Immerse yourself in the dynamic world of forex trading, where understanding trading sessions and currency pairing holds the key to unlocking lucrative opportunities. As you embark on this thrilling journey, this comprehensive guide will serve as your roadmap, empowering you with the knowledge and strategies to navigate the ever-changing forex market like a seasoned pro.

Image: fxssi.com

Understanding Forex Trading Sessions

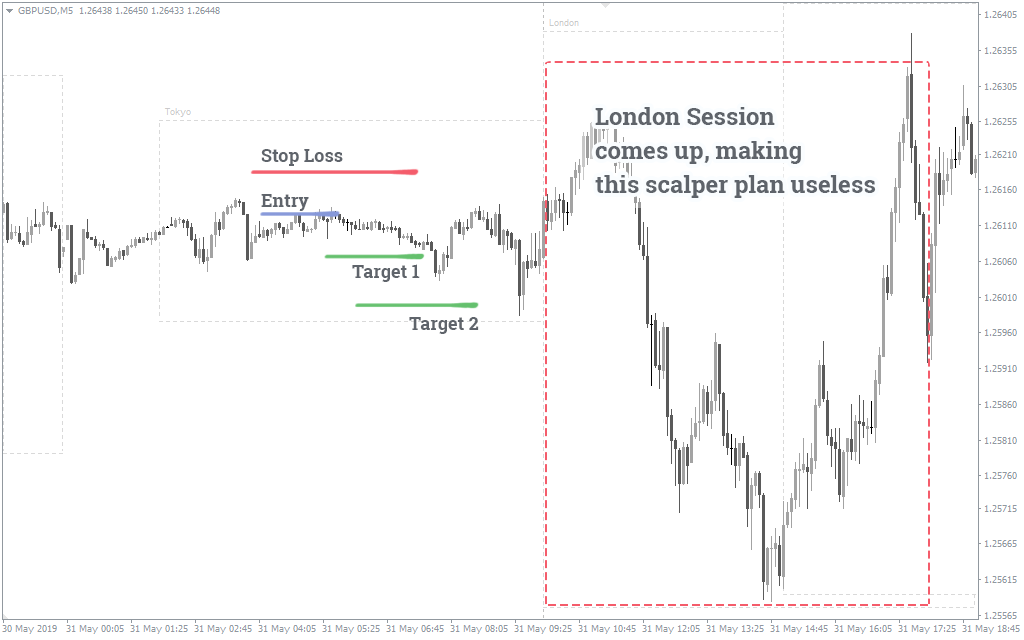

Mastering forex trading sessions is akin to unriddling a complex puzzle. The forex market is an unceasing tapestry of trading activity that spans the globe, creating a rhythmic cadence of overlap between different financial centers. Each session brings with it unique market conditions influenced by specific macroeconomic factors and geopolitical events.

The three primary trading sessions, each representing a different time zone, are pivotal to understanding market liquidity and volatility. The Asian session, from midnight to noon UTC, sets the stage for the day’s trading activities. The European session, from 7:00 AM to 4:00 PM UTC, takes over the baton, characterized by higher liquidity and volatility. As the European session draws to a close, the New York session, spanning from 1:00 PM to 10:00 PM UTC, heralds the peak of trading volume and price fluctuations.

Currency Pairs: A Balancing Act

In the realm of forex, currency pairs play a starring role, embodying the very essence of trading. A currency pair is a pairing of two distinct currencies, quoted with one currency as the base and the other as the counter. Traders buy or sell one currency against the other, essentially wagering on one currency’s appreciation or depreciation relative to the other.

Currency pairs fall into three broad categories: major, minor, and exotic. Major currency pairs, including EUR/USD, USD/JPY, and GBP/USD, account for the bulk of global forex trading volume. Minor currency pairs, such as AUD/JPY and EUR/GBP, offer a blend of liquidity and volatility. Exotic currency pairs, involving a major currency paired with a lesser-traded currency, present unique challenges and opportunities due to their lower liquidity and higher volatility.

The Dance of Supply and Demand: Order Types

Understanding order types is crucial to orchestrating successful forex trades. Forex orders fall into two main categories: market orders and pending orders.

Market Order: A market order is an immediate execution order, executed at the prevailing market price. Traders use market orders when they prioritize swift trade execution over price.

Pending Order: A pending order is an order placed in anticipation of a desired price level being reached. Pending orders allow traders to strategize conditional trade executions, specifying conditions such as price triggers and expiration times.

Image: www.calibrateindia.com

Technical Analysis: Decoding Market Patterns

Technical analysis, revered by traders worldwide, is the art of interpreting price charts to predict future market movements. This predictive analytics approach leverages historical price data, identifying trends, support and resistance levels, and chart patterns to discern potential trading opportunities.

Commonly employed technical indicators include moving averages, Bollinger Bands, and Relative Strength Index (RSI). These tools, when combined with a keen eye for pattern recognition, arm traders with insights into market sentiment, momentum, and potential turning points.

Forex Trading Sessions And Currency Pairs

Conclusion

Embarking on a forex trading journey requires a deep understanding of trading sessions, currency pairs, and the nuances of technical analysis. By mastering these concepts, you’ll gain the knowledge and confidence to navigate the forex market with precision.

Remember, forex trading is a dynamic and ever-evolving domain, demanding continuous learning and self-evaluation. As you delve deeper into this captivating realm, remain adaptable, never cease to question market trends, and foster a relentless pursuit of knowledge. The rewards of successful forex trading lie in the capacity to anticipate market ebbs and flows, astutely positioning yourself to reap the fruits of profitable trades. Embrace the challenge, cultivate your trading skills, and unlock the boundless possibilities that await you in the thriving global forex market.