Introduction

In the realm of global finance, currency exchange plays a pivotal role in facilitating trade, investments, and international travel. Pakistan, as a prominent emerging economy, actively participates in the foreign exchange (forex) market to manage its currency’s value and maintain economic stability. Understanding forex open currency rates, the cornerstone of international currency transactions, is crucial for businesses, investors, and individuals navigating the complexities of cross-border financial dealings.

Image: nationalselfinsurerohsaudittool.blogspot.com

Forex open currency rates refer to the exchange rates prevailing at the start of each trading day in the global forex market. These rates determine the exchange value of one currency against another, influencing the cost of imports, exports, and financial transactions across borders. Fluctuations in forex open currency rates can impact businesses, investment strategies, and even national economies; hence, staying abreast of these rates is essential.

Navigating the Forex Market: Understanding Exchange Rate Mechanics

The forex market operates as a decentralized global network where currencies are bought, sold, and exchanged. Open currency rates are determined by supply and demand forces, influenced by various economic and geopolitical factors, such as interest rate differentials, inflation, economic growth prospects, political stability, and market sentiment.

When demand for a particular currency exceeds supply, its value rises, and open currency rates reflect this appreciation. Conversely, when supply outstrips demand, the currency depreciates, leading to lower open currency rates. These fluctuations can create opportunities for arbitrage, where traders buy and sell currencies simultaneously in different markets to capitalize on exchange rate differences.

Embracing Technology’s Role in Shaping Forex Dynamics

Technological advancements have transformed the forex market, introducing sophisticated trading platforms and analytical tools. Electronic trading systems have accelerated transaction speed and efficiency, allowing traders to access real-time market data and execute trades instantly. Automated trading algorithms have also emerged, using complex mathematical models to analyze market trends and place trades based on predefined parameters.

Forex trading has become increasingly accessible through online platforms and mobile applications. These platforms provide user-friendly interfaces, real-time rate updates, and educational resources, empowering individuals and small businesses to participate in the forex market. However, it’s crucial to approach forex trading with caution, as it involves inherent risks and requires a thorough understanding of market dynamics.

Exploring Central Bank Intervention: Influencing Forex Open Currency Rates

Central banks play a significant role in influencing forex open currency rates through monetary policy. By adjusting interest rates, central banks can make their currency more or less attractive to foreign investors, thereby affecting supply and demand dynamics. Higher interest rates tend to attract foreign capital, strengthening the currency, while lower interest rates can lead to currency depreciation.

Central banks may also intervene directly in the forex market by buying or selling their currency to influence its value. These interventions can stabilize exchange rates during periods of excessive volatility or support economic policy objectives, such as promoting exports or managing inflation.

Image: thebestforexscalperea.blogspot.com

Analyzing Economic Indicators: Unraveling Market Drivers

To make informed decisions in the forex market, it’s imperative to monitor economic indicators that influence open currency rates. Key indicators include:

• Gross Domestic Product (GDP): Measures the total value of goods and services produced in a country, reflecting its economic growth and potential.

• Consumer Price Index (CPI): Gauges inflation by tracking changes in the prices of goods and services purchased by consumers.

• Unemployment Rate: Indicates the proportion of the labor force that is unemployed, providing insights into the health of the job market.

• Interest Rates: Set by central banks, interest rates influence the cost of borrowing and saving, affecting investment decisions and the attractiveness of a currency.

• Political and Economic Stability: Events such as elections, policy changes, or geopolitical tensions can impact market sentiment and currency valuations.

Grasping Technical Analysis: Forecasting Exchange Rate Movements

Technical analysis involves using historical price data to forecast future price movements in the forex market. Traders employ various technical indicators and charting techniques to identify trends, support and resistance levels, and potential reversal points. While technical analysis can be a valuable tool, it’s crucial to recognize its limitations and combine it with fundamental analysis for a comprehensive understanding of market dynamics.

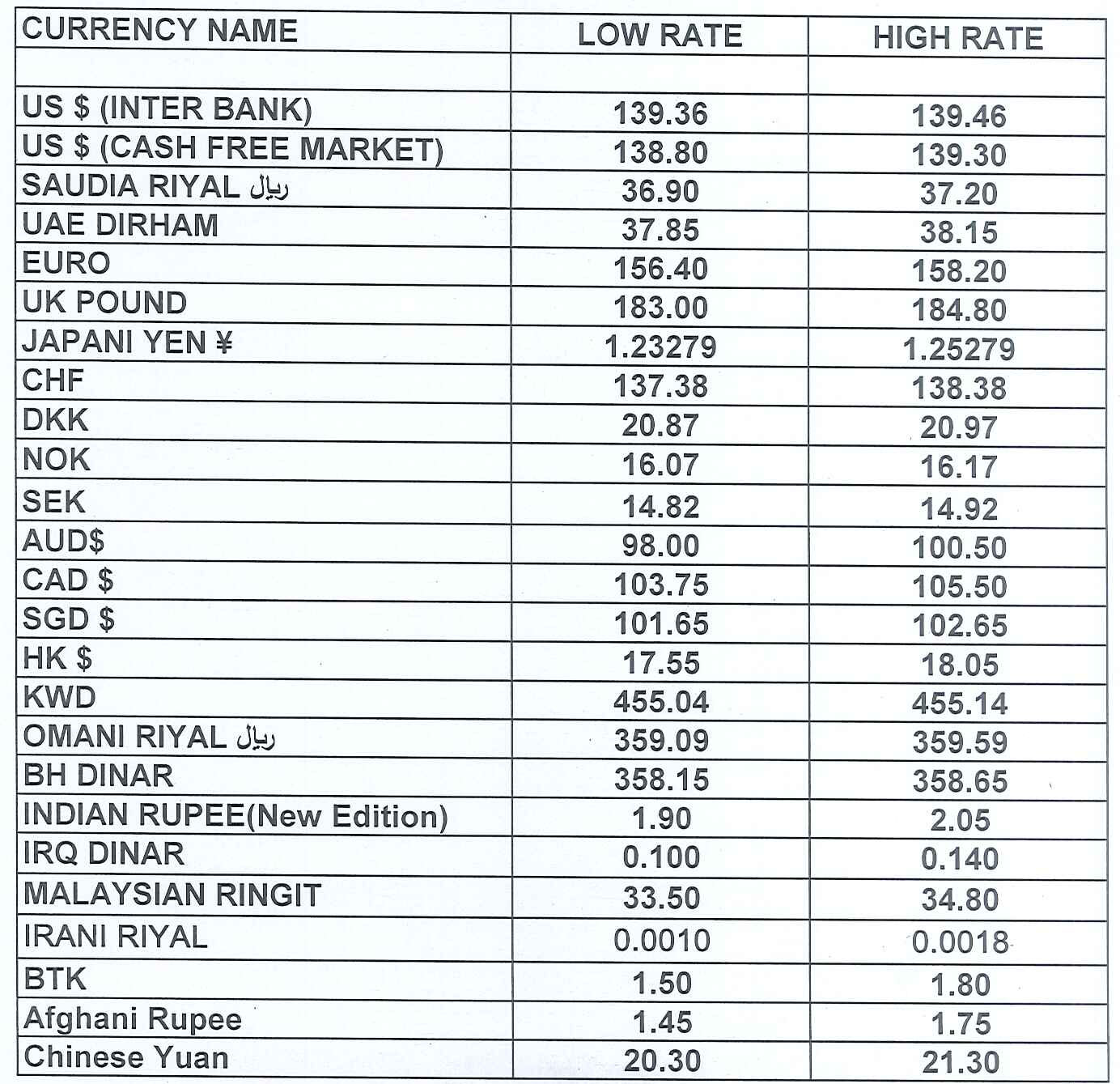

Forex Open Currency Rates Pakistan

Conclusion

Understanding forex open currency rates is indispensable for navigating the intricacies of international finance. By comprehending market dynamics, leveraging technological tools, and analyzing economic indicators, businesses and individuals can effectively manage currency risks, make informed investment decisions, and capitalize on opportunities in the global forex market.

Remember, staying informed, exercising prudence, and seeking professional guidance when necessary are key to maximizing the benefits of forex trading while mitigating potential risks. The dynamic nature of the forex market offers both challenges and opportunities; with knowledge and strategy, one can navigate these currents and harness the power of global currency exchange.