In today’s interconnected global economy, understanding foreign exchange (forex) rates is crucial for businesses, travelers, and investors alike. The Philippine peso (PHP) is the official currency of the Philippines, a vibrant and emerging economy in Southeast Asia. For those looking to stay abreast of the latest forex rates and their impact on the Philippine economy, this comprehensive guide provides an in-depth analysis.

Image: howtotradeonforex.github.io

The Intricacies of Forex Rates: Unraveling the Interplay of Currencies

Foreign exchange rates represent the value of one currency relative to another. They constantly fluctuate based on a multitude of factors, including economic conditions, supply and demand, and political events. The peso’s value against other currencies, such as the US dollar (USD), euro (EUR), or Japanese yen (JPY), directly influences international trade, investments, and tourism.

Decoding the Impact of Forex Rates on the Philippine Economy

Fluctuations in forex rates significantly affect the Philippine economy. A stronger peso against major currencies makes imports cheaper, reducing inflation and increasing domestic purchasing power. Conversely, a weaker peso can make exports more competitive, boosting exports and driving economic growth. It also impacts foreign investments as a stronger currency encourages foreign investors to invest in the Philippines.

Unveiling the Drivers of Forex Rate Volatility: A Tapestry of Interconnected Factors

Numerous elements contribute to the volatility of forex rates. Economic data releases, such as gross domestic product (GDP) growth, interest rates, and inflation, heavily sway currency values. Political events, including elections and geopolitical tensions, can also cause market fluctuations. Moreover, central bank interventions and global economic conditions play pivotal roles in shaping forex rates.

Image: forexroboteasy1.blogspot.com

Transacting with Confidence: A Guide to Navigating Forex Rates for Businesses, Travelers, and Investors

For businesses engaged in international trade, understanding forex rates is imperative. Accurate currency conversion is vital for pricing exports competitively, calculating import costs, and managing cross-border transactions. Travelers should research the forex rates at their destination to optimize their currency exchange. Investors seeking to diversify their portfolios or capitalize on currency fluctuations can utilize forex markets as an investment vehicle.

Forecasting the Future of the Philippine Peso: Unveiling Potential Scenarios

Predicting future forex rates is a complex endeavor. However, analyzing historical data, monitoring economic indicators, and considering geopolitical factors can provide valuable insights. Analysts anticipate the continued strengthening of the Philippine peso against the US dollar in the coming years, with factors such as rising foreign direct investment and a robust domestic economy contributing to this trend.

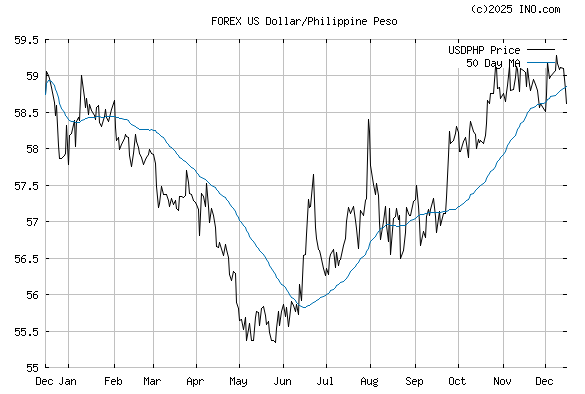

Forex Rates Today In Philippine Peso

https://youtube.com/watch?v=U_12fyImpjM

Conclusion

Understanding forex rates and their impact on the Philippine economy is essential for informed decision-making in today’s globalized world. By staying attuned to forex market dynamics and leveraging the information provided in this guide, businesses, travelers, and investors can effectively navigate currency fluctuations and maximize their opportunities. As the Philippine economy continues on its growth trajectory, the peso’s value will undoubtedly play a crucial role in shaping its economic destiny.