Introduction

The foreign exchange market, commonly known as forex or FX, is the world’s largest financial market, where currencies are traded against each other. With a daily trading volume exceeding $6.6 trillion, forex transactions play a pivotal role in international commerce and global economic stability. India, being an emerging economic hub, has seen a substantial increase in forex transactions over the past few years. HDFC Bank, one of India’s leading private sector banks, stands as a prominent player in the forex market, offering competitive rates and a wide range of services. In this article, we delve into the intricacies of forex rates and provide an in-depth analysis of HDFC Bank’s offerings in this dynamic financial landscape.

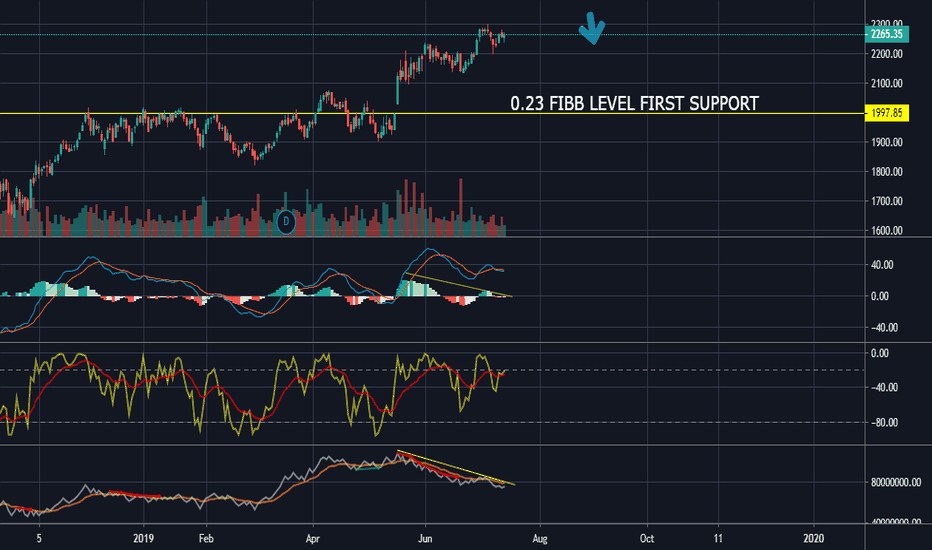

Image: xfxtrading.blogspot.com

Understanding Forex Rates

Forex rates represent the value of one currency relative to another. They fluctuate constantly, influenced by a complex interplay of economic, political, and market factors. The relative strength or weakness of individual economies, interest rate differentials, inflation rates, political stability, and global economic conditions all contribute to these fluctuations. Understanding forex rates is crucial for businesses engaged in international trade, individuals planning overseas investments, and travelers seeking to exchange currencies.

HDFC Bank: A Leading Player in Forex Transactions

HDFC Bank has emerged as one of the leading providers of forex services in India, catering to a wide spectrum of customers. The bank’s extensive network of branches and partnerships with leading financial institutions allows it to offer competitive forex rates and a seamless experience to its clients. Whether you are a business seeking to manage your cross-border payments, an individual planning a vacation abroad, or a trader seeking to capitalize on currency fluctuations, HDFC Bank has a customized solution to meet your forex needs.

HDFC Bank’s Comprehensive Forex Services

HDFC Bank offers a comprehensive suite of forex services designed to cater to diverse customer requirements. These include:

-

Foreign Currency Exchange: The bank provides real-time forex rates for a wide range of currencies, allowing customers to exchange currencies at competitive rates.

-

Travel Currency Cards: Designed for travelers, these prepaid cards are linked to a forex account and can be used to make payments and withdraw cash in foreign countries, eliminating the hassle of carrying foreign currency.

-

Import and Export Services: HDFC Bank assists businesses with their import and export transactions, providing expert guidance and tailored solutions to mitigate forex risks and optimize foreign exchange management.

-

Hedging Solutions: The bank offers hedging products such as forwards, futures, and options to help businesses protect themselves against adverse currency fluctuations and manage their forex exposure effectively.

-

Corporate Forex Transactions: HDFC Bank provides customized forex services for corporate clients, handling large-scale transactions, risk management, and cross-border payments.

Image: forexrate.in

Benefits of Choosing HDFC Bank for Forex Transactions

-

Competitive Forex Rates: HDFC Bank offers competitive forex rates, ensuring that customers get the most bang for their buck.

-

Extensive Branch Network: With a widespread network of branches across India, HDFC Bank provides convenient access to forex services for customers.

-

Dedicated Customer Support: The bank’s dedicated forex team is available to provide expert guidance and personalized assistance to customers.

-

Secure Transactions: HDFC Bank employs robust security measures to ensure the safety and confidentiality of customer transactions.

-

Tailored Solutions: HDFC Bank understands that every customer’s forex needs are unique and provides customized solutions to meet their specific requirements.

Factors Influencing HDFC Bank’s Forex Rates

HDFC Bank’s forex rates are influenced by a combination of macroeconomic and global factors, including:

-

Demand and Supply: The demand for a particular currency relative to its supply impacts its exchange rate. High demand for a currency typically leads to its appreciation, while an increase in supply can result in depreciation.

-

Interest Rate Differentials: Countries with higher interest rates tend to attract capital inflows, leading to an appreciation of their currencies.

-

Inflation Differentials: If inflation is higher in one country compared to another, the value of its currency may decline due to reduced purchasing power.

-

Political Stability and Economic Outlook: Political stability and a positive economic outlook usually lead to currency appreciation, while instability and uncertainty can trigger depreciation.

-

Global Economic Conditions: Factors such as economic growth, geopolitical events, and natural disasters can influence exchange rates by impacting demand for currencies and global risk appetite.

Forex Rate Hdfc Bank Today

Conclusion

HDFC Bank stands as a reliable and competitive provider of forex services, offering a comprehensive suite of solutions tailored to meet diverse customer requirements. The bank’s competitive forex rates, extensive network, dedicated customer support, and commitment to security make it an ideal choice for individuals and businesses seeking to navigate the intricacies of global currency markets. By understanding the factors influencing forex rates and the benefits of choosing HDFC Bank, customers can make informed decisions and maximize the value of their international transactions.