Introduction

In the fast-paced and ever-evolving world of Forex trading, understanding supply and demand zones is like having a secret weapon. These pivotal points on a currency chart represent areas where the forces of supply and demand collide, revealing valuable insights into market sentiment and potential trading opportunities. Embark on this comprehensive guide as we delve into the intricacies of Forex supply and demand zones, empowering you with the knowledge and tools to navigate the financial markets with confidence and precision.

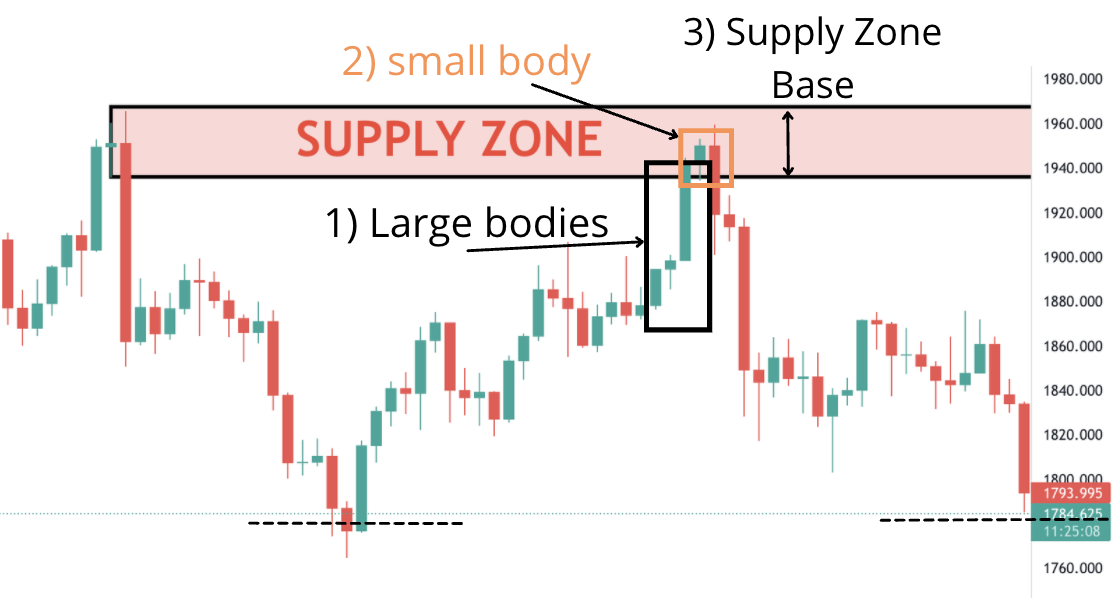

Image: www.reddit.com

What are Supply and Demand Zones in Forex Trading?

Supply and demand zones are price levels where the number of buyers (demand) and sellers (supply) reach an equilibrium. These zones emerge naturally within market dynamics and play a crucial role in determining price movements. Supply zones indicate areas where there is an excess of sellers, pushing prices lower. In contrast, demand zones represent areas where buyers dominate, driving prices upward.

How to Identify Supply and Demand Zones

Identifying these pivotal zones requires a keen eye and a deep understanding of market behavior. The most common method involves analyzing price action and volume data. When prices repeatedly reach a certain level and then reverse, it’s a strong indication of a supply or demand zone. Volume data can further confirm the strength of these zones, as higher volume typically indicates increased buying or selling pressure.

The Significance of Supply and Demand Zones

The significance of these zones lies in their ability to provide traders with critical information:

-

Price Support and Resistance: Supply zones act as resistance levels, preventing prices from rising further. Conversely, demand zones provide support, hindering prices from falling below that level.

-

Trend Identification: Breakout above a supply zone or breakdown below a demand zone can signal a change in market trend.

-

Trading Opportunities: These zones offer lucrative trading opportunities. Buyers can initiate long positions at demand zones, while sellers can enter short positions at supply zones.

Image: www.vrogue.co

Expert Insights and Actionable Tips

-

Trend Analysis: Trade in the direction of the prevailing trend to increase your chances of success.

-

Confirmation: Look for multiple confirmations through price action, volume data, and technical indicators before entering a trade.

-

Risk Management: Employ proper stop-loss orders to protect your capital and manage risk.

Forex Supply And Demand Zones

Conclusion

Mastering Forex supply and demand zones is a key ingredient in the recipe for successful trading. This profound understanding of market dynamics empowers you to identify potential trading opportunities, manage risk effectively, and navigate the complex financial landscape with confidence. Embrace the concepts presented in this comprehensive guide, and you will unlock a world of possibilities in the exhilarating realm of Forex trading. Remember, knowledge is power, and the more proficient you become, the closer you’ll get to trading mastery.