Introduction

In an era of globalization, international travel and business transactions have become commonplace. Understanding and navigating the intricacies of foreign exchange rates is crucial for anyone venturing beyond their home country. HDFC Bank, one of India’s leading financial institutions, offers comprehensive forex exchange services to cater to the diverse needs of its customers. This article delves into the world of HDFC Bank forex exchange rates, providing a detailed guide to help you make informed decisions.

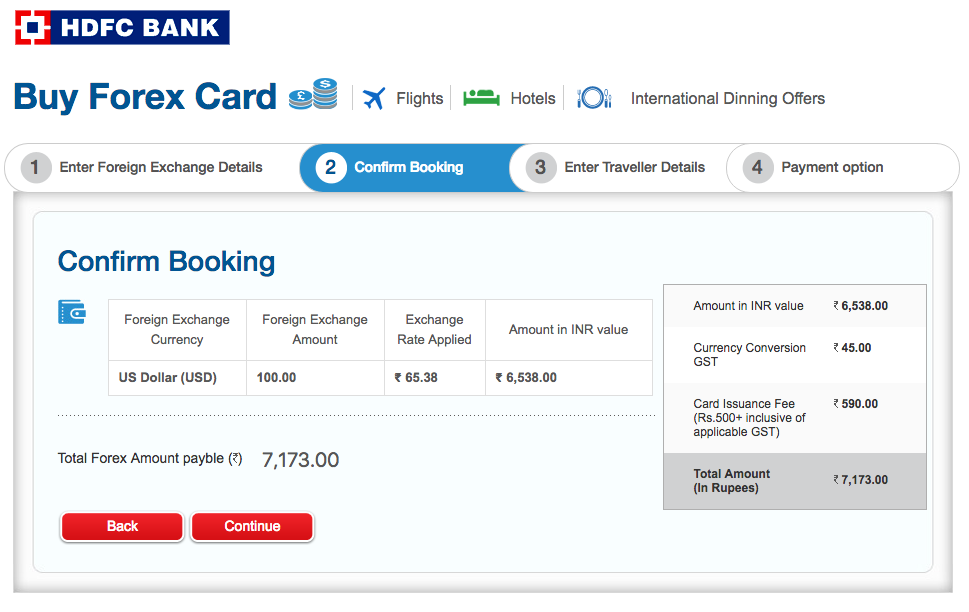

Image: www.pdfprof.com

Understanding Forex Exchange Rates

Foreign exchange rates represent the value of one currency relative to another. They fluctuate continuously, influenced by various factors such as economic conditions, interest rates, and political events. When transacting in foreign currencies, you must consider the exchange rate to determine the amount of currency you will receive or spend.

HDFC Bank’s Forex Services

HDFC Bank offers a wide range of forex services to meet the needs of individuals, businesses, and corporates. These services include:

- Foreign currency notes: Purchase or exchange foreign currency notes at competitive rates.

- Traveler’s checks: Safely and conveniently carry funds while traveling abroad.

- Wire transfers: Send and receive funds internationally with ease and security.

- Forex cards: Pre-loaded cards that allow you to spend in multiple currencies worldwide.

- Documentary credit: Secure method for international trade transactions.

Determining HDFC Bank Forex Exchange Rates

HDFC Bank’s forex exchange rates are determined by several factors, including:

- Market demand and supply: Fluctuations in the market affect the exchange rates.

- Economic conditions: Strong or weak economic indicators influence the value of currencies.

- Interest rates: Changes in interest rates can impact exchange rates.

- Political events: Geopolitical events can create volatility in exchange rates.

Image: www.businesstoday.in

How to Access HDFC Bank Forex Exchange Rates

You can access HDFC Bank’s forex exchange rates through various channels:

- Online: Visit the HDFC Bank website to view live exchange rates.

- Mobile Banking: Use the HDFC Bank Mobile Banking app to check rates and initiate transactions.

- Forex branches: Visit HDFC Bank’s dedicated forex branches for personalized assistance.

Benefits of Using HDFC Bank Forex Services

- Competitive rates: HDFC Bank offers competitive exchange rates compared to other banks and money changers.

- Convenience: Access forex services online, through mobile banking, or at convenient branch locations.

- Security: Trustworthy and secure platform for all your forex transactions.

- Expertise: HDFC Bank’s experienced forex professionals provide guidance and support.

Expert Insights on Forex Exchange Rates

- “Understanding forex exchange rates empowers you to make well-informed decisions when transacting abroad.” – Ms. Priyanka Rao, Senior Forex Specialist, HDFC Bank.

- “Monitoring exchange rate trends can help you time your transactions to maximize savings.” – Mr. Amit Gupta, Head of Forex Operations, HDFC Bank.

Actionable Tips for Forex Transactions

- Research and compare exchange rates from different providers before making a trade.

- Consider hedging your currency risk by using forward contracts or options.

- Be aware of additional fees or commissions associated with forex transactions.

- Inform your bank about your travel dates and the currencies you will need to avoid unnecessary charges.

Hdfc Bank Forex Exchange Rates

Conclusion

HDFC Bank’s forex exchange services offer a safe and convenient way to manage your international transactions. By understanding the intricacies of forex exchange rates and utilizing HDFC Bank’s competitive rates and expert support, you can navigate the global financial landscape with confidence. Whether you are an individual traveler, a business executive, or a corporate entity, HDFC Bank’s forex services are tailored to meet your unique financial needs.