Navigating the world of international travel and currency exchange can be a daunting task. However, with HDFC Bank’s NetBanking Forex Card, you can bid farewell to the hassles of carrying cash or dealing with multiple currency notes. Designed to provide utmost convenience and savings, this revolutionary card empowers you to manage your foreign currency needs seamlessly from the comfort of your home.

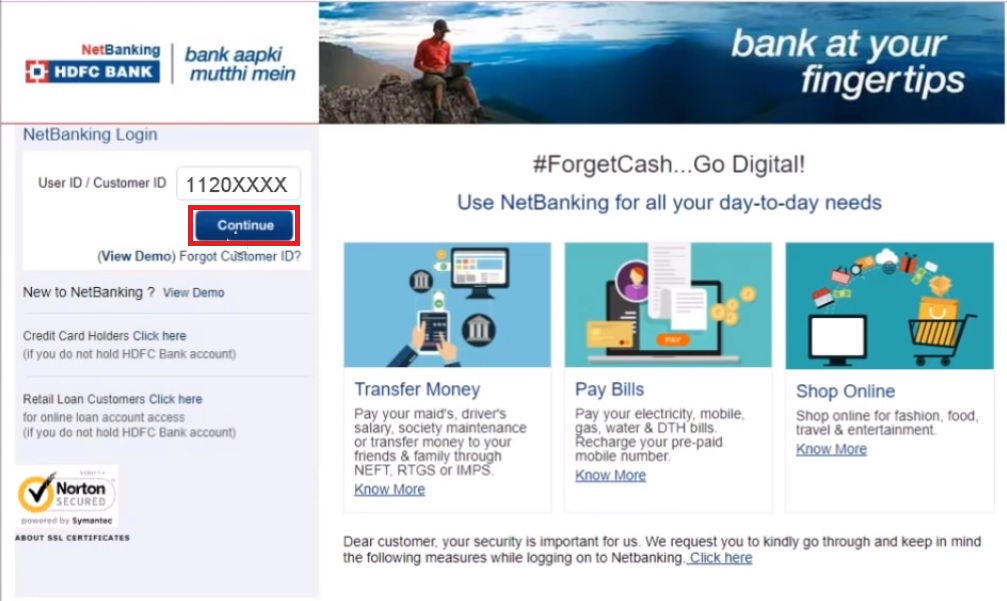

Image: forexwinmoney1.blogspot.com

Understanding HDFC Bank’s NetBanking Forex Card

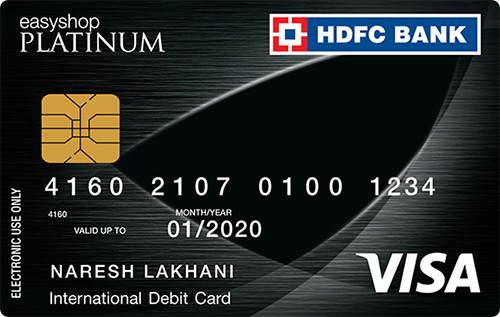

HDFC Bank’s NetBanking Forex Card is a prepaid card linked to your HDFC Bank account, enabling you to load multiple foreign currencies onto a single card. This card serves as a perfect solution for travelers, students, and business professionals who frequently make international transactions. With its widespread acceptance at millions of merchant outlets and ATMs worldwide, you can enjoy cashless and hassle-free experiences during your overseas adventures.

Key Benefits of the NetBanking Forex Card

Convenience and Security:

Say goodbye to the stress of carrying large sums of cash or exchanging currencies at inconvenient rates. The NetBanking Forex Card offers a safe and secure way to manage your foreign currency needs.

Competitive Exchange Rates:

HDFC Bank offers competitive exchange rates, ensuring you get the most value for your money.

Multiple Currency Management:

Store up to 10 different foreign currencies on a single card, eliminating the need to carry multiple currency notes.

Real-Time Tracking:

Keep a track of your card balance and transactions in real-time through NetBanking, ensuring complete control over your expenses.

24/7 Customer Support:

HDFC Bank’s dedicated customer support team is available 24/7 to assist you with any queries or emergencies.

How to Apply for the NetBanking Forex Card

Applying for HDFC Bank’s NetBanking Forex Card is a straightforward process:

- Visit the HDFC Bank website or your nearest branch.

- Complete the application form and submit the required documents.

- Load the desired foreign currency onto your card.

Image: forestparkgolfcourse.com

Unlock the Limitless Benefits of HDFC Bank’s NetBanking Forex Card

Whether you’re planning a business trip to Singapore, a family vacation in Europe, or an educational adventure in the United States, the HDFC Bank NetBanking Forex Card is your ultimate travel companion. Its convenience, security, and cost-saving advantages make it an indispensable tool for managing your foreign currency expenses.

For frequent business travelers:

Streamline your international business transactions with the NetBanking Forex Card, ensuring access to multiple currencies and competitive exchange rates.

For globetrotting families:

Provide your family with a secure and convenient way to handle their expenses while exploring the world. Control and track your family’s foreign currency spending with ease.

For students abroad:

Empower your student with the NetBanking Forex Card, ensuring they have access to the local currency without the hassle of carrying cash. Monitor their expenses and provide financial support from the comfort of your home.

Hdfc Bank Netbanking Forex Card

Conclusion

HDFC Bank’s NetBanking Forex Card revolutionizes the way you manage your foreign currency needs. With its unmatched convenience, security, and cost-saving benefits, it’s the ideal solution for global travelers, business professionals, and students alike. Unlock the world of seamless international transactions and embrace the ease and savings offered by HDFC Bank’s NetBanking Forex Card today!