In the fast-paced world of forex trading, identifying currency pairs with high daily ranges can significantly boost your profit potential. Daily range refers to the difference between the highest and lowest prices a currency pair reaches within a 24-hour period. The higher the daily range, the greater the volatility and potential for substantial gains.

Image: www.audacitycapital.co.uk

Understanding High Daily Range Currency Pairs

Currency pairs with high daily ranges are often characterized by a confluence of factors, including:

- Economic disparities: Significant differences in economic growth rates, inflation, and interest rates between two countries can drive currency value fluctuations.

- Political instability: Uncertainties due to political tensions, elections, or major events can increase market volatility and lead to wider daily ranges.

- Major news events: Central bank announcements, economic data releases, and geopolitical events can trigger large price swings in currency pairs.

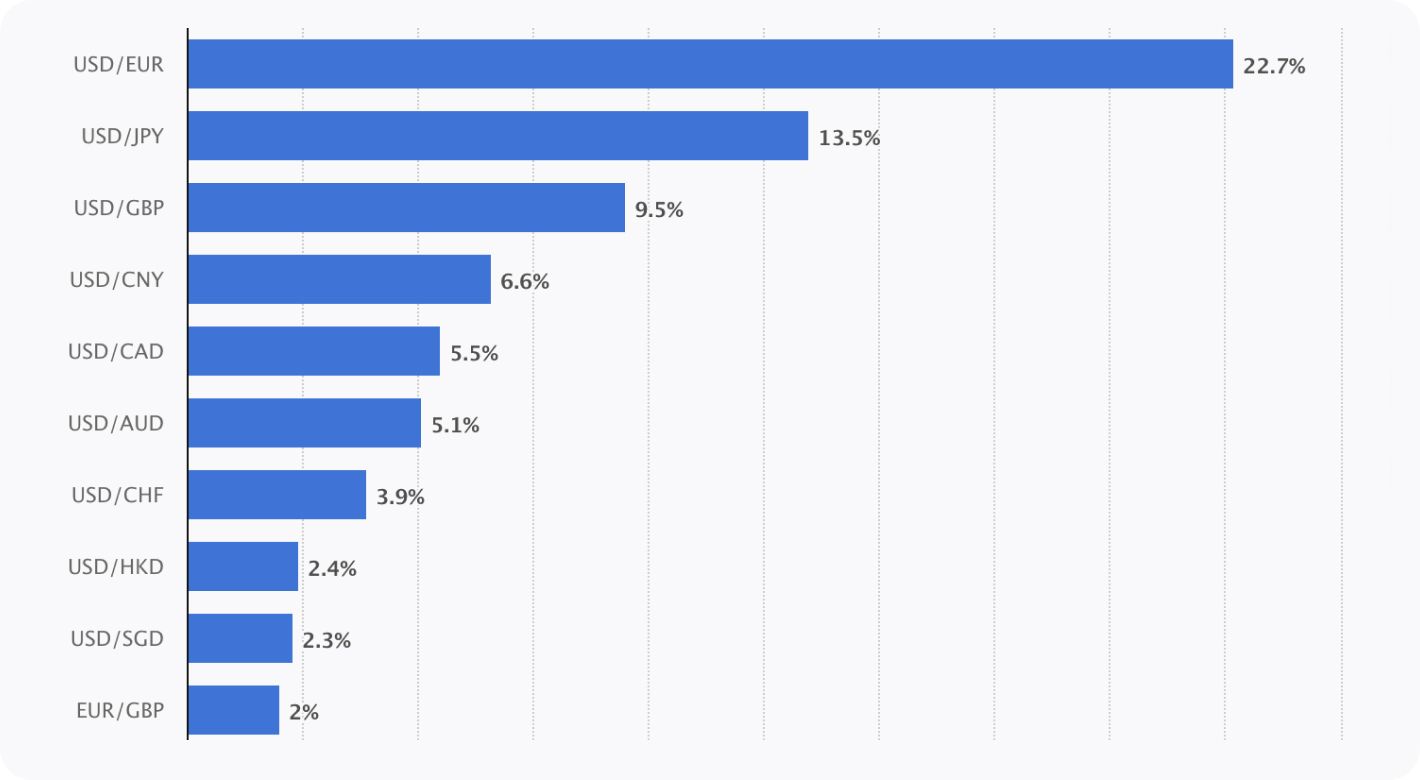

Top Forex Pairs with High Daily Range

Based on historical data and current market conditions, some of the forex pairs with the highest daily ranges include:

1. EUR/USD (Euro/US Dollar)

This classic forex pair exhibits high daily range due to economic divergence between the Eurozone and the US, political uncertainties in Europe, and market sentiment towards global economic growth.

Image: fxopen.com

2. GBP/USD (British Pound/US Dollar)

The Pound Sterling’s volatility is influenced by the UK’s political landscape, Brexit negotiations, and its economic ties to the Eurozone. High daily ranges often occur during times of political or economic uncertainty.

3. USD/JPY (US Dollar/Japanese Yen)

This pair is known for its wide daily ranges during periods of market stress and major news events. The Yen acts as a safe-haven currency, causing demand surges during global market turmoil.

4. AUD/USD (Australian Dollar/US Dollar)

The Australian Dollar is sensitive to commodity prices and Chinese economic growth. High daily ranges are often seen in response to shifts in global commodity demand and trade dynamics.

5. NZD/USD (New Zealand Dollar/US Dollar)

Similar to the AUD/USD, the NZD/USD pair experiences high daily ranges due to its correlation with global economic conditions, particularly demand for dairy products and commodities.

Tips for Trading Forex Pairs with High Daily Range

Harnessing the potential of high daily range currency pairs requires a strategic approach:

- Manage your risk: Use appropriate leverage and position sizing to limit potential losses.

- Analyze market conditions: Track economic indicators, political news, and market sentiment to gauge the underlying forces driving price movements.

- Identify support and resistance levels: Identify key price levels that have historically acted as barriers to further price movement.

- Set realistic profit targets: Establish clear profit goals based on your risk tolerance and market analysis.

- Exercise patience and discipline: Trading high daily range currency pairs requires patience and adherence to your trading strategy.

FAQ on Forex Pairs with High Daily Range

Q: Why are daily ranges important in forex trading?

A: Daily ranges indicate the potential for price volatility, which can translate into larger profit opportunities or losses.

Q: How can I determine the daily range of a currency pair?

A: Subtract the lowest price from the highest price within a 24-hour trading period.

Q: Is it safe to trade forex pairs with high daily ranges?

A: While high daily ranges offer potential, they also present higher risk. Traders must manage their risk effectively and have a solid trading strategy in place.

Forex Pairs With Highest Daily Range

Conclusion

Understanding and trading forex pairs with high daily range provides an opportunity to enhance returns and maximize profitability. By identifying currency pairs influenced by significant economic disparities, political uncertainties, and major news events, traders can position themselves to capitalize on market volatility. Remember, trading forex comes with inherent risk, so it’s crucial to approach it with a comprehensive strategy, risk management techniques, and a willingness to learn and adapt to changing market conditions.