Introduction

In the dynamic realm of finance, forex trading stands tall as a lucrative endeavor that captivates traders worldwide. Its allure stems from the chance to profit from the constant ebb and flow of currencies, exchanging one for another at the right time to maximize returns. However, embarking on this journey requires a solid understanding of the process, from applying for an account to executing successful trades. This comprehensive guide will illuminate the path, empowering you to navigate the intricacies of forex trading and unlock its boundless potential.

Image: forextraininggroup.com

The Basics of Forex Trading

Forex (foreign exchange) trading involves buying and selling currencies against each other, anticipating their relative value changes. This global market is one of the largest and most liquid in the world, offering traders vast opportunities to generate profits. Currencies are traded in pairs, with the value of one rising or falling in relation to the other. For instance, if you buy the EUR/USD pair and the Euro strengthens against the US dollar, you stand to gain.

Applying for a Forex Trading Account

The first step towards forex trading is selecting a reputable broker. Diligent research and comparison are vital to find a broker that aligns with your trading goals, offers competitive spreads, and provides a secure platform. Once you have chosen a broker, you will need to open an account. This typically involves completing an application form, providing personal information, and verifying your identity. Most brokers require you to fund your account with a minimum deposit, which varies depending on the platform.

The Forex Trading Platform

Once your account is set up, you will be granted access to the broker’s trading platform. This software is your gateway to executing trades and managing your portfolio. Trading platforms offer a range of features, including real-time market data, charting tools, and news feeds. It is essential to familiarize yourself with the platform’s interface and functionality before placing any trades.

Image: tradingpdf.net

Understanding Currency Pairs and Spreads

Forex pairs are denoted by a three-letter currency code, such as EUR/USD for the Euro and US Dollar pair. Each pair has a bid price and an ask price, representing the price at which you can buy or sell the currency, respectively. The difference between these prices is called the spread, which is the broker’s commission for facilitating the trade. Spreads vary depending on the currency pair, market volatility, and the broker’s fees.

Leverage and Margin Trading

Leverage is a double-edged sword in forex trading, allowing you to trade with more capital than you have deposited. While it can magnify potential profits, it also amplifies losses. Margin trading involves borrowing funds from the broker to increase your trading power. However, it is essential to use leverage prudently, as it can lead to substantial losses if markets move against you.

Technical and Fundamental Analysis

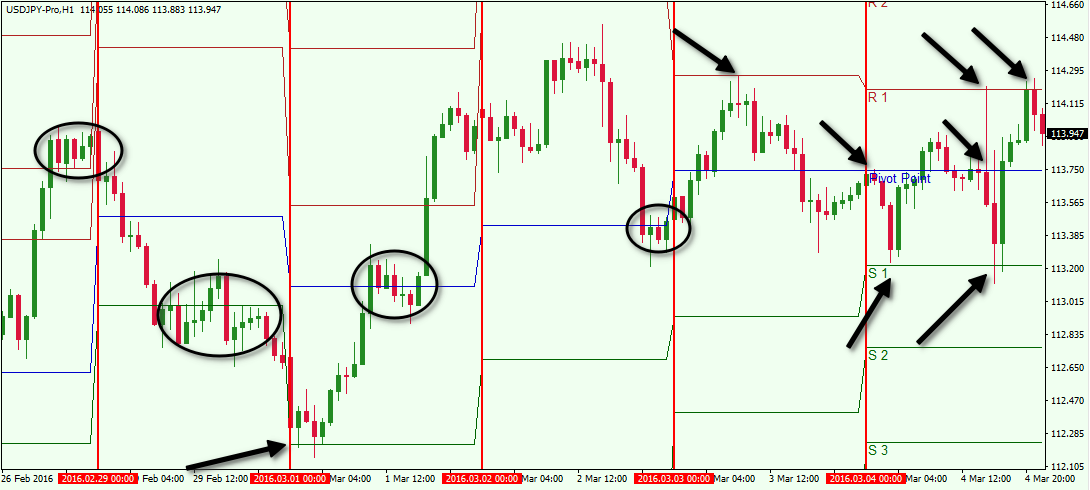

Technical analysis and fundamental analysis are two primary approaches used by forex traders to make informed trading decisions. Technical analysis involves studying historical price data to identify patterns and predict future market movements. Fundamental analysis focuses on economic factors and world events that can influence currency values. By combining these analytical tools, traders can increase their chances of success in the ever-changing forex market.

Risk Management

Managing risk is paramount in forex trading. Techniques such as stop-loss orders and position sizing can mitigate potential losses. A stop-loss order automatically closes a trade when the price reaches a predetermined level, limiting the trader’s exposure to risk. Position sizing involves determining the appropriate amount of capital to allocate to each trade to avoid overleveraging and potential ruin.

Expert Insights and Actionable Tips

Seasoned forex traders emphasize the importance of education, patience, and emotional discipline. Continuous learning through books, articles, and webinars can enhance your understanding of the market and trading strategies. Patience is critical, especially when facing market fluctuations. Emotional discipline prevents impulsive decision-making and ensures a rational approach to trading.

How To Apply For Forex Trading

Conclusion

Forex trading presents immense opportunities for financial growth, but it demands a deep understanding of the market and prudent risk management. By following the steps outlined in this comprehensive guide, you can navigate the complexities of forex trading, from applying for an account to executing successful trades. Remember that success in forex trading requires a commitment to ongoing learning, meticulous analysis, and the ability to manage risk. Embrace this challenge, and you may find yourself reaping the rewards of this dynamic and rewarding market.