Forex trading, short for foreign exchange trading, has gained immense popularity in recent times due to its perceived ease of accessibility and the potential for substantial profits. However, it’s crucial to dispel misconceptions and delve into the realities of this financial market to determine if it truly aligns with its reputation as an effortless revenue stream.

Image: www.kobo.com

Understanding the Mechanics of the Forex Market

Forex trading involves the exchange of currencies between individuals, banks, and institutions. Unlike traditional stock exchange, forex transactions occur over-the-counter, decentralized networks where parties agree upon exchange rates. This accessibility has contributed to the perception of forex trading as an easy and open market.

However, it’s essential to clarify that while the initial setup and trading process may appear straightforward, achieving success in the forex market requires considerable knowledge, skill, and discipline. The market is highly volatile, influenced by various macroeconomic factors, political events, and global financial trends.

Essential Requirements for Successful Forex Trading

To navigate the forex market effectively, traders must possess the following:

- Knowledge: A deep understanding of how the forex market operates, including factors that affect currency prices, technical analysis, and risk management strategies.

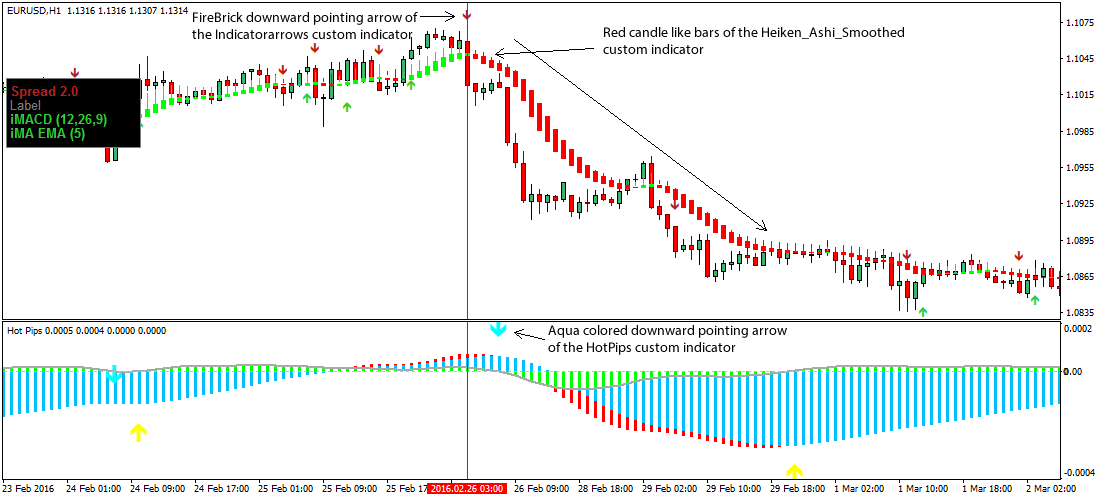

- Skill: The ability to analyze market data, interpret charts, and anticipate future price movements. This involves mastering technical and fundamental analysis techniques.

- Discipline: Forex trading requires discipline to manage risk, avoid impulsive decisions, and adhere to a well-defined trading plan.

The Challenge: Market Volatility and Seasoned Participants

Despite the accessible nature of the forex market, it is essential to recognize the inherent challenges posed by its volatility. Currency prices can fluctuate rapidly, posing significant risks to traders who lack the necessary knowledge and skills to navigate these fluctuations.

Moreover, the forex market is dominated by experienced traders and institutions with deep pockets and sophisticated trading tools. Retail traders may face competition from these well-equipped participants, making it more challenging to achieve consistent profitability.

Image: yejifumevofyq.web.fc2.com

Assessing Forex Trading as a Viable Opportunity

Based on the aforementioned complexities, it is evident that forex trading is not as effortless as it may first appear. While the initial setup and trading process might be straightforward, developing the necessary knowledge, skill, and discipline can be a time-consuming and demanding endeavor.

Prospective traders must approach the forex market with realistic expectations and a willingness to invest significant time and effort in education and practice. Success in forex trading requires a deep understanding of the market, discipline, and the ability to manage risk effectively.

How Easy Is Forex Trading

Conclusion

Forex trading offers opportunities for potential profit, but it is not a get-rich-quick scheme. To succeed in this market, traders must possess the necessary knowledge, skills, and discipline. By dispelling the misconception of effortless profits, this article aims to provide a realistic perspective on the challenges and requirements of forex trading, empowering prospective traders with the information they need to make informed decisions.