In the realm of forex trading, the Martingale strategy has gained prominence as a controversial but potentially lucrative approach to reaping profits from currency fluctuations. This strategy, rooted in a unique formula of doubling down on losing trades, has sparked both heated debates and tales of extraordinary returns. Join us as we delve into the complexities of the Forex Martingale strategy, exploring its potential benefits and the inherent risks it entails.

Image: acikubolex.web.fc2.com

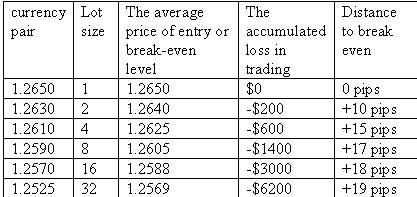

The fundamental principle underlying the Martingale strategy is deceptively simple – increase trade size after each loss until a winning trade offsets all previous losses and yields a profit. However, beneath this simplistic facade lies a profound mathematical truth – the Law of Large Numbers. This principle dictates that over an extensive series of random events, the probability of an eventual win approaches certainty. In the context of forex trading, this means that while individual trades may result in losses, over time, the strategy predicts that wins will outweigh losses, leading to overall profitability.

Unlocking the Advantages: Potential Rewards of the Forex Martingale Strategy

Proponents of the Martingale strategy extol its virtues, citing the allure of substantial profits as a key reason for its appeal. By doubling down on losing trades, traders can potentially recoup their losses swiftly once a winning trade materializes. This approach harnesses the power of compounding returns, where profits from successful trades are reinvested to magnify future gains. Additionally, the Martingale strategy can instill a sense of discipline in traders, compelling them to adhere to a predefined trading plan and avoid emotional decision-making.

Unveiling the Risks: Potential Pitfalls of the Forex Martingale Strategy

Despite the tantalizing prospects, the Martingale strategy is not without its perils. Paramount among these is the potential for catastrophic losses, especially during prolonged losing streaks. The strategy’s relentless doubling down can lead to an exponential increase in trade size, rapidly depleting a trader’s capital. Moreover, the assumption of a random distribution of wins and losses may not always hold true in the unpredictable forex market. Extended periods of losses can severely strain a trader’s financial resources and emotional resilience.

Another significant risk associated with the Martingale strategy is the potential for margin calls. When a trader’s losses exceed their available margin, they may be forced to liquidate their positions at unfavorable prices, exacerbating losses. This risk is particularly acute during periods of high market volatility, where prices can fluctuate rapidly, leaving traders vulnerable to sudden margin calls.

Essential Considerations: Understanding the Dynamics of the Forex Martingale Strategy

To mitigate the inherent risks of the Martingale strategy, it is crucial for traders to possess a thorough understanding of its dynamics. Careful selection of risk parameters, including trade size and maximum drawdown limits, is paramount to managing potential losses. Additionally, traders should meticulously monitor their trading performance, adjusting their strategy as needed to adapt to changing market conditions.

It is also essential to recognize that the Martingale strategy is not suitable for all traders. Its inherent risks demand a high tolerance for volatility and the ability to withstand extended losing streaks without succumbing to emotional trading. Traders with limited capital or a conservative risk appetite may find alternative strategies more appropriate.

Image: forexwot.com

Forex Martingale Strategy That Works

Conclusion: Navigating the Delicate Balance of Risk and Reward with the Forex Martingale Strategy

The Forex Martingale strategy presents a double-edged sword – a potent tool for unlocking profits but also a treacherous path fraught with risks. While the allure of substantial returns may tempt traders, it is imperative to proceed with caution and fully comprehend the potential pitfalls. Careful risk management, a disciplined approach, and a realistic assessment of one’s financial capacity are essential for harnessing the potential benefits of the Martingale strategy while mitigating its inherent risks.