The world of finance can be a daunting place, especially for those seeking to navigate the ever-fluctuating forex market. Technical analysis, a valuable tool in the trader’s arsenal, can provide invaluable insights into price movements, helping you make informed decisions amidst the market’s volatility. Embark on an educational journey with this comprehensive guide, designed to empower you with the knowledge and strategies you need to conquer the markets. Embrace technical analysis as your compass and unlock the potential to become a confident and successful trader.

Image: cartoondealer.com

Understanding Technical Analysis: A Glimpse into Market Psychology

Technical analysis is the art of studying past price movements and patterns to predict future price movements. It is not a crystal ball, but rather a meticulous process of observing market behavior, identifying recurring trends, and extracting valuable trading signals. By scrutinizing price charts, traders can gain insights into the collective psychology of market participants, enabling them to anticipate future market trends with greater accuracy.

Laying the Foundation: Core Concepts of Technical Analysis

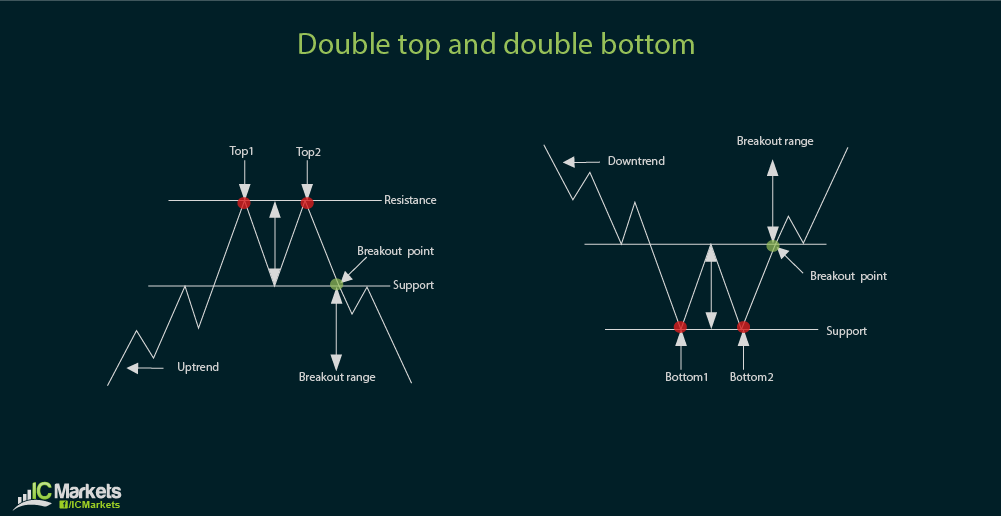

At the heart of technical analysis lies a fundamental understanding of core concepts that form the building blocks of market analysis. Trend analysis, support and resistance, and technical indicators are the cornerstones of this discipline. Trends provide insights into the overall direction of the market, while support and resistance levels indicate areas where prices may bounce off or break through. Technical indicators, on the other hand, are mathematical formulas that help traders identify trends, momentum, and overbought or oversold conditions in the market.

Demystifying Moving Averages: A Trader’s Guiding Light

Moving averages are one of the most widely used technical indicators, smoothing out price fluctuations and revealing the underlying trend of the market. By calculating the average price over a specific period, moving averages act as a dynamic support or resistance level, providing traders with valuable insights into potential trading opportunities. Understanding the different types of moving averages, such as the Simple Moving Average (SMA) and the Exponential Moving Average (EMA), is paramount for effective trend analysis.

Image: www.icmarkets.com

Candlestick Patterns: Decoding the Market’s Language

Candlestick patterns form the visual language of technical analysis, providing traders with a powerful tool to interpret price action. These patterns are composed of multiple candlesticks, each representing a specific trading period, and their shapes and positions can reveal valuable insights into the market’s sentiment. By studying candlestick patterns, traders can identify potential reversals, continuations, and trading opportunities, helping them anticipate market movements with greater precision.

Empowering Traders: Expert Insights and Proven Strategies

In the realm of technical analysis, knowledge is power. This comprehensive guide offers not only a thorough understanding of core concepts but also practical wisdom from seasoned experts. Renowned traders share their time-tested strategies, providing valuable insights into risk management, position sizing, and identifying high-probability trading opportunities. Whether you’re a novice trader seeking guidance or an experienced professional looking to refine your skills, this guide is an invaluable resource.

A Call to Action: Embrace the Power of Technical Analysis

Technical analysis is not an exact science, but when applied with discipline and understanding, it can significantly enhance your ability to make informed trading decisions. By grasping the fundamental concepts outlined in this guide, you can unlock valuable insights into price movements, anticipate market trends, and identify potential trading opportunities. Embrace technical analysis as your guiding star and embark on a journey towards conquering the forex market.

Additional Resources to Enhance Your Knowledge

- Tradingview: A comprehensive platform offering advanced charting tools and technical analysis capabilities.

- Investopedia: A trusted source for financial education, providing in-depth articles, tutorials, and market analysis.

- Forex Factory: A global hub for forex traders, offering news, analysis, forums, and trading tools.

- Babypips: A free online forex education platform, providing comprehensive courses for traders of all levels.

Forex Technical Analysis Strategies Pdf

Disclaimer: Risk Management is Paramount

Trading financial instruments involves inherent risk, and it’s crucial to approach the markets with prudence. Careful consideration of your risk tolerance, trading capital, and market conditions is essential. Seek professional financial advice if necessary. The strategies outlined in this guide are for educational purposes only and should not be construed as financial advice.