Introduction

In the adrenaline-fueled realm of forex trading, the ability to decipher market movements with precision can elevate traders from the depths of despair to the heights of triumph. Price action strategies, rooted in the analysis of price movements alone, offer a potent weapon in this relentless pursuit of market mastery. This comprehensive guide will unveil the intricacies of forex price action strategies, empowering you with the knowledge and confidence to navigate the turbulent waters of the currency market.

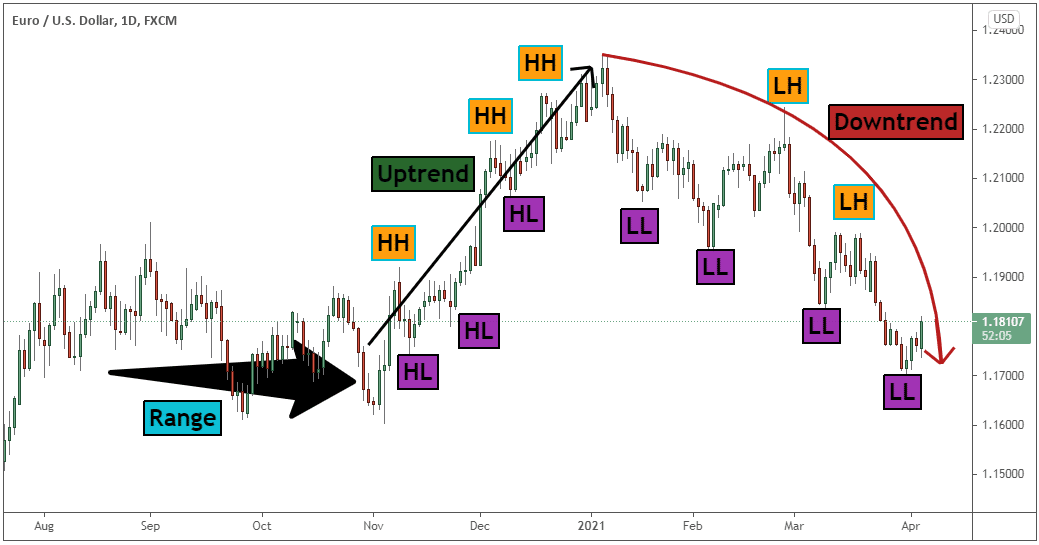

Image: tradingstrategyguides.com

1. Unraveling Price Action: A Foundation of Success

Price action trading stems from the fundamental premise that the price movements of a currency pair encapsulate all relevant information about its future trajectory. By studying these price patterns with keen observation and analytical prowess, traders can discern hidden trends, predict market reversals, and execute informed trading decisions. From candlesticks to chart patterns, price action strategies provide a comprehensive tapestry of trading signals, guiding traders toward profitable opportunities with uncanny accuracy.

2. The Anatomy of Candlesticks: A Visual Navigator

The building blocks of price action analysis are candlesticks, intricate formations that depict price fluctuations over a specified time frame. Each candlestick comprises four distinct components: open, high, low, and close, offering a detailed snapshot of the battle between bulls and bears. Identifying and interpreting candlestick patterns is akin to deciphering a secret language, revealing market sentiment and aiding in the formulation of trading strategies.

3. Chart Patterns: Where Technical Analysis Takes Center Stage

Forex price action trading is intricately entwined with chart patterns, recurring formations on price charts that offer valuable insights into market sentiment. These patterns, ranging from bullish hammers to bearish head and shoulders, serve as reliable indicators of imminent price movements, giving traders the edge in anticipating market shifts and positioning themselves accordingly.

Image: tradeciety.com

4. Combining Indicators: Synergy for Enhanced Precision

While price action strategies hold immense power in their own right, their effectiveness can be amplified when complemented by technical indicators. By overlaying indicators such as moving averages, Bollinger Bands, and MACD onto price charts, traders can confirm market trends, identify overbought or oversold conditions, and enhance the accuracy of their trading decisions.

5. Fibonacci Retracements: Harnessing Nature’s Golden Ratio

Nature’s mathematical masterpiece, the Fibonacci sequence, finds its application in forex price action trading through Fibonacci retracements. These retracement levels, plotted at specific ratios of a preceding trend, function as potential support and resistance levels, guiding traders in determining potential price reversals and setting optimal entry and exit points.

Forex Price Action Strategy Pdf

Conclusion

Mastering forex price action strategies is a journey of discovery and discipline, a quest to unlock the secrets of market behavior and emerge as a formidable force in the realm of currency trading. By delving into the world of candlestick formations, chart patterns, technical indicators, and Fibonacci retracements, you gain the power to decipher market movements, predict trends, and execute trades with precision. Embrace the knowledge imparted within this guide, refine your trading skills through relentless practice, and unlock the true potential that lies within forex price action strategies.