Introduction

In the realm of forex trading, the shooting star candlestick pattern stands out as a beacon of bearish reversal, signaling a potential shift in market momentum. Its distinctive shape, resembling a shooting star streaking across the night sky, conveys a vivid message of impending decline. Understanding the nuances of this candlestick formation is crucial for traders seeking to navigate market trends effectively.

Image: www.tradingwolf.com

Anatomy of a Shooting Star Candlestick

A shooting star candlestick consists of three essential components:

- Bearish: Indicates a reversal from an uptrend.

- Small Body: The candle body is typically small, reflecting relatively low trading range during the session.

- Long Upper Shadow: The upper shadow extends significantly beyond the body, symbolizing buying pressure that failed to sustain.

- No Lower Shadow or Short Lower Shadow: The lower shadow is either absent or minimal, indicating a lack of support at lower prices.

Occurrence and Significance

Shooting star candlesticks often appear at the end of an uptrend, indicating a potential reversal. They suggest that buyers have lost their momentum and that sellers are poised to take control. When complemented by other technical indicators such as moving averages or support/resistance levels, shooting star candlesticks provide valuable confirmation of a bearish trend reversal.

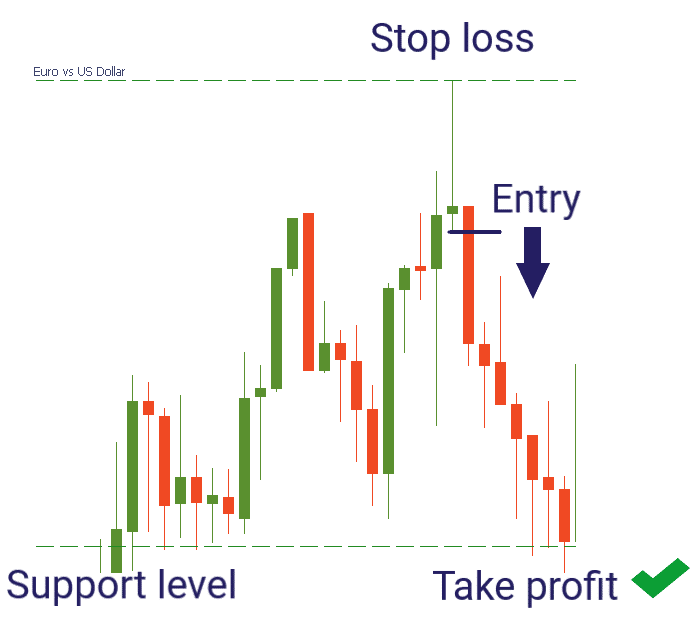

Trading Strategies with Shooting Stars

Traders can incorporate shooting star candlesticks into their trading strategies based on various principles:

- Reversal Signal: The primary interpretation is as a reversal signal, prompting traders to consider closing long positions or initiating short trades.

- Confirmation Pattern: Shooting star candlesticks can confirm bearish trend reversals when they appear in confluence with other indicators, such as overbought conditions indicated by oscillators

- Risk Management: Shooting stars can serve as warning signs, signaling potential losses in ongoing trades. Traders may use them to adjust their risk levels accordingly.

- Pattern Recognition: Spotting shooting star candlesticks early in their formation can provide an advantageous entry point for short trades, enabling traders to capitalize on the reversal.

Image: www.pinterest.com

Limitations and Considerations

While shooting star candlesticks are valuable trading tools, certain limitations must be considered:

- False Signals: They can occasionally produce false signals, especially in volatile markets or when not corroborated by other indicators.

- Context-Dependent: Shooting star candlesticks should be interpreted within the broader market context, taking into account factors such as trend, support/resistance levels, and volume.

- Confirmation: Always seek confirmation from other technical indicators or chart patterns before making any significant trading decisions based on shooting stars.

Forex Shooting Star Candlestick Meaning

Conclusion

The shooting star candlestick is a pivotal formation in the technical trader’s arsenal. Its distinctive shape and bearish implications can provide valuable insights into market momentum reversals. By understanding the anatomy, occurrence, and trading strategies associated with shooting stars, traders can enhance their abilities to identify potential trend shifts and make informed decisions in their foreign exchange trading endeavors. Remember to exercise prudence in interpreting this pattern and seek confirmation from multiple sources to maximize its efficacy.