Grasping the Dynamics of the Global Currency Exchange

The foreign exchange (forex) market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. However, understanding how this market moves and the factors that influence its fluctuations can be a daunting task for beginners. In this guide, we explore the intricate workings of the forex market, providing you with a comprehensive overview of its movements and the key drivers that shape them.

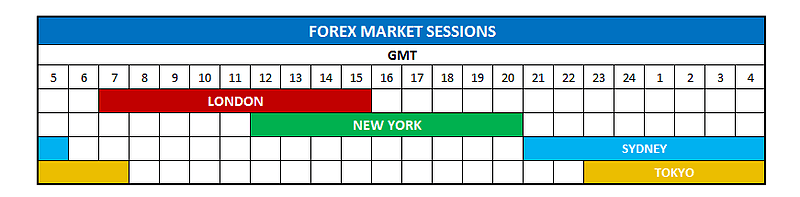

Image: www.mydigitrade.com

The Fundamentals of Forex Market Movements

The forex market is driven by the exchange rates between currencies, which are constantly influenced by a multitude of factors. These include:

- Economic Indicators: Economic data such as GDP, inflation, and unemployment rates provide insights into the health of a country’s economy, which can affect currency demand and supply.

- Interest Rates: Interest rates set by central banks influence the attractiveness of a country’s currency. Higher interest rates tend to strengthen the currency, while lower rates weaken it.

- Political and Geopolitical Events: Political stability, elections, wars, and other geopolitical events can have significant impacts on currency values.

- Supply and Demand: The basic principles of supply and demand govern the forex market. When demand for a currency exceeds supply, its value rises, while an excess supply leads to a decrease in value.

Technical Analysis and Market Movements

Technical analysis is a widely used method for predicting future price movements based on historical data. It involves studying charts and patterns to identify trends, support and resistance levels, and potential trading opportunities.

Traders use technical indicators such as moving averages, Bollinger Bands, and Ichimoku Clouds to analyze price action and make informed trading decisions. While technical analysis can be a valuable tool, it’s important to note that it is not a foolproof method and trading decisions should be made with caution.

Tips for Navigating the Forex Market

Whether you’re a novice or an experienced trader, understanding the nuances of the forex market is crucial for success. Here are a few tips to help you navigate the dynamic landscape:

- Understand the Fundamentals: Gain a deep understanding of the economic, political, and geopolitical factors that influence currency movements.

- Conduct Thorough Research: Analyze historical data and market trends to identify potential opportunities and avoid pitfalls.

- Manage Risk: Utilize stop-loss orders and other risk management tools to minimize potential losses.

- Practice Discipline: Avoid emotional trading and stick to your trading plan to maintain objectivity.

Image: dailypriceaction.com

FAQ on Forex Market Movements

- Q: What is the most important factor that influences forex market movements?

A: There is no single most important factor, as a combination of economic indicators, political events, and market sentiment all play a role. - Q: Can I use technical analysis to predict future prices with certainty?

A: Technical analysis is not a guaranteed method of prediction, but it can provide valuable insights into potential market movements. - Q: How can I minimize risk in the forex market?

A: Implementing risk management strategies such as stop-loss orders, using appropriate leverage, and diversifying your portfolio can help reduce potential losses.

How Does The Forex Market Move

Conclusion

Understanding how the forex market moves and the factors that influence its fluctuations is essential for successful trading. By grasping the fundamentals, employing technical analysis, and following the tips provided, traders can navigate the dynamic global currency exchange with confidence. Ultimately, whether you’re interested in trading currencies or simply gaining knowledge of this fascinating market, this guide provides a comprehensive overview and practical insights to empower your financial endeavors.