Navigating the world of foreign exchange can be daunting, especially when planning an international trip. But what if there was a way to simplify currency conversion and ensure seamless transactions abroad? The HDFC NetBanking Forex Card is your answer, empowering you with a secure and convenient solution for all your travel expenses.

Image: xytiyyreli.web.fc2.com

Unveiling The HDFC NetBanking Forex Card: A World of Convenience At Your Fingertips

The HDFC NetBanking Forex Card is a prepaid card linked to your HDFC bank account, designed exclusively for travelers. Unlike traditional cash or credit cards, it eliminates the need to carry large amounts of foreign currency, reducing the risk of theft or loss. With this card in your wallet, you can effortlessly make purchases, withdraw cash, and manage your finances from anywhere in the world.

Benefits that Elevate Your Travel Experience

A world of advantages awaits you with the HDFC NetBanking Forex Card:

-

Unbeatable exchange rates: Enjoy competitive rates that are updated regularly, ensuring you get the most out of your money.

-

Zero transaction fees: Say goodbye to hidden charges. Make purchases and withdraw cash without incurring any additional fees.

-

24/7 accessibility: Manage your card anytime, anywhere through HDFC’s secure NetBanking portal. Track your expenses, set limits, and control your finances with ease.

-

Wide acceptance: The HDFC NetBanking Forex Card is accepted at millions of ATMs, stores, and online merchants worldwide, providing unmatched convenience.

-

Reload anytime: Running low on funds? Simply log into your NetBanking account and reload your card instantly, ensuring you have the cash you need when you need it most.

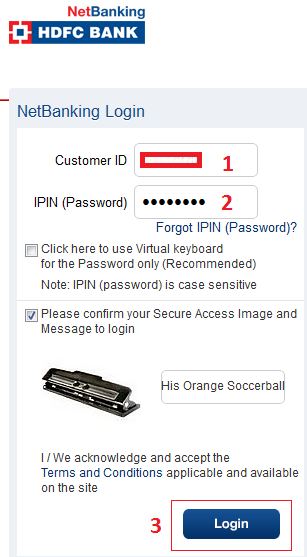

A Step-by-Step Guide to Your Forex Card

Getting started with your HDFC NetBanking Forex Card is a breeze:

-

Apply online: Visit the HDFC website and submit an application, providing your personal details and travel itinerary.

-

Verification and approval: HDFC will verify your details and approve your application within a few hours.

-

Receive your card: Your HDFC NetBanking Forex Card will be delivered to your registered address within 48 hours.

-

Load funds: Transfer funds from your HDFC bank account to your Forex Card through NetBanking or mobile banking.

-

Activate your card: Once your card is loaded, activate it by calling HDFC’s customer care number.

Image: venamacment.hatenadiary.com

Expert Advice for Travelers

-

Plan ahead: Determine how much foreign currency you’ll need based on your travel plans and budget.

-

Load multiple currencies: If you’re visiting multiple countries, consider loading different currencies onto your card to avoid exchange rate fluctuations.

-

Keep a record: Track your expenses and receipts to ensure accurate accounting and avoid overspending.

-

Notify HDFC: Inform HDFC before traveling so they can monitor your transactions and assist in case of emergencies.

-

Be vigilant: Keep your card and PIN safe, and report any suspicious activity immediately.

Hdfc Net Banking Forex Card

Conclusion: Your Travel Companion for Peace of Mind

The HDFC NetBanking Forex Card is the ultimate travel companion, providing peace of mind and financial flexibility. With its competitive rates, zero transaction fees, and 24/7 accessibility, you can focus on creating unforgettable memories without worrying about currency hassles. So, embrace the world with confidence, knowing that your finances are in safe hands. Apply for your HDFC NetBanking Forex Card today and experience the future of convenient and secure international transactions.