In the ever-evolving realm of global finance, the foreign exchange (forex) market stands as a bustling epicenter, facilitating the conversion of currencies across borders. With an estimated daily trading volume exceeding $6.6 trillion, it’s a playground for traders seeking opportunities to profit from currency fluctuations. If you’re an aspiring trader eager to conquer this financial arena from India, understanding the forex market hours clock is pivotal to your success.

Image: www.axi.com

Navigating the Forex Market’s Timeline

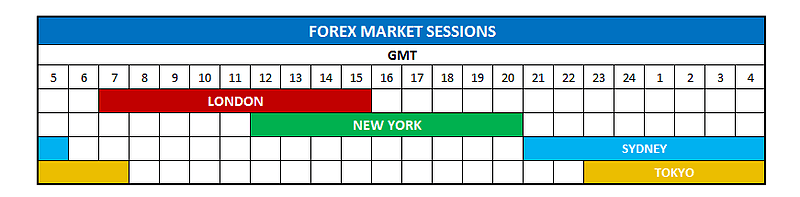

The forex market is a decentralized global marketplace that operates 24 hours a day, five days a week, from Monday to Friday. However, trading activity and liquidity vary significantly across different time zones. Major financial hubs like London, New York, and Tokyo serve as central trading hubs, shaping market behavior at different times of the day.

Understanding these “active trading sessions” is crucial for Indian traders, as they influence currency volatility and trading opportunities. The primary forex market trading hours in India align with the following global sessions:

- Asian session: 9:00 AM – 5:00 PM IST (coinciding with London’s opening)

- European session: 1:00 PM – 9:00 PM IST (London remains active)

- American session: 9:00 PM – 5:00 AM IST (New York opening)

- Australian session: 5:00 AM – 9:00 AM IST (encompasses Tokyo’s closing)

Choosing the Right Trading Session for You

Each trading session has unique characteristics and opportunities. The Asian session, for instance, often exhibits lower volatility and fewer trading opportunities due to reduced participation from major market players like banks and investment firms. However, the European and American sessions, when the markets are most active, provide ample liquidity and volatility, creating more favorable conditions for trading.

As an Indian trader, you may find the European session particularly valuable due to its overlap with the Indian daytime. This alignment allows you to actively monitor and trade during a time when currency fluctuations are at their peak. Additionally, the American session, though partially overlapping with Indian nighttime, also offers increased liquidity and opportunities, albeit with slightly reduced volatility compared to the European session.

Factors Influencing Forex Market Hours

It’s essential to note that the forex market hours clock can be influenced by external factors, such as:

- Market holidays: National holidays in major financial centers can impact trading hours.

- Central bank announcements: Important economic news and interest rate decisions can lead to temporary market closures or reduced liquidity during key announcements.

- Technical issues: Unexpected technical issues on trading platforms or infrastructure can occasionally disrupt market activity.

Tips for Successful Trading in India

- Familiarize yourself with the forex market trading hours clock to plan your trades effectively.

- Identify trading sessions that align with your time zone and lifestyle.

- Study the specific characteristics of each trading session to understand market volatility and liquidity patterns.

- Track global economic news and events that may impact currency fluctuations.

- Stay up-to-date on market holidays and other external factors that could affect trading activity.

Unveiling the Forex Market’s Potential

Understanding the forex market hours clock in India unlocks a world of opportunities for aspiring traders. By strategically selecting trading sessions and leveraging market knowledge, you can optimize your trading experience and increase your chances of reaping profitable returns in the dynamic forex market. So, embrace the clock and embark on your forex trading journey with confidence and a solid understanding of market timing.

Image: dailypriceaction.com

Forex Market Hours Clock In India