In the fast-paced world of forex trading, understanding lot sizes is crucial for managing risk and maximizing profits. Whether you’re a seasoned trader or just starting out, mastering lot size calculation can help you trade more confidently and strategically.

Image: www.forextrading200.com

Before we delve into the details, let us clear some common misconceptions: Lot sizes are not fixed and can vary depending on your account currency and broker’s specifications.

What is a Lot Size?

A lot size represents a standardized unit of measurement for currencies traded in the forex market. It is essentially the amount of base currency (the first currency listed in a currency pair) you’re trading when you place an order.

Standard Lot Sizes

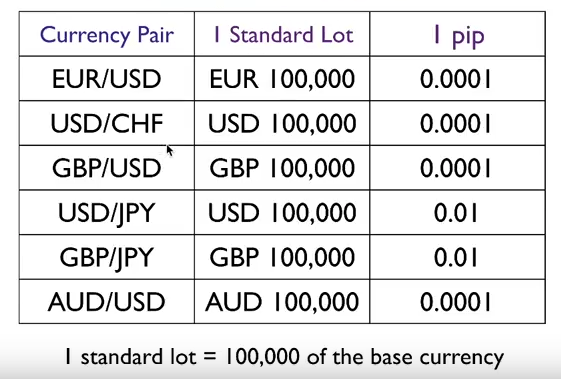

Standard lot sizes vary across different currencies:

- Standard lot: 100,000 units of the base currency.

- Mini lot: 10,000 units of the base currency.

- Micro lot: 1,000 units of the base currency.

- Nano lot: 100 units of the base currency.

Calculating Lot Size

To calculate the lot size you’re trading, divide the order volume (in the base currency) by the appropriate lot value. For instance, if you place an order for 200,000 USD in EUR/USD, and your broker offers standard lot sizes of 100,000 USD, you’ll be trading two standard lots.

200,000 USD / 100,000 USD = 2 standard lots

Image: dotretho.net

Why Proper Lot Sizing Matters

Proper lot sizing is vital for managing risk and maximizing returns:

- Risk Management: Large lot sizes increase exposure to market fluctuations, potentially leading to significant losses. Choosing an appropriate lot size based on account size and risk tolerance minimizes potential losses.

- Profit Optimization: Trading smaller lot sizes allows for more flexibility and the potential to open multiple positions, increasing profit opportunities and reducing risk.

- Margin Requirements: Each lot size requires a certain amount of margin to cover potential losses. Choosing an appropriate lot size ensures you have sufficient margin to support your trading activity.

Tips and Expert Advice from Experienced Traders

To assist you in mastering lot size calculation, here are some tips from seasoned traders:

- Start Small: Begin with smaller lot sizes until you gain confidence and understand market dynamics.

- Consider Risk Appetite: Determine your tolerance for risk and trade accordingly. Larger lot sizes are suitable for traders with higher risk appetite, while smaller lot sizes are ideal for conservative traders.

- Use Margin Calculator: Many brokers provide margin calculators to estimate the margin requirements for your desired lot size.

- Monitor Account Balance: Ensure your account balance adequately covers potential losses associated with your chosen lot size.

FAQ on Lot Size in Forex

Q: What happens if I trade a lot size too large for my account?

A: Trading excessive lot sizes can deplete your account if losses occur, leading to a margin call or account closure.

Q: Can I trade different lot sizes for different currency pairs?

A: Yes, you can trade different lot sizes for different currency pairs, as long as they are compatible with your broker’s specifications.

Q: How can I calculate the value of a pip for a specific lot size?

A: To calculate the value of a pip, multiply the pip value of the currency pair by the lot size. For example, for a 100,000 USD lot size (standard lot) in EUR/USD with a pip value of $10, the pip value would be $10 x 100,000 = $1,000.

Q: What is fractional pip pricing?

A: Fractional pip pricing allows for quoting prices with decimals instead of round numbers (e.g., 1.2345 instead of 1.2340). It increases the precision of pricing and trading.

How Much Is A Lot Size In Forex

Conclusion

Mastering lot size calculation is essential for successful forex trading. By understanding lot size concepts, you can optimize risk management, maximize profits, and trade confidently in the dynamic forex market.

Are you eager to delve deeper into the world of lot size in forex? Share your questions or experiences in the comments below, and let us continue the discussion!

}