In today’s interconnected world, global travel and trade have become commonplace. One of the most essential elements of international journeys and transactions is the need for convenient and secure currency exchange. The HDFC Prepaid NetBanking Forex Card serves as an indispensable tool for individuals who wish to save money on their financial transactions while ensuring peace of mind. This article delves into the features, benefits, and indispensable value of the HDFC Prepaid NetBanking Forex Card, empowering you to navigate the complexities of foreign exchange with confidence and ease.

Image: virginiaoy-images.blogspot.com

What is the HDFC Prepaid NetBanking Forex Card?

The HDFC Prepaid NetBanking Forex Card is a reloadable, multi-currency prepaid card that allows cardholders to load multiple foreign currencies and make transactions in over 100 countries worldwide. Unlike traditional credit or debit cards, the Forex Card is not linked to your bank account, offering an added layer of security and control over your spending. It provides real-time currency conversion, ensuring that you always get the best exchange rates and avoiding hidden fees associated with other exchange methods.

Benefits of Using the HDFC Prepaid NetBanking Forex Card

Convenience and Flexibility:

- Load multiple currencies into a single card, eliminating the need to carry multiple currencies or exchange cash.

- Enjoy the ease of making payments in local currency at over 35 million merchant locations worldwide.

- Withdraw cash in foreign currencies from ATMs, providing flexibility and accessibility during travel.

Cost Savings:

- Benefit from competitive foreign exchange rates offered by HDFC, saving you money compared to conventional methods of exchange.

- Zero transaction fees on all purchases and ATM withdrawals, making every transaction cost-effective.

Security and Peace of Mind:

- The HDFC Prepaid NetBanking Forex Card is chip-enabled and comes with a Personal Identification Number (PIN) for added security.

- The card is not linked to your bank account, protecting you from fraudulent activities.

- Cardholders have access to 24/7 customer support for assistance and emergencies.

How to Use the HDFC Prepaid NetBanking Forex Card

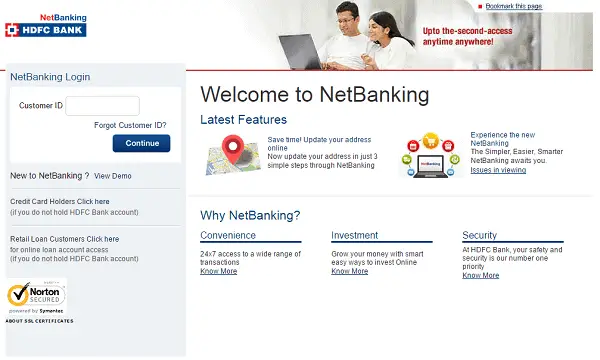

- Activation: Visit HDFC Bank’s NetBanking portal or any authorized HDFC branch to activate your card and load it with the desired foreign currencies.

- Loading Funds: Load funds into your card through HDFC NetBanking, phone banking, or by visiting an HDFC branch.

- Making Purchases: Use your Forex Card to make purchases at merchants that accept Visa or MasterCard, including online transactions.

- Cash Withdrawals: Withdraw cash from ATMs displaying the Visa or MasterCard logo and enter your PIN.

Image: guidetologin.com

Additional Features and Services

- Online Account Management: Manage your card conveniently through HDFC’s NetBanking portal, where you can track your transactions, view balances, and reload funds.

- Mobile App: Utilize the HDFC Bank Mobile App for seamless card management and easy access to your account information.

- Travel Assistance: Enjoy travel assistance services, including emergency cash advances, card replacement, and reporting lost or stolen cards.

Hdfc Prepaid Netbanking Forex Card

Conclusion

The HDFC Prepaid NetBanking Forex Card is an essential tool for global adventurers, business travelers, and anyone who transacts in foreign currencies. With its convenience, cost-saving benefits, and superior security, it empowers cardholders to manage their international finances with confidence and ease. Whether you’re planning a vacation abroad or conducting business across borders, the HDFC Prepaid NetBanking Forex Card is your passport to a world of financial freedom and peace of mind.