Introduction:

Image: paxful.com

In the realm of personal finance, we often grapple with the question of where to invest our hard-earned money. As we navigate through a labyrinth of options, three giants emerge: Forex, Cryptocurrencies, and Stocks. Each of these titans offers unique opportunities and potential pitfalls, and understanding their distinct characteristics is crucial for making informed financial decisions.

In this comprehensive guide, we will delve into the intricate world of Forex, Crypto, and Stocks, unraveling their intricacies, assessing their risks and rewards, and empowering you with the knowledge to chart your path towards financial freedom.

Delving into Forex:

Forex, an abbreviation for Foreign Exchange, is the global marketplace for exchanging currencies. It is a decentralized network where currencies are traded in pairs, such as EUR/USD or GBP/JPY. The Forex market operates 24 hours a day, offering immense liquidity and trading opportunities.

Traders speculate on currency price fluctuations to make profits. They analyze economic and political events,利率, inflation rates, and other factors that influence валюта rates. Forex trading can be highly lucrative but also carries substantial risk, as currency prices can change dramatically.

Unveiling the Crypto Phenomenon:

Cryptocurrencies, like Bitcoin and Ethereum, have taken the financial world by storm. These digital currencies are built on decentralized blockchains, eliminating the need for intermediaries like banks. Cryptocurrencies are powered by complex cryptography, which ensures their security and anonymity.

The crypto market is highly volatile, offering significant potential returns but also substantial risks. Investors are advised to tread cautiously and conduct thorough research before venturing into this realm.

Exploring Equity Markets: Stocks and Shares

Stocks represent fractional ownership in publicly traded companies. When you purchase stocks, you become a shareholder, entitled to a portion of the company’s profits (dividends) and voting rights. Stock markets provide investors with access to the growth potential of companies and the opportunity for capital appreciation.

Stock markets have historically outperformed other investment options over the long term. However, they are not immune to fluctuations and can experience significant downturns during economic downturns.

Image: technoblender.com

Discerning the Differences:

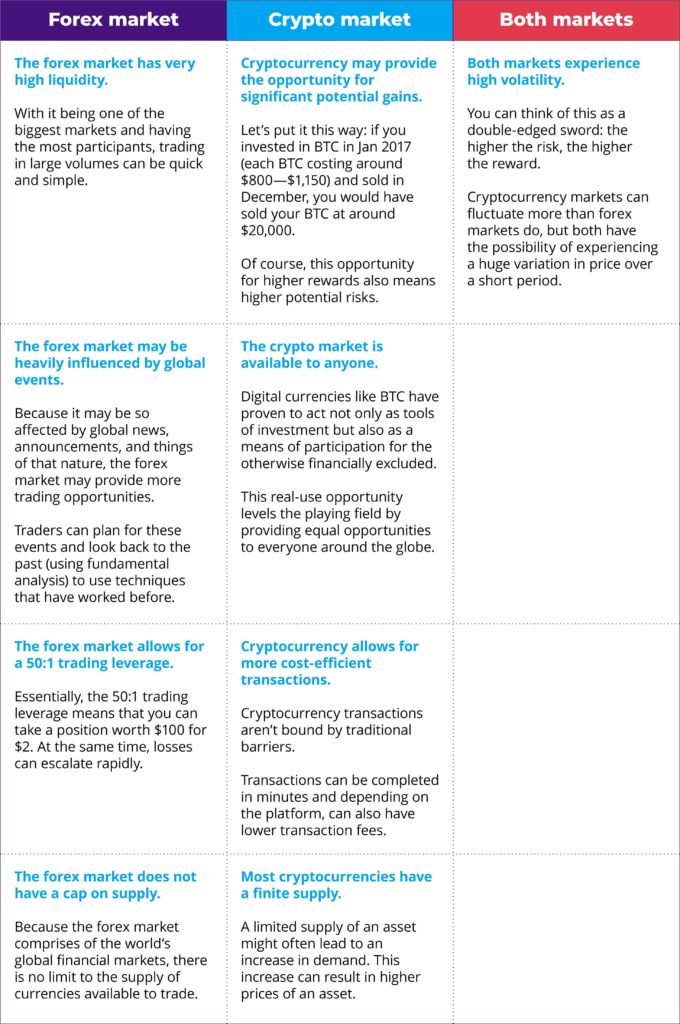

Asset Class: Forex represents currencies, Cryptocurrencies are digital currencies, while Stocks represent ownership in companies.

Trading Market: Forex is traded in the foreign exchange market, Crypto in decentralized cryptocurrency exchanges, and Stocks in organized stock exchanges like the NASDAQ or NYSE.

Risk Assessment: Forex and Crypto carry higher risk due to price volatility, while Stocks offer more stability over the long term.

Accessibility: Forex and Crypto are accessible to retail investors through brokerage platforms, while Stock investments typically require a higher capital outlay.

Volatility: Crypto and Forex exhibit significant price volatility compared to Stocks, which tend to fluctuate less dramatically.

Regulation: Regulatory frameworks for Forex and Crypto are evolving, while Stock markets are well-regulated.

Navigating the Crossroads:

Choosing between Forex, Crypto, and Stocks depends on your individual risk tolerance, investment horizon, and financial goals. Here’s a simplified approach:

- High Risk, High Reward Potential: Forex or Cryptocurrencies

- Moderate Risk: Stocks

- Long-Term Stability: Stocks

- Diversification: Allocating portions of your portfolio across all three asset classes

Expert Insights and Actionable Tips:

- “Forex trading requires a deep understanding of macroeconomic factors and currency dynamics.” – James Stanley, FX Analyst

- “Investing in Cryptocurrencies should be considered a high-risk, long-term investment strategy.” – Joe DiPasquale, CEO of BitGo

- “Stock market investments provide a solid foundation for building wealth over time, but diversification is essential.” – David Swensen, Chief Investment Officer at Yale University

Forex Vs Crypto Vs Stocks

Conclusion:

The choice between Forex, Crypto, and Stocks is a personal one, driven by your financial objectives and risk appetite. By understanding the complexities and nuances of each asset class, you can make informed decisions that align with your financial strategy. Remember, the path to financial freedom is paved with knowledge, prudent decision-making, and a healthy dose of diversification. Invest wisely and let your finances soar.