Introduction

In the bustling financial hub of South Africa, the allure of forex trading has captivated the imaginations of many. Forex, short for foreign exchange, is the global marketplace where currencies are traded. This dynamic arena offers boundless opportunities for financial gain. Yet, for the unwary, it can also be an unforgiving landscape. Embark on this in-depth guide as we unveil the intricacies of forex trading in South Africa, empowering you with the knowledge and strategies to navigate this ever-evolving market.

Image: tamildada.info

“The thrill of forex trading coursed through my veins. The potential for exponential returns was both intoxicating and intimidating. It was as if I’d stumbled upon a hidden treasure trove, its riches tantalizingly within reach. Yet, I knew that mastering this enigmatic realm required a deep understanding and a steadfast resolve.”

Forex Trading in South Africa

Definition and History

Forex trading involves buying and selling different currencies with the aim of profiting from fluctuations in their exchange rates. This global marketplace operates 24 hours a day, 5 days a week, offering unparalleled liquidity and volatility. The history of forex trading in South Africa can be traced back to the early days of the rand, which was established in 1961. Since then, the market has evolved dramatically, fueled by technological advancements and increased access to financial instruments.

Benefits and Risks

Forex trading offers numerous potential benefits, including high liquidity, the ability to leverage returns, and flexible trading hours. However, it’s equally important to acknowledge the inherent risks associated with this volatile market. Considerable skill, discipline, and risk management techniques are necessary to navigate the fluctuating exchange rates and maximize profitability.

Image: tradingforexamrik.blogspot.com

A Comprehensive Overview

Understanding Currency Pairs

In forex trading, currencies are always traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is known as the base currency, while the second is called the quote currency. The exchange rate between two currencies determines how much of the base currency is required to buy one unit of the quote currency.

Trading Platforms and Instruments

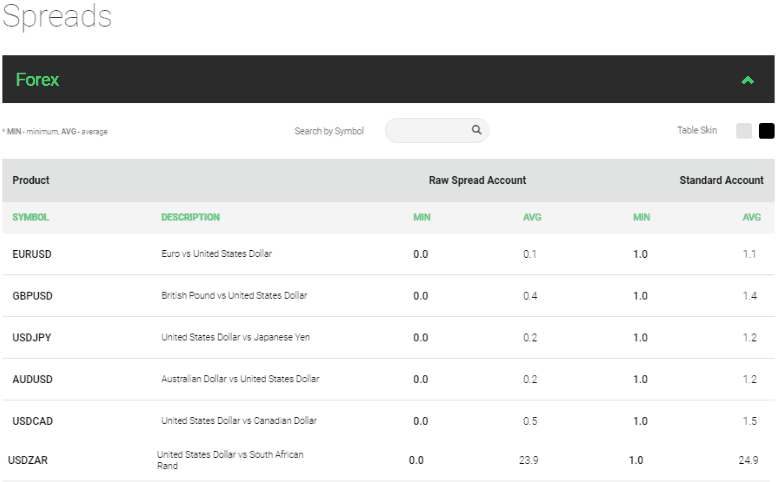

A wide range of trading platforms are available to South African forex traders, offering varying levels of sophistication and functionality. These platforms generally provide access to real-time market data, charting tools, and order execution capabilities. Additionally, a variety of trading instruments have emerged, including spot contracts, forwards, and futures, allowing traders to adopt tailored strategies based on their risk tolerance and time horizons.

Key Factors Influencing Exchange Rates

Numerous factors influence the exchange rates of currencies, including economic indicators (e.g., Gross Domestic Product, inflation), political stability, monetary policy, and market sentiment. Forex traders must diligently monitor these factors and anticipate their impact on currency movements to make informed trading decisions.

The Latest Trends and Developments

Technological advancements such as algorithmic trading and automated trading platforms have revolutionized the face of forex trading in South Africa. These tools have enhanced the efficiency and speed of execution, opening up new opportunities for swift and effective trading. Additionally, the growing popularity of mobile trading has made forex trading increasingly accessible from anywhere at any time.

Expert Tips and Advice

Risk Management as a Paramount Priority

Effective risk management is the cornerstone of successful forex trading. Traders must establish predefined risk appetite thresholds, employ stop-loss orders, and diversify their portfolio to manage potential losses. They should meticulously monitor market conditions and adjust their strategies accordingly to avoid excessive exposure to volatility.

The Importance of Education and Continuous Learning

Forex trading is a highly dynamic and ever-evolving field. Traders who commit to ongoing education and personal development will gain a competitive edge. By regularly reading market analysis, attending workshops, and engaging with trading communities, traders can stay abreast of the latest insights and refine their trading strategies.

Frequently Asked Questions

Q: Is forex trading a viable income stream in South Africa?

A: Forex trading can be a profitable source of income, but it requires skill, discipline, and proper risk management. Traders should approach it as a serious endeavor, dedicating time to learning, developing sound strategies, and implementing effective risk management practices.

Q: How do I get started with forex trading in South Africa?

A: To commence forex trading in South Africa, you will need to open an account with a reputable broker. Choose a broker that aligns with your trading style, offers competitive spreads and commissions, and provides high-quality customer support. Begin by practicing on a demo account to hone your skills before transitioning to live trading.

How Forex Trading Works In South Africa

https://youtube.com/watch?v=FfYMIhxG-1g

Conclusion

Forex trading in South Africa offers intriguing possibilities for financial success, yet it’s crucial to recognize that it’s not a path devoid of risks. Traders who approach forex trading with a solid understanding of market dynamics, judicious risk management, and an unwavering dedication to continuous learning will position themselves to harness the opportunities it presents. Whether you’re a seasoned trader or just starting your forex journey, we encourage you to explore this enigmatic world further. Engage with reputable trading communities, seek guidance from experienced mentors, and embrace the thrill of navigating the dynamic currents of global currency markets.

“As you delve into the realm of forex trading, remember that knowledge is your most potent weapon. Embrace the adventure, yet never cease to seek enlightenment. May your trading endeavors be met with abundant rewards.”