options Exchange Volatility Index (VIX), also known as the ‘fear index,” measure the volatility of the S&P 500 index. While not directly related to Forex, these indices can provide insights into the overall market sentiment, which can impact currency prices.

4. News and Market Analysis:

Staying informed about current events and economic data releases can help you gauge potential volatility in the Forex market. News and market analysis often provide insights into market sentiment and external factors that can influence currency prices. By monitoring relevant information sources, you can stay up-to-date on market conditions and make informed decisions.

Image: forbiforextradingsystemfreedownload.blogspot.com

Understanding Volatility Interpretation

Once you have checked Forex market volatility, it’s crucial to interpret the results accurately. High volatility indicates that the market is experiencing significant price swings, which can be both risky and potentially profitable. However, it’s important to proceed with caution during periods of high volatility as the market can be unpredictable. Low volatility, on the other hand, suggests that the price of a currency pair is relatively stable and may be less likely to experience large price movements.

Strategies for Dealing with Volatility

Dealing with volatility effectively is essential for success in Forex trading. Here are some strategies to consider:

1. Risk Management:

First and foremost, it’s crucial to implement sound risk management principles. This includes setting stop-loss orders, determining your risk tolerance, and managing your positions wisely. By managing your risk effectively, you can mitigate potential losses and protect your trading capital.

2. Trading Range:

Volatility can also be used to your advantage. Identifying and trading within a range can be a viable strategy during periods of low to moderate volatility. By setting tight stop-loss orders and taking timely profits, you can capture consistent gains within a defined price range.

3. Breakouts:

Breakouts, or the price moving outside a defined trading range, often occur during periods of high volatility. Traders can profit from breakouts by identifying potential breakout levels and placing orders accordingly. However, it’s crucial to manage risk effectively during breakouts as they can be false and lead to substantial losses.

4. Trending Markets:

Trending markets are characterized by sustained price movements in a particular direction. Volatility in trending markets can be used to identify and capitalize on profitable trading opportunities. By understanding the underlying trend and using appropriate trading strategies, you can position yourself for optimal returns.

In addition to the strategies mentioned above, it’s important to remember that volatility is an inherent aspect of the Forex market. Even the most experienced traders cannot completely eliminate volatility from their trades. Therefore, it’s essential to continuously monitor and adapt to changing market conditions and adjust your trading strategies accordingly.

How To Check Forex Market Volatility

Conclusion

Understanding how to check Forex market volatility is crucial for successful trading. By utilizing the various methods outlined in this guide, traders can accurately assess the level of risk associated with different currency pairs. Whether you’re a seasoned professional or just starting out, monitoring and interpreting volatility can empower you to make informed decisions and navigate the unpredictable Forex market with greater confidence. Remember to practice sound risk management and adapt your strategies to the prevailing market conditions to maximize your chances of success.