Introduction: Embark on a Journey into the Forex Realm

The foreign exchange market, commonly known as Forex, is an enthralling global network where currencies are traded and exchanged. With a daily trading volume of over $5 trillion, the Forex market pulsates with the ebb and flow of the world’s financial ambitions. It’s a world of limitless possibilities, where fortunes are made and lost, where the savvy and the daring capitalize on the relentless movement of currencies.

Image: www.tradingwithrayner.com

In this comprehensive guide, we’ll delve into the intricate workings of the Forex market. We’ll explore its history, unravel its foundational principles, and decipher the latest trends shaping this dynamic financial landscape. Whether you’re a seasoned trader or a curious novice, this article will empower you with the knowledge and insights to navigate the Forex market with confidence and clarity.

Unveiling the History: A Tale of Global Financial Connections

The origins of the Forex market can be traced back to the dawn of international trade. As nations engaged in commerce, they needed a standardized system to facilitate the exchange of currencies. This led to the emergence of currency exchange bureaus, where merchants and travelers could convert their currencies into the local tender.

Over time, the Forex market evolved into an organized and regulated system. In 1971, the United States abandoned the gold standard, which had pegged the value of the dollar to gold. This momentous decision ushered in the era of floating exchange rates, where currency values were determined by the forces of supply and demand.

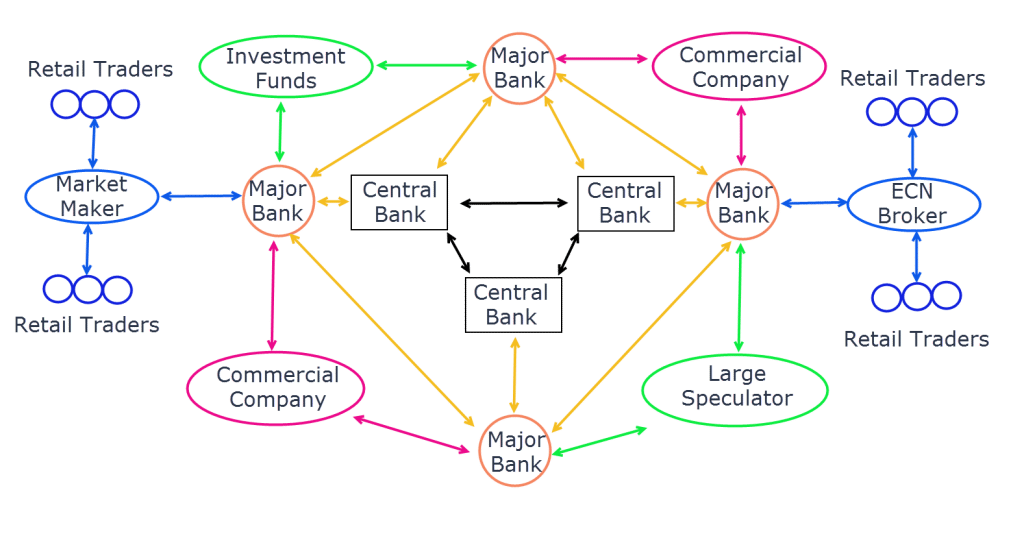

The Players: A Diverse Ensemble of Market Participants

The Forex market is a kaleidoscope of participants, each with their unique motivations and strategies. These include:

-

Central Banks: These monetary authorities wield immense influence over currency values by regulating interest rates and implementing other monetary policies.

-

Commercial Banks: These institutions facilitating currency exchange for businesses and individuals.

-

Hedge Funds: These investment vehicles pool capital from multiple investors to engage in sophisticated currency trading strategies.

-

Retail Traders: These individual traders, armed with their knowledge and intuition, navigate the Forex market in pursuit of profit.

The Trading Mechanism: A Symphony of Currency Pairs

The Forex market operates on the concept of currency pairs. When you trade in Forex, you’re buying or selling one currency while simultaneously doing the opposite with another. The most traded currency pair is EUR/USD, followed by USD/JPY, GBP/USD, USD/CHF, and AUD/USD.

Currency pairs are quoted using two prices: the bid price and the ask price. The bid price is the price at which you can sell the base currency (the first currency in the pair), while the ask price is the price at which you can buy it. The difference between the bid and ask prices is known as the spread.

Image: madeinatlantis.com

Analysis and Trading Strategies: Navigating Market Movements

Success in the Forex market hinges upon a deep understanding of market analysis. Technical analysis employs charts and historical data to identify patterns and predict future price movements, while fundamental analysis considers economic and geopolitical factors that influence currency values.

Traders deploy a myriad of trading strategies to harness market opportunities. Scalping involves capitalizing on small price fluctuations, while day trading entails buying and selling within the same trading day. Long-term trading, on the other hand, involves holding positions for days, weeks, or even months.

Embracing Technology: The Digital Revolution in Forex Trading

Technology has revolutionized Forex trading, empowering retail traders with sophisticated platforms and analytical tools. Online brokers provide user-friendly interfaces, real-time market data, and comprehensive trading tools. Additionally, algorithmic trading employs computer programs to execute trades based on predefined parameters.

Risk Management: A Prudent Path to Success

Venturing into the Forex market demands a judicious approach to risk management. Setting clear leverage limits, using stop-loss orders, and diversifying your portfolio are cornerstones of risk mitigation. Understanding the risks involved and implementing sound strategies is paramount to preserving your capital.

Education and Discipline: The Pillars of Trading Mastery

Thriving in Forex trading necessitates a commitment to education and unwavering discipline. Seek guidance from reputable sources, attend webinars and conferences, and practice your trading strategies using demo accounts. Discipline yourself to stick to your trading plan and avoid the pitfalls of irrational decision-making.

How Is The Forex Market Works

Conclusion: The Promise and Potential of Forex Trading

The Forex market beckons with the promise of financial freedom and the thrill of outsmarting the markets. It’s a world where knowledge, discipline, and a deep understanding of the intricate global financial tapestry are the keys to success.

As you embark on your Forex trading journey, remember that the market is constantly evolving, presenting both opportunities and challenges. Embrace a mindset of continuous learning, adapt to changing market conditions, and stay abreast of the latest trends. With unwavering determination, diligent risk management, and a thirst for knowledge, you can harness the power of the Forex market and reap the rewards that lie within its ever-flowing currents.