The world of currency exchange can be a complex and intimidating maze for those unfamiliar with its intricacies. However, with the right knowledge and understanding, traversing this financial landscape can become an empowered and lucrative endeavor. Currency exchange charts serve as essential tools for deciphering the ever-fluctuating values of currencies worldwide. In this comprehensive guide, we will embark on a journey to unravel the secrets of these charts, empowering you to make informed decisions while navigating the global financial arena.

Image: photodune.net

Understanding the Basics: What are Currency Exchange Charts?

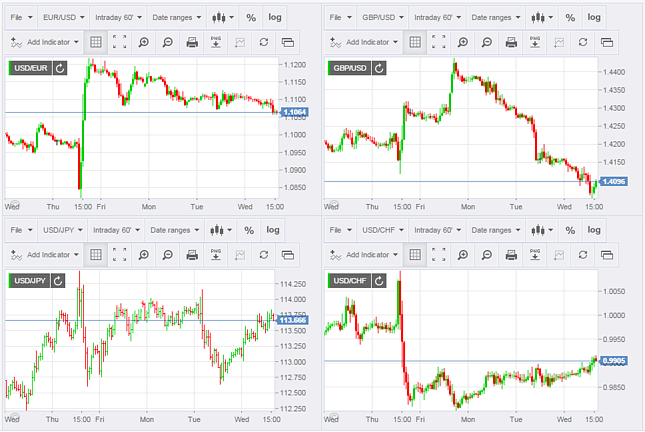

Currency exchange charts are visual representations that depict the real-time or historical values of one currency against another. They provide valuable insights into the dynamics of currency pairs, displaying the exchange rate, which indicates how much of one currency is required to purchase a unit of another. Understanding these charts is crucial for global travelers, business professionals, and anyone interested in the international financial markets.

Types of Currency Exchange Charts

There are various types of currency exchange charts, each tailored to specific needs. The most common include:

- Line Chart: A straightforward graph that plots the exchange rate over time.

- Bar Chart: A segmented representation of exchange rates over specified time intervals.

- Candle Stick Chart: A detailed graph that displays multiple data points within each time interval, including open, close, high, and low values.

Essential Elements of Currency Exchange Charts

To effectively interpret currency exchange charts, it is crucial to familiarize yourself with the following key elements:

- Currency Pair: The currencies being exchanged, represented as a pair (e.g., EUR/USD).

- Exchange Rate: The amount of the base currency required to purchase one unit of the quote currency.

- Base Currency: The currency used as the reference point (placed first in the currency pair).

- Quote Currency: The currency being purchased (placed second in the currency pair).

- Bid Price: The price at which a currency can be bought.

- Ask Price: The price at which a currency can be sold.

- Spread: The difference between the bid and ask prices, representing the broker’s profit margin.

Image: proper-cooking.info

Interpreting Currency Exchange Charts

Decoding currency exchange charts requires a keen eye for detail and an understanding of market trends. Here’s how to navigate these charts like a pro:

- Identify Currency Pair: Determine which currencies are involved in the exchange.

- Determine the Exchange Rate: Read the displayed exchange rate, noting the base and quote currencies.

- Analyze the Chart Patterns: Study the historical or real-time exchange rate movements to identify trends or patterns.

- Pinpoint Support and Resistance Levels: Identify key levels where the exchange rate has repeatedly bounced off, indicating potential buying or selling opportunities.

- Monitor Economic Indicators: Stay informed about news and events that can influence currency values, such as interest rate changes or economic data releases.

Advanced Techniques for Currency Exchange Chart Analysis

For seasoned traders and investors, advanced techniques can further enhance chart analysis:

- Technical Indicators: Employ technical indicators like moving averages or Bollinger Bands to identify trading opportunities and predict market movements.

- Correlation Analysis: Explore the relationships between different currency pairs to identify potential trading strategies.

- Chart Patterns: Study chart patterns like head and shoulders or double tops to predict market reversals or continuations.

How To Read Currency Exchange Charts

Harnessing Currency Exchange Charts for Profitable Trading

Empowering yourself with the knowledge to read currency exchange charts is the gateway to unlocking potential profits in the foreign exchange market. By identifying favorable exchange rate scenarios, traders can buy currencies when