Introduction

The forex market, the largest financial market globally, attracts both experienced and novice traders with its potential for substantial profits. However, to achieve consistent profitability, traders must develop a sharp analytical eye and a solid trading strategy — including a sound understanding of risk management. One of the most important aspects of forex trading is calculating the risk-reward ratio (RRR), a crucial determinant of profitable trades. In this comprehensive guide, we’ll delve into the concept of RRR, explain its significance, and provide practical tips to calculate and optimize it for your trading strategy.

Image: pipsedge.com

Understanding the Significance of Risk-Reward Ratio

Risk vs. reward — it’s the age-old dilemma that perplexes traders across all financial markets. Risk refers to the amount you stand to lose on a trade, while reward is the potential return you could make. Striking a balance between the two is the cornerstone of successful trading. The RRR metric quantifies this balance, indicating the potential reward you could reap for every unit of risk taken. Skilled traders prioritize trades with a favorable RRR, providing a greater chance of accumulating profit over time.

Calculating Risk-Reward Ratio

Calculating the RRR is a relatively straightforward mathematical exercise. Simply divide the potential profit by the potential loss. For example, if you anticipate earning $500 while risking $200 on a particular trade, your RRR would be 2.5 (500 divided by 200). An RRR of 1:1 means you have the prospect of profiting the same amount you risk; a 2:1 ratio indicates potential profit double the amount risked.

Adjusting the Risk-Reward Ratio

RRR isn’t set in stone and can be adjusted based on your trading preferences and risk tolerance. More conservative traders may prefer a lower RRR, such as 1:1 or 1:2, to minimize potential losses. Conversely, aggressive traders may opt for a higher RRR, such as 2:1 or even 3:1, to maximize potential rewards.

Image: www.mitrade.com

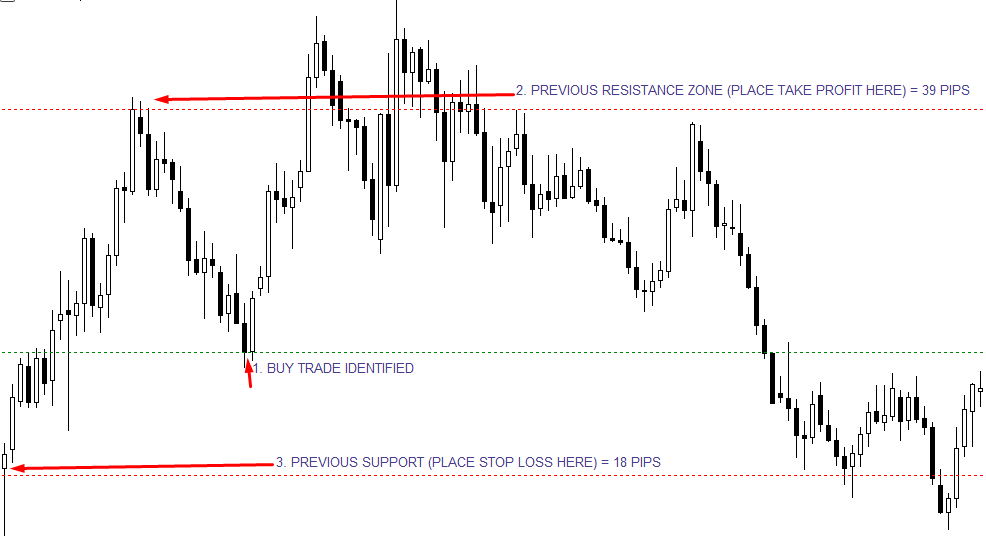

Trading with a Stop-Loss and Take-Profit

A stop-loss order is a crucial tool for managing risk and maintaining a favorable RRR. It automatically exits your trade when the market price reaches a predefined level, preventing further losses if the trade turns sour. Likewise, a take-profit order secures your profit by closing the trade when the market price hits a desired target.

Tips for Optimizing Risk-Reward Ratio

• Conduct thorough market research: Understand the market dynamics and identify trading opportunities with favorable RRR.

• Employ technical analysis: Enhance your decision-making process by using technical indicators and charting techniques.

• Set realistic targets: Avoid setting overly ambitious profit targets; focus on achievable goals within realistic market conditions.

• Use a demo account: Practice trading techniques and strategies without risking real capital until you build confidence.

• Manage emotions: Avoid letting emotions sway your trading decisions. Stick to your trading plan and maintain discipline.

How To Calculate Risk Reward Ratio In Forex Trading

Conclusion

Grasping the concept of RRR is paramount for success in forex trading. By calculating and adjusting your RRR judiciously, you can improve your risk management practices and maximize your earnings. Remember, trading involves inherent risk; it’s not about eliminating risk but managing it effectively to enhance your chances of making informed, profitable trades.