The world of finance has undergone a seismic shift in recent years, propelled by the advent of online trading platforms. Retail forex trading, once the exclusive domain of financial institutions, is now accessible to individuals from all walks of life. This democratization of trading has led to an astronomical surge in the number of retail forex traders, creating a vibrant and dynamic market.

Image: fabalabse.com

In the past, retail traders faced significant barriers to entry, including high trading costs, complex platforms, and limited access to market information. Today, with the proliferation of user-friendly platforms and competitive pricing structures, trading has become not only feasible but also alluring for many individuals seeking financial freedom and independence.

The Rise of Retail Forex Trading

The growth of retail forex trading can be attributed to several key factors. First, advancements in technology have made it possible for individuals to trade from anywhere with an internet connection. Second, the availability of educational resources and trading tools has empowered individuals to learn about forex trading and develop their trading strategies.

Moreover, the introduction of mobile trading platforms has further enhanced accessibility, allowing traders to execute trades from their smartphones or tablets. This convenience has attracted a new generation of traders who seek to manage their investments on the go.

The Definition and History of Retail Forex Trading

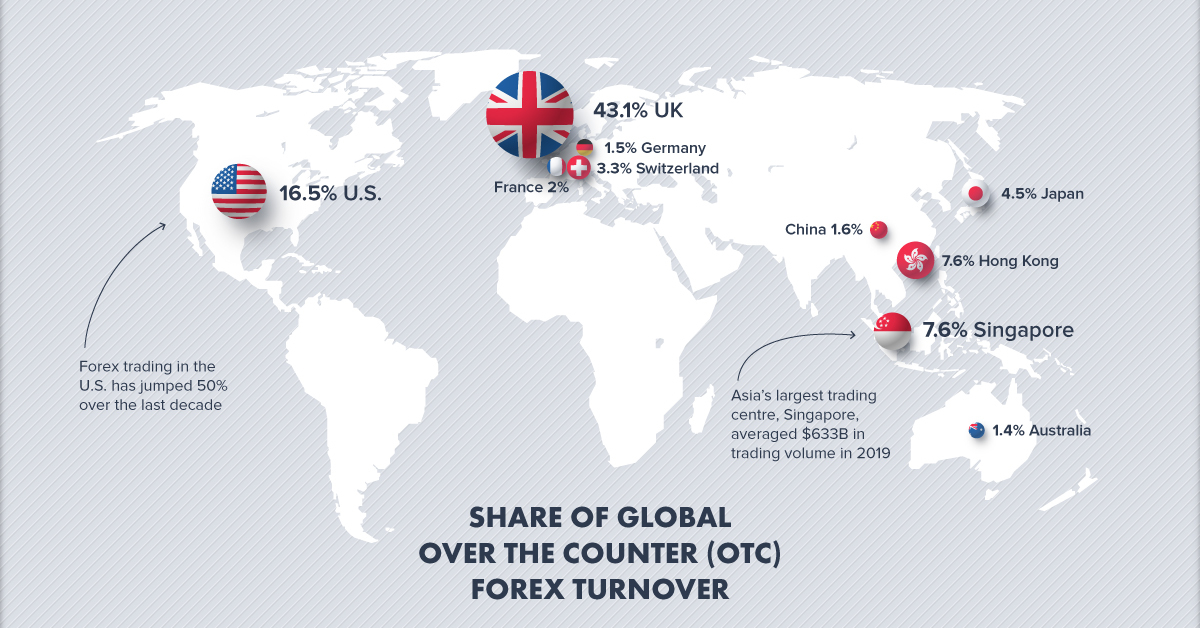

Retail forex trading involves the buying and selling of currency pairs, speculating on the fluctuations in their exchange rates. Unlike institutional traders who trade in large volumes, retail traders typically engage in smaller-scale transactions. The forex market is the world’s largest financial market, with an average daily trading volume of over $6 trillion.

The origins of retail forex trading can be traced back to the 1970s when the Bretton Woods system of fixed exchange rates collapsed. This event led to the creation of a floating exchange rate system, allowing currencies to fluctuate freely against each other. This newfound flexibility paved the way for the development of the forex market as we know it today.

The Benefits and Risks of Retail Forex Trading

Retail forex trading offers several potential benefits. First, it provides individuals with the opportunity to earn a profit by successfully predicting currency movements. Second, it allows traders to diversify their portfolios, hedging against risks associated with other asset classes.

However, it is important to note that retail forex trading also carries inherent risks. The market is highly volatile, and traders can experience significant losses if they are not properly prepared. It is crucial to have a sound understanding of the market and to manage risk effectively through proper money management.

Image: www.visualcapitalist.com

Strategies and Tips for Retail Forex Traders

To achieve success in retail forex trading, it is essential to develop a comprehensive trading strategy. This strategy should outline the trader’s goals, risk tolerance, and trading methodology. There are numerous strategies to choose from, each with its own strengths and weaknesses.

Some of the most popular trading strategies include technical analysis, fundamental analysis, and algorithmic trading. Technical analysis involves analyzing price charts to identify trends and patterns, while fundamental analysis focuses on economic data and news events that may affect currency prices. Algorithmic trading uses computer programs to automate trading decisions based on pre-defined rules.

Conclusion

The world of retail forex trading has witnessed an unprecedented surge in popularity in recent years, offering individuals unprecedented opportunities for financial freedom and independence. With the democratization of trading, the market has become more accessible than ever before, attracting a diverse range of traders with varying levels of experience and expertise.

To succeed in retail forex trading, it is imperative to have a clear understanding of the market, develop a sound trading strategy, and manage risk effectively. By embracing these principles and continuously expanding their knowledge, traders can navigate the complexities of the forex market and potentially achieve their financial goals.

Are you interested in exploring the exciting world of retail forex trading? If so, we encourage you to conduct your research, seek guidance from experienced traders, and develop a deep understanding of the market dynamics. With the right mindset and a dedication to learning, you can unlock the potential of retail forex trading and embark on a rewarding financial journey.

How Many Retail Forex Traders Are There

FAQ on Retail Forex Trading

Q: What is retail forex trading?

A: Retail forex trading involves the buying and selling of currency pairs by individuals in smaller-scale transactions.

Q: How has technology impacted retail forex trading?

A: Advancements in technology have made online trading platforms accessible, empowering individuals to trade from anywhere with an internet connection.

Q: What are the benefits of retail forex trading?

A: Retail forex trading offers the potential for earning a profit, diversifying portfolios, and accessing a 24/7 market.

Q: Are there any risks associated with retail forex trading?

A: Yes, retail forex trading carries risks due to market volatility. It is crucial to manage risk effectively and have a comprehensive trading strategy.

Q: What are some popular trading strategies for retail forex traders?

A: Popular trading strategies include technical analysis, fundamental analysis, and algorithmic trading.